Consumer Staples Leading

The Consumer Staples sector has been on fire lately. As shown in the snapshot from our Trend Analyzer tool below, Staples is up more than any other sector over the last week (+3.29%), and it’s now trading in extreme overbought territory at two standard deviations above its 50-day moving average.

(Click on image to enlarge)

Back in early May, the Consumer Staples sector was down more than 14% year-to-date, but it has gained back nearly all of its losses. As shown below, Staples is now down just 3.9% year-to-date. Unfortunately, Staples is still well behind its counterpart — Consumer Discretionary — which is up 14.7% on the year.

As you can see in the chart above, the first four months of the year were horrific for Consumer Staples. But since the sector hit its low for the year at the start of May, it’s been a different story.

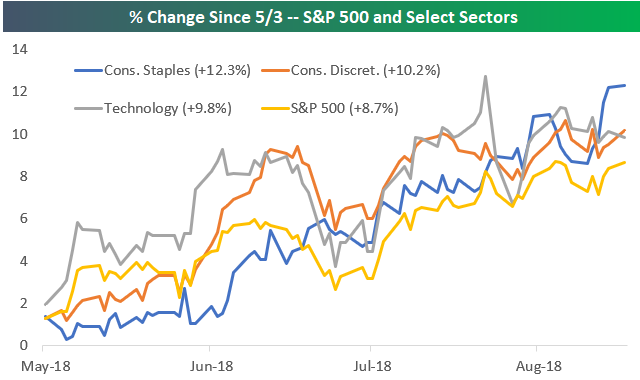

Since May 3rd, Consumer Staples is actually outperforming the S&P 500, Consumer Discretionary, and even Technology:

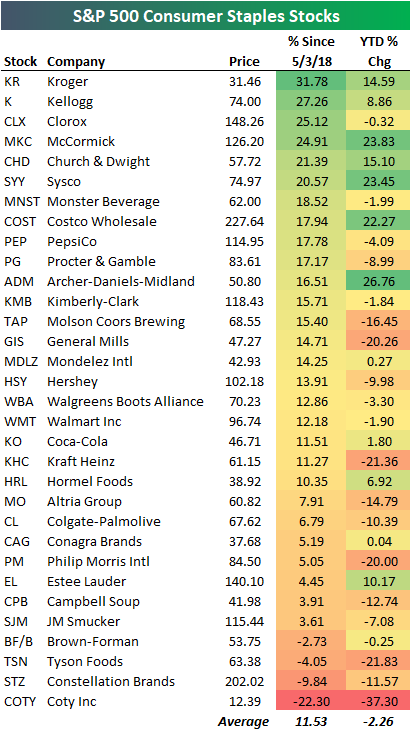

Below is a table showing the performance of S&P 500 Consumer Staples stocks on a year-to-date basis and since the sector’s May 3rd low. As shown, all but four stocks in the sector are up since May 3rd, while six are up more than 20%. Grocery store chain Kroger (KR) is up the most since May 3rd with a gain of 31.78%, followed by Kellogg (K), Clorox (CLX), and McCormick (MKC) all with gains of more than 24%.