CMI Breaking Out? GLD, NFLX, CMI, JOY, CAT

As cautioned in my Market Forecast last Sunday, stocks took a quick fall on Monday, but soon recovered nicely. Friday’s jobs report prompted some buying, however the S&P 500 SPX was still not able to break out.

We did not trade much this week. We did a quick trade on GLD calls when gold bounced on Monday. Then, we traded NFLX calls three times beautifully and booked some quick profits. All of our closed trade this week were profitable:

| NFLX Options Sell to close 5.00 (3.07%) of NFLX Dec 20 2014 Call 350.0 at 13.00000 | 18.18% ($1,000.00) Profit |

| NFLX Options Sell to close 5.00 (2.52%) of NFLX Dec 20 2014 Call 350.0 at 10.50000 | 9.38% ($450.00) Profit |

| NFLX Options Sell to close 5.00 (2.97%) of NFLX Dec 20 2014 Call 345.0 at 12.50000 | 24.38% ($1,225.00) Profit |

| GLD Options Sell to close 10.00 (1.55%) of GLD Dec 20 2014 Call 114.0 at 3.20000 | 18.52% ($500.00) Profit |

Energy stocks are still really weak, which we will visit tomorrow in our weekly Market Forecast and Sector Watch. Overall, commodity sectors are pretty weak. I did find something intriguing in the peripheral of commodities: CMI

CMI got a good pop on Wednesday; so did JOY and CAT. However, both JOY and CAT moved back down with rest of the commodity related stocks on Thursday and Friday. But, not CMI! CMI held on to the gain and added more!

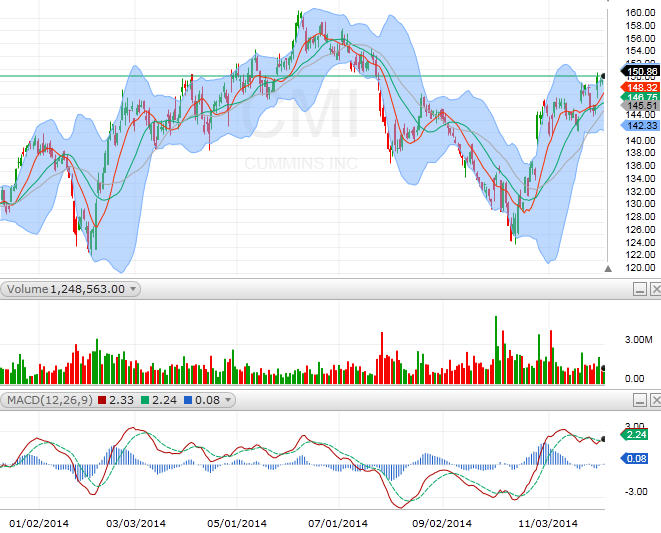

CMI

CMI looks like its setting up for a breakout. If it does breaks above $152, we could see a retest $160!

Let’s keep an eye on this first thing next week! I’ll be back to take a closer look at the broader market and major sectors tomorrow.