Covering Expenses In Retirement With Dividends

How would you define a retirement without worry? One thing near the top of everyone's list when thinking about this issue is not having to worry about income. I have said in other articles that you are truly retired (or able to retire) when your passive income covers your expenses.

The very wealthy among us can just draw down on their principal for income. Where that principal is invested is a secondary concern to them. If it's invested in the stock market and a correction hits, that's OK; if it's in low-yielding bonds that barely (or don't even) match inflation, no problem. Because the principal is so large to start with, it almost doesn't matter where the funds are invested. They'll be fine regardless.

But that probably does not describe you. Maybe you are worried that you don't have enough principal to retire on or you are not sure how much you can take from that principal in retirement.

There is a way you can make it work. You will need an investment portfolio, of course, with most of it in stocks. That alone makes some people nervous as they head into retirement, due to equities' volatility. But if you get that portfolio dialed in correctly, you won't need to take any principal at all--or very little, anyway.

Back In The Old Days

In 2007, you could have gotten a 5% yield on 10-year treasury notes--about as safe an investment as you can find. Today's yield on treasuries is less than half that. People in the not-independently-wealthy category will need to find a better income-generating investment vehicle. Quick back-of-the-envelope math explains it: A million dollars invested in risk-free treasuries ten years ago would have generated $50,000 annually, whereas today, it would be less than $25,000.

So how will we make up for the shortfall? My answer will sound familiar to those who have read my articles at TalkMarkets before: Stocks that pay dividends, and regularly increase those dividends.

Stocks in general, have had quite a run in recent years, but you can still build a diversified portfolio--across a number of sectors--made up of companies that pay solid, growing dividends, and that have done so for years.

Here's a (perhaps overly) simple, four-step checklist:

1. Get a solid handle on what your spending needs in retirement will be like.

2. Amass a decent-sized nest egg. (You need money in order to make money.)

3. Allocate that nest egg across solid, dividend-paying--and dividend-boosting--stocks.

4. Determine whether your dividend stock portfolio will generate enough income to cover your retirement spending needs.

Let's see what a portfolio of these sorts of stocks might look like.

|

Company |

Ticker |

Yield |

Annual Dividend Growth (5-Yr) |

Consecutive Div Increase (Years) |

|

AmeriGas Partners |

7.8% |

5% |

12 |

|

|

Chevron |

3.8% |

6.8% |

29 |

|

|

Coca-Cola |

3.4% |

8.3% |

54 |

|

|

Duke Energy |

4.3% |

2.5% |

12 |

|

|

Qualcomm |

3.9% |

20% |

14 |

|

|

Spectra Energy Partners |

5.8% |

7.3% |

10 |

|

|

Verizon |

4.7% |

3% |

12 |

|

|

Wal-Mart |

2.9% |

7.3% |

43 |

|

|

Welltower |

5.3% |

3.9% |

14 |

|

|

Averages |

|

4.7% |

7% |

22.2 |

Data as of February 10, 2017.

An equally weighted portfolio of these stocks would yield around 4.7% annually. On top of that, the stocks listed here have boosted their payouts year after year, sometimes for decades--and by 7% annually on average for the past five years.

In other words, with a diversified portfolio like this, we can get pretty close to those 2007 treasury yields. And these are just some of the companies we can use for building such a portfolio. There are plenty of other firms with long track records of increasing their payouts.

As with any stock portfolio, you'll see a lot more volatility here than you would see with a fixed-income portfolio. But that should not matter to you very much. As long as the dividends keep rolling in, your retirement income plan should remain on track.

Ron and Lisa's Plan

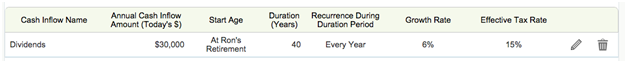

Let's have a look at an example. This couple in their early 50s has around $500,000 in investable assets, and they are trying to determine if they are on track to retire in 10 years. They think their spending will be about $60,000 a year in retirement. They would prefer not to start taking Social Security until they are at full retirement age (67) when they will be able to get the most out of it.

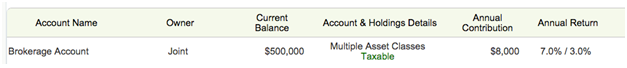

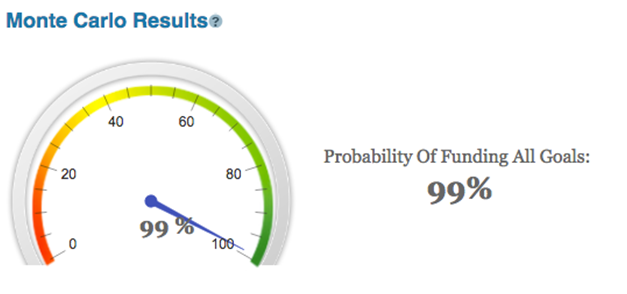

The couple plans to invest half of their portfolio in growth stocks and half in value stocks until they retire. At that point, they're planning to shift to a more conservative allocation. (To keep things simple, we're assuming they have a single, taxable brokerage account for their investable assets.)

Here's how Ron and Lisa's plan looks when we put it through our Monte Carlo simulation:

That doesn't look so good. The couple actually has a fair amount of money coming in once Social Security starts, but with the plan as-is, they'll likely run out of money before then.

What should they do? Well, the portfolio above will be a big part of the answer. Remember, that portfolio should generate an annual yield in the 4.7% range, with dividends growing at about 7% annually, on average.

But we don't want to put our couple in that portfolio until they retire. For the next ten years, we want them in that value-and-growth-stock portfolio, contributing a modest amount of money to the account each year.

So, first, we need to estimate what that the value of the portfolio will look like at retirement when we move them into the new portfolio. We're assuming a fairly conservative 7% annual return on that value-and-growth combination now, but that's not quite conservative enough here. We really can't count on 7% market returns, year after year, for any single 10-year time period. A bear market or a recession, especially early on, could drastically reduce that number.

Knocking that annual return down to 5% annually (while still assuming an $8,000 annual contribution) gives us a balance at retirement of about $650,000:

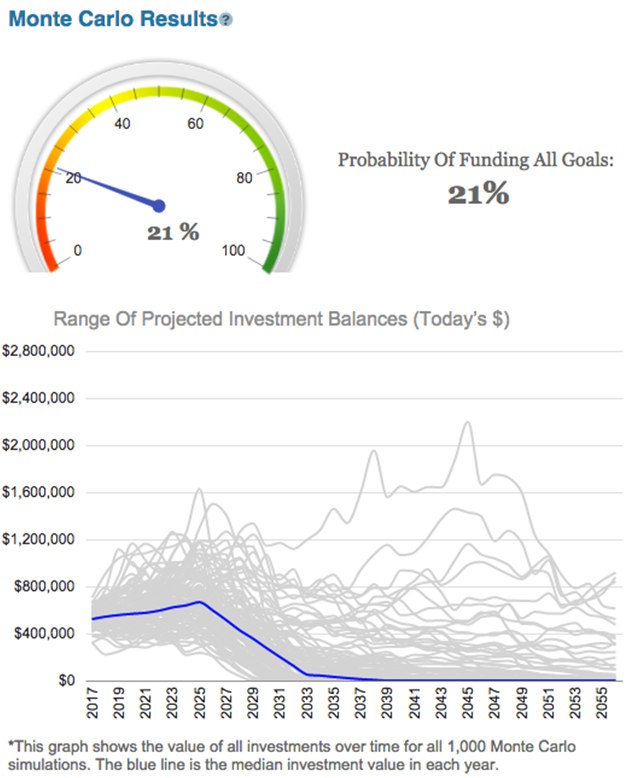

Our next step, then, is to enter an annual cash flow of $30,000, starting at retirement. That's 4.7% on our $636,000 portfolio. We'll take down the dividend growth rate a bit just to be a little more conservative.

So, to recap, we:

- Give our assumption for annual return over the next 10 years a haircut, from 7% to 5%

- Assume dividends on the $636,000 portfolio of 4.7%, or $30,000 annually, growing 6% annually, and taxed at 15%

- Assume the remaining non-dividend portion of total return on the portfolio (capital gains) after retirement will be 2% annually

Once we make these adjustments:

That's a figure we can be comfortable with.

Having a larger percentage of your portfolio in stocks at retirement can be scary. But it does not need to be. With the right stocks, a decent-sized nest egg, and a solid grip on your spending needs, putting a higher percentage into stocks could be the best--and quickest--way to a successful retirement plan.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find ...

more