China Increases Its Tariff Rate To 25%

The S&P 500 was down 0.75 of one point as all the major indexes were flat on Wednesday. This is a continuation of the extremely low volatility we have seen this summer as the VIX was down 0.73% to 10.85. The Nasdaq was up 0.06% which was enough to extend its winning streak to 7 days which is the longest one since March. Facebook stock was up 0.75% as it continues its positive momentum following the crash after its earnings report. Snapchat announced it lost 3 million daily active users which is great news for Facebook as Instagram is eating Snapchat’s lunch. The consumer staples sector was the worst performer again as it was down 0.77%. The technology was the best as it was up 0.28%.

Treasuries Rally

The 10-year bond continued to defy Jamie Dimon’s call for 5% rates as it fell one basis point to 2.95%. There should be volatility in the bond market on Friday when the CPI report comes out. It makes sense that there hasn’t been much action this week because not much important economic data has come out and earnings season has slowed to a trickle. The 2-year yield was flat at 2.67% which means the difference between the 2 bonds is 28 basis points.

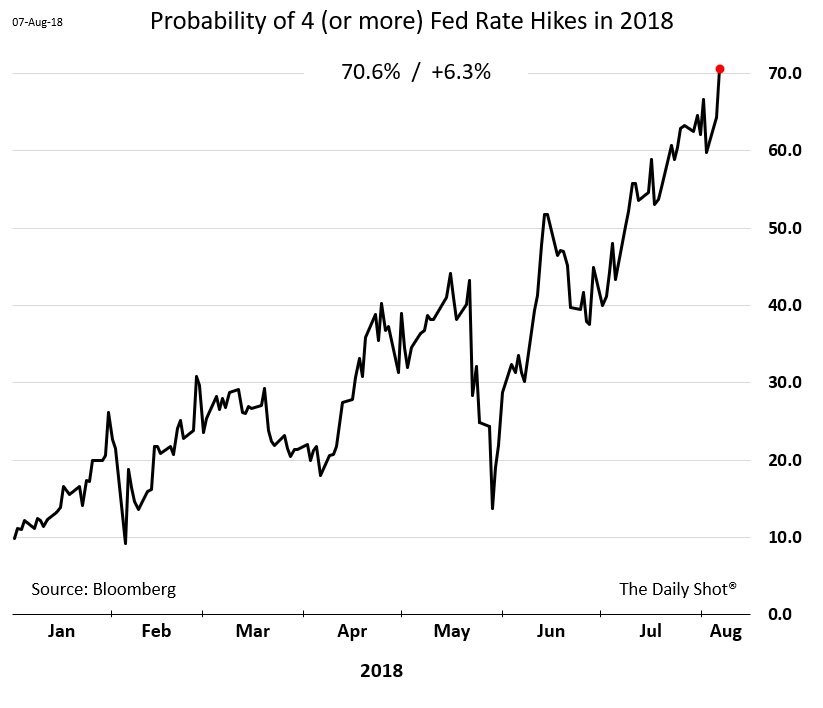

Latest Action In The Fed Funds Futures Market

As you can see from the chart below, there is a 70.6% chance the Fed hikes rates at least 2 more times this year. The market doesn’t react to rate hikes. It reacts to changes in the Fed funds futures market. The rate hike in September isn’t going to flatten the curve because there is already a 96% chance of a hike. If there is another hike in December, the 2-year yield should increase if the chance stays at this rate. However, it’s more likely that the probability either goes very close to zero or near 100% like in September. The Fed has been very clear with its policy stance in the past few years. As the probability continues to increase, the 2-year yield should increase, flattening the curve. Next, we’ll look at the chances for 2019 hikes, which should bring the curve to an inversion if the 10-year yield doesn’t get above 3%.

(Click on image to enlarge)

Tariff Dispute Intensifies

China announced it will retaliate against America’s latest round of tariffs against it. China will put a 25% tariff on $16 billion worth of American products. These 333 goods include large passenger cars, motorcycles, various fuels, and fiber optic cables. China is also taxing coal, grease, Vaseline, asphalt, plastic products, and recyclables. The American 25% tariff on Chinese goods is set to go into effect on August 23rd. On July 25th, Trump said the Chinee tariffs were “vicious” and his tariffs on China were “nice.” The Chinese Ministry of Commerce said it needed to tax American goods to “defend the nation’s dignity.”

It’s not surprising that the stock market ignored the latest action because even though this is a high rate, only $16 billion worth of goods isn’t a lot. It’s also never a surprise to see China matching American tariffs. If China ever acts as the aggressor and taxes more American goods than Trump announces, the market will sell off. I’m deeply concerned by this political theater because if it keeps going for another few months, we could be looking at a trade war that has an outsized impact on stocks and GDP. This reminds me of the debt ceiling debate which caused volatility as large threats were made in negotiations. Government shutdowns are nothing compared to the tariffs we’re seeing today. I think the market is whistling past the graveyard. There will be a sharp decline at some point in the next few weeks if more threats are acted upon.

C&I Lending Standards

C&I loan growth has recovered as it was up 5.4% in June which was the highest growth rate since February 2017. C&I loan growth got a lot of attention in 2017 because growth came close to 0% which is a sign of a recession. It was like the weak restaurant sales growth in 2016 and 2017 in that it was wrong to cause alarm. Some say C&I loan growth is a lagging indicator, so investors shouldn’t worry about it. The chart below shows the percentage of loan officers tightening lending standards for large and medium-sized firms compared with year over year non-residential fixed investment growth. This chart shows C&I lending standards are a leading indicator for non-residential fixed investment growth. Since C&I lending standards are loosening, non-residential fixed investment should improve.

(Click on image to enlarge)

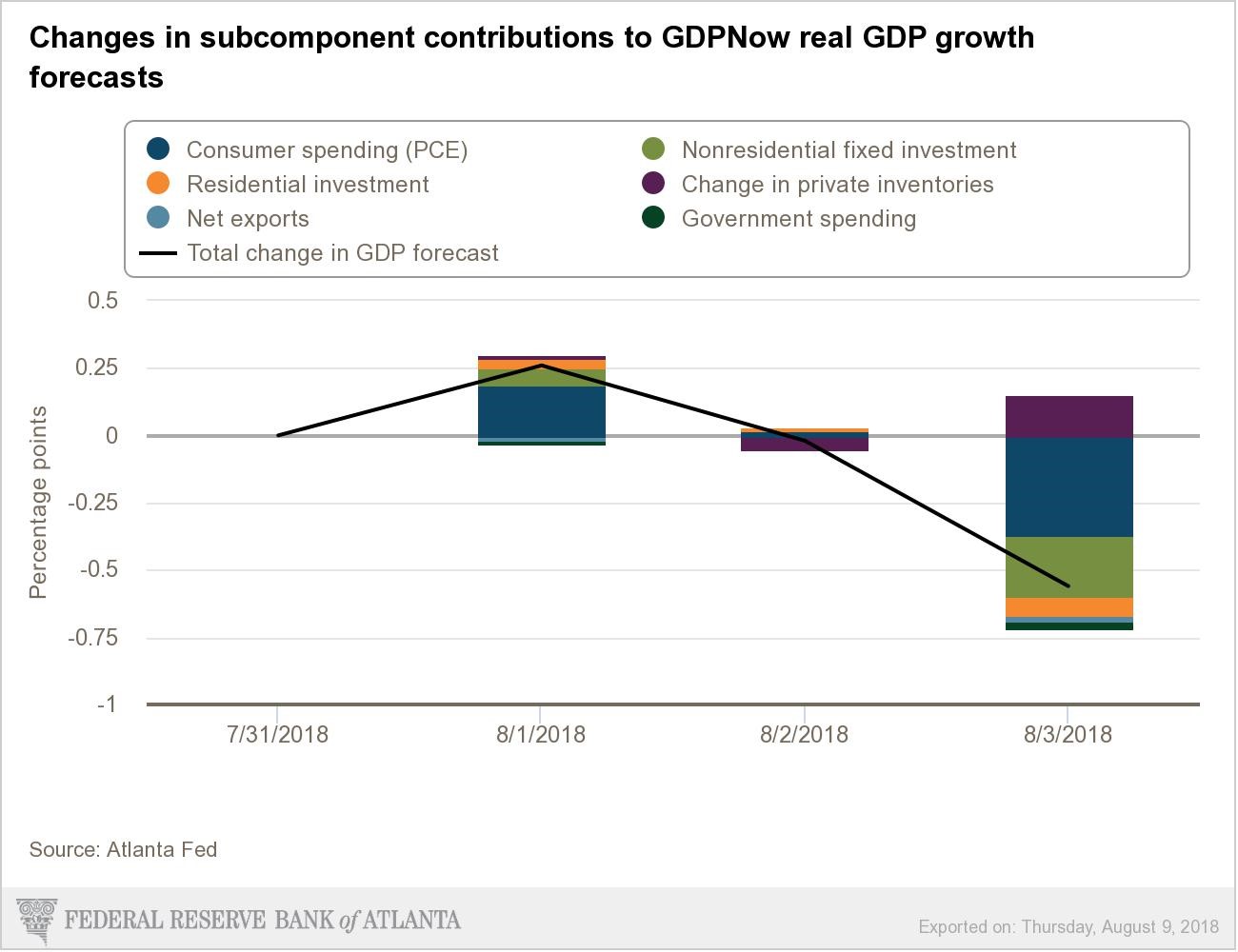

GDP Expectations

The average Q3 GDP growth estimate in the CNBC rapid update is 4.2% with 7 estimates included as of August 1st. This average was perfectly accurate last quarter, implying Q3 might be another quarter of quick growth. It’s still very early in the quarter to be sure of these forecasts, but this means the soft data reports from July were strong. The Atlanta Fed GDP Nowcast shows GDP growth will be 4.4% as of August 3rd. This estimate fell from 5% on August 1st. As you can see from the chart below, the estimate was brought down by the lowered expectations for real consumer spending growth and real private fixed investment growth. They fell from 3.4% and 5.9% to 2.9% and 4.2%.

The St. Louis Fed GDP Nowcast expects GDP growth will be 3.37%. The NY Fed’s Nowcast estimate fell sharply from 2.83% to 2.58%. The biggest negative impact was from the international trade report. The ISM manufacturing and non-manufacturing reports also caused weakness in the Nowcast.

(Click on image to enlarge)

Conclusion

Optimism about economic growth is causing GDP estimates to increase, C&I lending standards to loosen, and the Fed fund futures market to anticipate more rate hikes. This optimism isn’t reflected in the ECRI leading index. If GDP growth is above 4% in back to back quarters, the current rally in the S&P 500 is justified. I’m on the side of the NY Fed because many reports have disappointed my expectations.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more