Climb This Ladder With A Margin Of Safety

Recently I informed my newsletter subscribers that I had decided to sell out of United Development Funding (NASDAQ:UDF) and replace that position with shares in Starwood Property Trust (NYSE:STWD).

Ultimately my decision to drop the higher-yielding mREIT was based on multiple reasons, all directly related to the lack of clarity related to UDF's externally-advised platform.

While I was able to make a modest profit on the "in-and-out" deal, my intentions were simply to build a powerful model of predictable income and I became increasingly concerned that UDF's sources of repeatability were not sustainable.

As you know, I generally stay focused on safer REIT investments but on occasion, "in my quest for durable income I seek to maintain a tactically balanced portfolio that includes a combination of safe income sprinkled with higher yielding components".

Ladder Capital: Another Alternative

Ladder Capital (NYSE:LADR) is a diversified commercial real estate company that was formed in 2008 and went public in 2014 (as a C-Corp). The company's primary business strategy is to originate and securitize first mortgage loans on stabilized, income-producing commercial real estate properties. LADR is one of the largest non-bank contributors of loans to CMBS securitizations in the U.S.

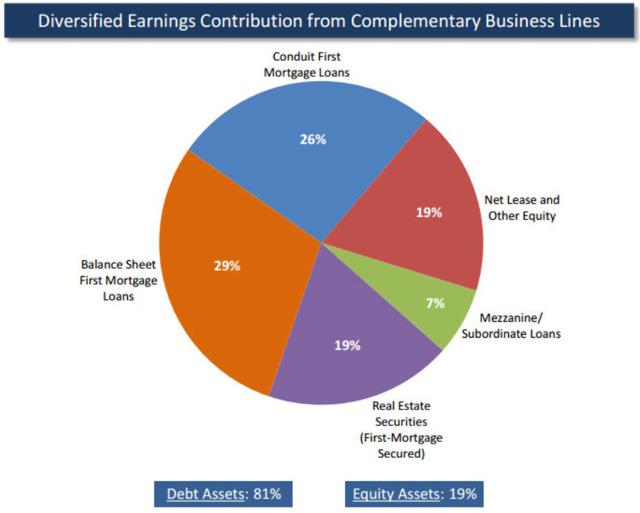

However, LADR has a unique model in which the company does not rely exclusively on securitization for its revenue and has other diversified sources of revenue, including earning a significant portion of its revenue from first mortgage balance sheet loans and property rentals as well as expanding its market share in the commercial mortgage loan origination market.

In 2014 LADR commenced the necessary steps to convert from a C-Corp into a REIT structure, and during the first quarter of 2015 the company received shareholder approval to convert to a REIT. (On March 2nd LADR said that shareholders had approved the plan to restructure as a REIT).

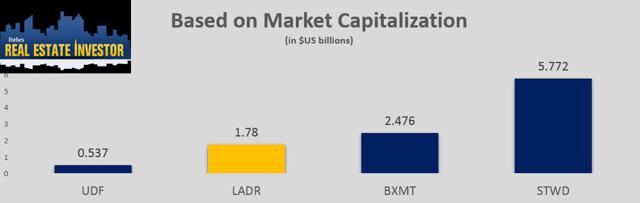

LADR's senior management team averages 26 years of industry experience and insiders (management and directors) own $239 million of LADR equity or around 13.3% of the company's $1.8 billion total market capitalization. Here's how LDR compares with the direct peer group:

LADR has maintained a disciplined credit culture throughout the organization with zero credit losses since inception.

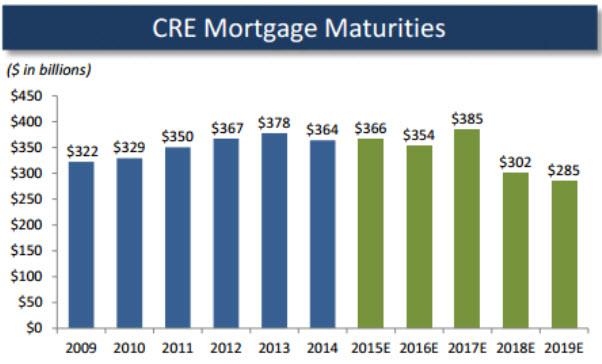

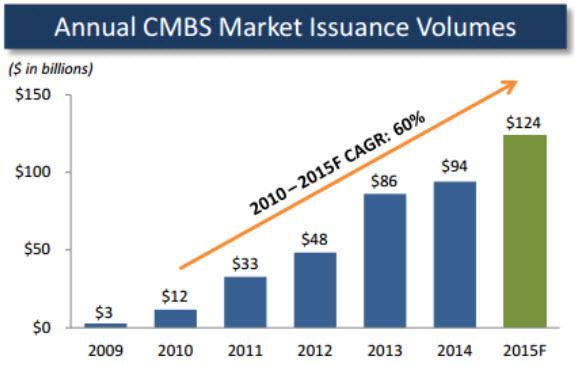

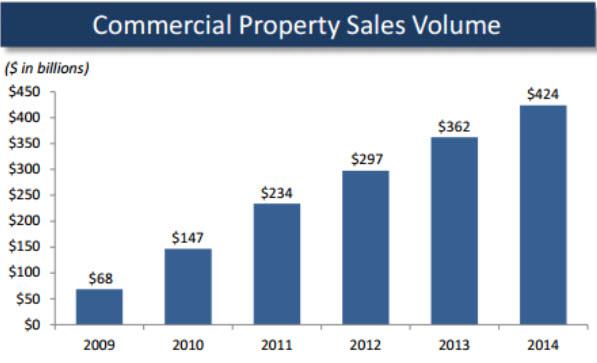

LADR operates as an internally-managed REIT (the other peers referenced are externally managed) that originated first mortgages secured by commercial real estate and invests in commercial properties and highly-rated CMBS (commercial mortgage backed securities). These charts below validate the strong expected demand for commercial real estate lending in the US.

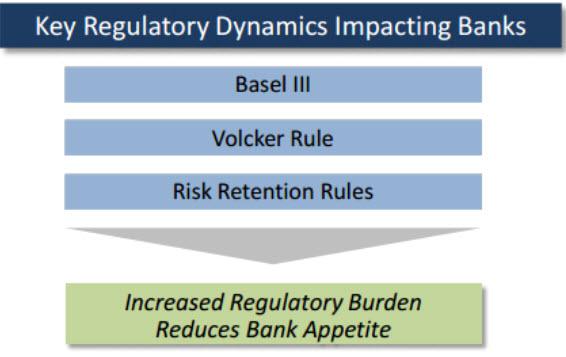

Due to increasing regulation for commercial banks, LADR is well-positioned to capitalize on the growing demand in CRE lending.

Ladder Capital's Triangular Approach to Profitability

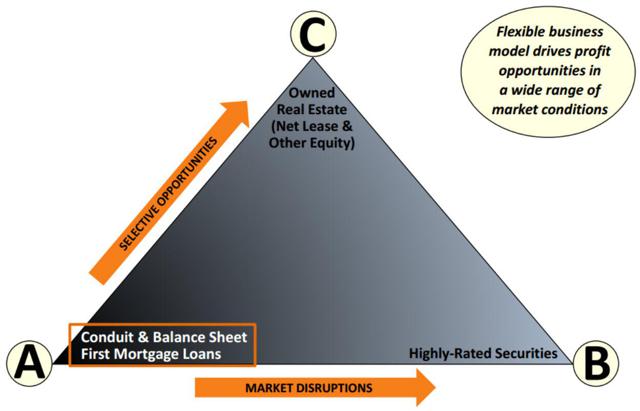

LADR setup the company in a "triangle" fashion to provide a flexible and simple lending model with diversified earnings drivers - all from complementary business lines. Here's a snapshot of the 5 lines of business:

LADR's tactical approach to the mREIT sector is rooted in the flexible manner in which the company can interact in periods of change. As the triangle below illustrates, LADR can capitalize on its 3 primary lines of business in order to take advantage of the most profitable trends.

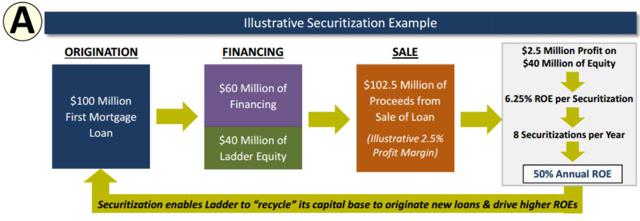

LADR's Senior Secured Balance Sheet business represents around 29% of revenue and this business is similar to BXMT and STWD. Generally LADR's loans are for 2-to-5-year terms. LADR's conduit finance business represents around 22% of revenue and this business line is comparable to STWD's subsidiary called LNR. Conduit loans are typically 5 to 10 years offered at fixed rate with LTV's (loan to value) of around 70% to 75%. Here's an example of how LADR's securitization model works:

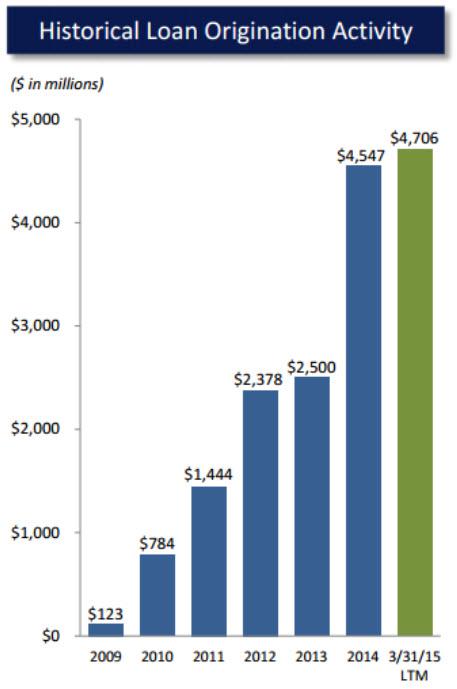

As you can see, LADR is able to recycle its capital multiple times increasing the earnings power. As evidenced by the snapshot below LADR has been successful at growing its securitizations: 29 securitization transactions from inception through 03/31/2015 at a 5.3% weighted-average profit margin.

Here's a snapshot of the company's historical origination business:

As illustrated below, LADR has a balanced securitization model with over $2 billion in loans (with an average loan balance of around $22 million).

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more