Care Capital Properties Has All The Ingredients Of Something Special

Next week, Care Capital Properties, Inc. (NYSE:CCP) will begin trading on the New York Stock Exchange. The Chicago-based healthcare REIT will spin off from Ventas, Inc. (NYSE:VTR) by issuing approximately 84 million shares and OP units, and begin trading on August 18th (the first day of trading).

On July 30th, VTR's board of directors approved the spin-off and declared a distribution of 1 share of Care Capital common stock for every 4 shares of Ventas common stock held at the close of business on August 10th (the record date for the distribution).

VTR shareholders are not required to take any action to receive the shares of CCP common stock, and they will not be required to surrender or exchange their VTR shares. Additionally, the number of VTR shares owned by each shareholder will not change as a result of the distribution.

There is currently no market for CCP common stock, which will be issued in book-entry form only - meaning, no physical shares will be issued. The company anticipates that "when-issued" trading under the symbol CCP WI. Holders who sell the right to CCP common stock in the "when-issued" market on or before the distribution date will retain their shares of VTR common stock.

Upon the distribution, "when-issued" trading is expected to end, and "regular-way" trading is expected to begin under the ticker symbol CCP.

VTR's common shares will continue to trade in the "regular-way" market with the entitlement to receive the CCP common stock being distributed. Holders who sell Ventas common stock in the "regular-way" market before and on the distribution date will also sell their right to receive CCP common stock.

VTR's common shares will also trade in the "ex-distribution" market under the symbol VTR WI without the entitlement to receive the CCP common stock being distributed. Holders who sell Ventas common stock in the "ex-distribution" market on or before the distribution date will retain their right to receive CCP common stock in the distribution.

This Pure-Play Skilled Nursing REIT Looks Solid

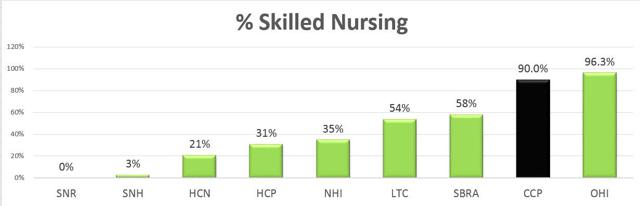

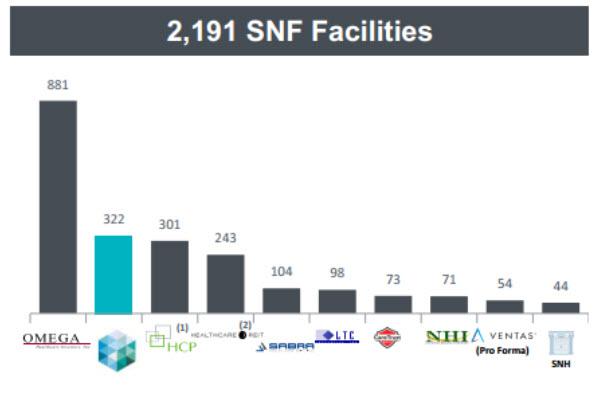

As part of the spin strategy, CCP will launch the portfolio with 355 properties that consist of skilled nursing (90%), senior housing (5%), specialty hospitals (4%), and loans (1%). The closest competitor is Omega Healthcare Investors (NYSE:OHI), with 560 properties (525 being skilled nursing). No other REIT has such exposure in skilled nursing.

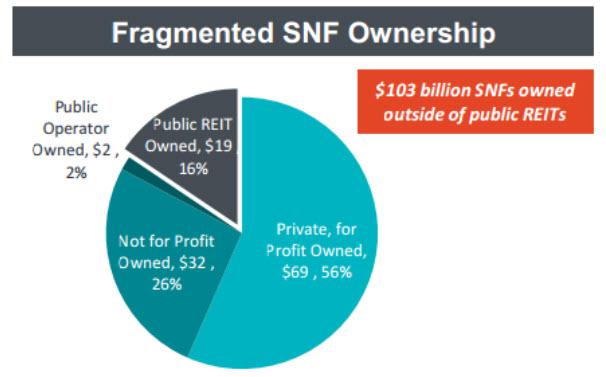

The investment thesis in CCP is rooted in skilled nursing, and that particular sub-sector has strong growth characteristics. The driving tailwinds for post-acute REITs are primarily based on fragmentation, where the $120-billion marketplace (of skilled nursing properties) is owned by less than 20% of the publicly traded REITs.

Accordingly, CCP (and OHI) have significant opportunities to consolidate fragmented skilled nursing asset ownership across the US. Post the merger with Aviv REIR (NYSE:AVIV), OHI is the largest in this "pure-play" category; however, CCP looked very similar to OHI prior to the merger (with Aviv).

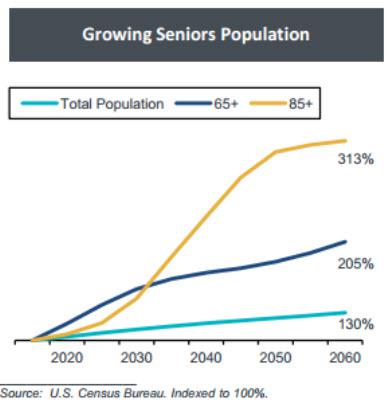

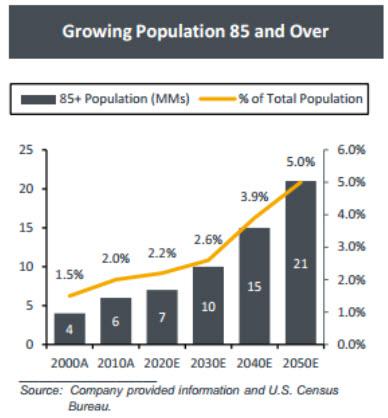

As I ponder my future ownership stake in CCP (I own VTR now), I must reflect on the significant success of OHI and the "pure-play" attributes that have made me "sleep well at night". Much of OHI's success is due to the risk management strategies of maintaining a circle of competence within the skilled nursing sector - a category with excellent supply and demand attributes. Seniors made up ~12% of population in 2000, and are expected to be 20% in 2030.

It is estimated that ~70% of Americans who reach age 65 will require some form of long-term care for an average of 3 years (Source: CCP Investor Presentation).

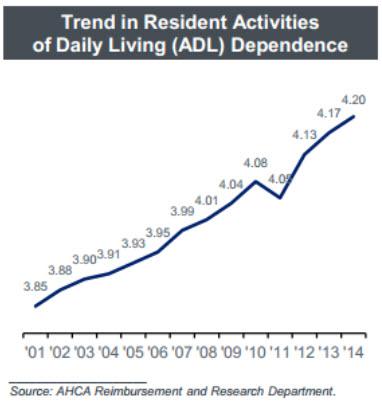

The rising acuity of patients is driven by aging demographics.

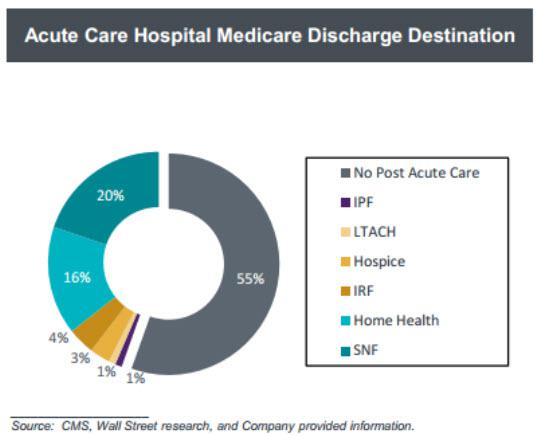

Skilled nursing payers are more focused on driving seniors to skilled nursing facilities which provide the lowest-cost setting of care. Accordingly, this comprehensive delivery of post-acute care generates strong demand for lower costs than alternative inpatient settings.

Skilled nursing facilities typically employ lower costs and less staff than long-term acute care hospitals and inpatient rehabilitation facilities - significantly less physical plant requirements, and efficiently designed to deliver care.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more