Checking A Broker’s Background Gets A Mandatory Link

FINRA, the regulatory authority for stock brokers and investment advisors, has recently approved a new rule requiring brokers to place a link on their webpage to connect the retail client to the FINRA broker check website. The FINRA broker check site provides professional background checks on advisors, disclosing client complaints and professional disciplinary actions against the advisor. The link, unfortunately, is not required to take the viewer all the way to the broker’s background. Instead the viewer will need to enter the brokers name or registration number in order to see the report.

Trust But Verify

When searching for your first or new advisor, getting his or her professional background is important. While choosing an advisor is a lot about trust, the background check should be done to verify that your initial impression is correct. I was recently trying to win a client from a large national broker. After looking at the expensive mutual funds being used in the portfolio I did a broker check on the advisor to learn that he had over 16 complaints filed against him over the last few years. All basically indicated that he was an aggressive salesman, promising success verbally that would be hard to obtain, while in writing promising nothing. Looking at the prospects clients’ portfolio, I quickly saw that this non-fiduciary advisor had sold her the most expensive funds in the industry. While, maybe he was a nice guy, his background check indicated that he was not to be trusted with client money.

Searching is Easy

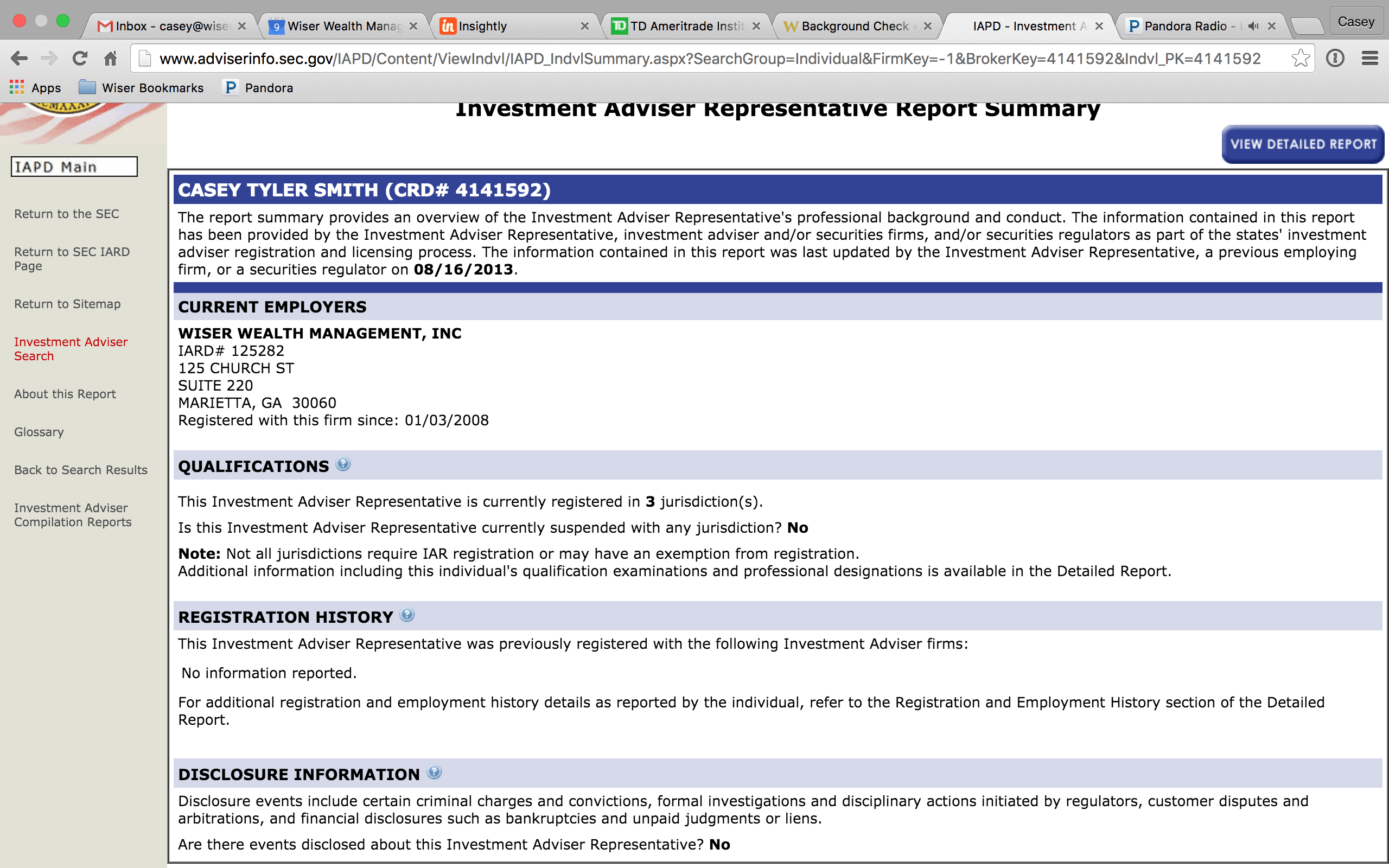

Anyone can do a broker check search by going to http://www.adviserinfo.sec.gov/. Once on the site you can search by individual or firm. As an example, you can type in my name, Casey Tyler Smith in zip code 30060 and hit search. In the top right you can select a detailed report. You should do this if the answer to the disclosure information at the bottom of the page is “yes.” The detail report will shine a light on any advisor complaints and the outcome.

Desired Outcome

If an advisor has been doing business long enough, there may have been a client incident at some point, so just because there is one does not automatically make for a bad advisor. Filing a complaint against an advisor is not necessarily an easy process, thus you have to feel very frustrated or hurt by the advisors sale of a product to want to go through the steps. So a disclosed event should not be taken lightly either. What you do not want to see is a situation like I described above where there are regular complaints. These are the advisors you should stay away from. Ultimately you want to work with an advisor that is a fiduciary (works in your best interest) and works under the fee-only (not fee based) model. While these advisors are historically hard to find, they are becoming more popular as the general public begins to recognize that banks and brokerage houses are selling them products that are not built in their best interest.

(Click on image to enlarge)

Casey Smith is owner and president of Wiser® Wealth Management, a wealth management firm based in Marietta, GA. Wiser® Wealth Management ...

more