Commodities Popped Last Week Amid Weakness Elsewhere

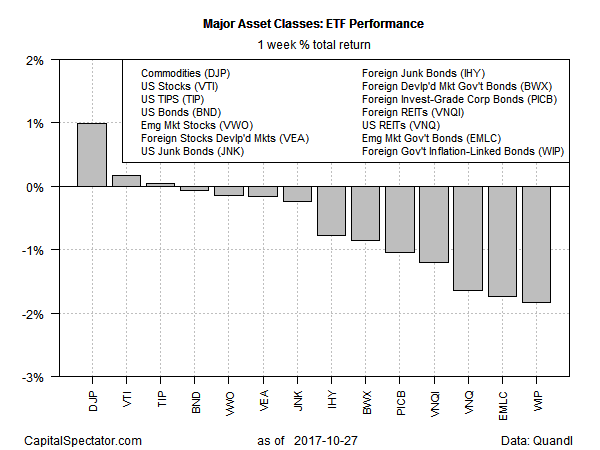

Broadly defined commodities rose last week, posting the strongest advance for the major asset classes, based on a set of exchange-traded products. The increase is an outlier during a week when most markets fell.

The iPath Bloomberg Commodity (DJP) jumped 1.0% for the five trading days through Oct. 27. US equities – the number-two performer – also posted a gain, edging up 0.2%. The rest of the field was in the red last week.

“Markets are rebalancing with strong demand driving most commodities,” says Jodie Gunzberg, global head of commodities and real assets at S&P Dow Jones Indices. She adds that industrial metals are “dominating the gains from bullish expectations about Chinese demand growth.”

Last week’s biggest weekly decline for the major asset classes: foreign inflation-indexed government bonds. SPDR Citi International Government Inflation-Protected Bond (WIP) slumped 1.8%, leaving the ETF at a three-month low.

For one-year results, stock markets around the world continue to lead, headed by US equities. Vanguard Total Stock Market (VTI)’s total return is currently a strong 23.9% for the past 12 months.

The second- and third-strongest gains for the major asset classes for the past year: foreign stocks in developed markets (Vanguard FTSE Developed Markets ETF (VEA)) and equities in emerging markets (Vanguard FTSE Emerging Markets ETF (VWO)), respectively.

The bottom performer in the one-year column: inflation-indexed Treasuries. iShares TIPS Bond (TIP) is off 0.3% for the 12 months through last week’s close.

Disclosure: None.