Contango In The (UVXY) Explained One More Time

There’s nothing like a swift kick in the shins, a slap in the face and a good boxing of the ears to give you a healthy dose of humility.

That’s how holders of the ProShares Ultra VIX Short-Term Futures ETF (UVXY) feel right about now. This is the popular ETF that rises when the S&P 500 (SPY) falls.

“Markets can remain irrational longer than you can remain liquid,” as my mentor, the legendary economist and early hedge fund trader, John Maynard Keynes, used to say. I know this because it is inscribed on a post it note taped to my screen.

This was only made possible by the Volatility Index falling to the $12 handle, the low for the year.

To see this happening with stocks at an all time high is nothing less than amazing. The (VIX) seems to be telling us that stocks are going sideways to up for the rest of the year.

I’ll believe it when I see it. Trees don’t grow to the sky.

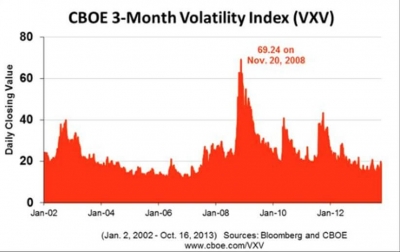

The reason this fund can only fall over the long term is because of the contango that permanently haunts it. While the front month Volatility Index (VIX) is trading at $13.92 today, three-month volatility is at a lofty $20.

The (UVXY) buys three month volatility and runs it into expiration. It then exacerbates this negative impact with 2X leverage. The guaranteed loss on this trade is therefore $3.37 X 2, or 43.5%. It is a perfect money destruction machine.

Do this every month, and eventually you use up all your capital. You see this most clearly on the long-term split adjusted (UVXY) chart below, which has it going from $30,000 to $42.33 in only three years, a loss of 99.9%.

This is why you should only hold the position for a few days or weeks at the most, and even then only to hedge long positions in other stock or indexes.

You only want to own (UVXY) and the (VIUX) during the brief, frenzied volatility spikes that occur, as we did with the last trade.

You might want to ask the question, “Why aren’t we shorting this thing?”

The (VIX) is prone to sudden, extreme moves to the upside whenever an unforeseen geopolitical or economic event takes place, such as a terrorist attack or a bad monthly nonfarm payroll number.

It can double in days, as traditional long side investors who are unable to sell short stocks or futures rush to buy some downside protection. It has done this a few times in the past year. During the crash, the (VIX) ratcheted all the way up to $90.

Often you get large moves of 20% or more right at the opening, as professional traders, who are almost always short volatility, rush to cover short positions, all at the same time. As a result, many of the people who try this strategy often go bust.

On top of this, your broker is unlikely to extend the margin you need to put on a decent position, especially to beginners.

The concern is that when the customer wipes himself out, they will take a piece of the broker’s capital with it. Customers who lose money in this way often end up suing their broker, another turn off.

The people who do make money at this tend to be large teams of very experienced traders with massive computer and programming support executing complex, state of the art risk control algorithms.

It costs millions of dollars to put all this together.

Needless to say, you should not try this at home.

Maybe the market is trying to tell me something. Like, quit looking for a seat after the music stops playing. Don’t trade if there is nothing there.

This is why I have backed off to a very rare 90% cash position, which I hate. Nobody pays you to hold cash.

It looks like it is going to be a long summer.

The Diary of a Mad Hedge Fund Trader, published since 2008, ...

more