Can You Solve The Triffen Dilemma?

When the US Dollar was pegged to $35 an ounce under a system called Breton Woods, a young economist named Robert Triffen predicted that the peg wouldn't hold. In 1971 he was proven right and the system collapsed.

Even though gold is now trading at around $1,200 an ounce, the Triffen Dilemma still holds true. The US Dollar is currently the global reserve currency. This creates a problem for the Federal Reserve, which is trying to run the economy at home but now needs to also consider how other countries will be affected.

The following passage may be familiar to those of you who have been reading these updates regularly...

By "agreeing" to have its currency used as a reserve currency, a country pins its hands behind its back. In order to keep the global economy chugging along, it may have to inject large amounts of currency into circulation, driving up inflation at home.

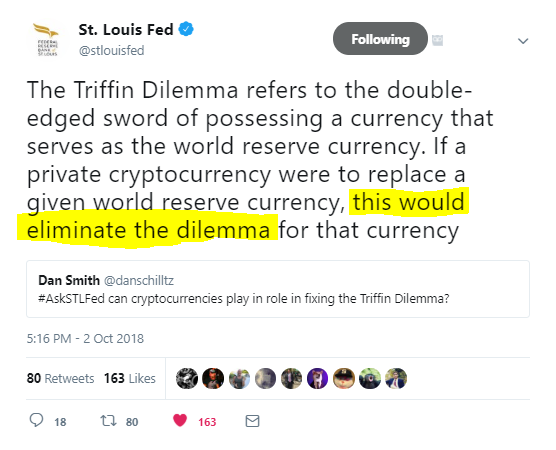

When asked how cryptocurrencies play into the Triffen Dilemma, the Federal Reserve Bank of St. Louis, who has already done a substantial amount of research into crypto, answered quite plainly...

So to answer the question, though you can contribute, you might not be able to single-handedly solve the Triffen Dilemma.

However, efforts like Veem, which has just procured $25 million from Google and Goldman Sachs, are working to integrate Bitcoin as the global reserve currency. A prospect that is not only good news for hodlers but can help bring stability to the entire global financial system.

Today's Highlights

- Extraordinary Times

- Amazon Hikes Wages

- Bitcoin Spike in Iran

Traditional Markets

Almost perfectly in line with what we discussed above, Jerome Powell, the Chairman of the Federal Reserve, commented yesterday on the status of the global economy stating that...

US Economy Experiencing “Extraordinary Times”, Outlook Strong

The fact that unemployment is near all-time lows and inflation has yet to show up in the market is truly extraordinary. This also flies in the face of everything we know about economics.

Chairman Powell's predecessor, Janet Yellen, was not ashamed to display public bewilderment as to the lack of inflation, so it's good to see Powell taking a more authoritative stance.

The Dow Jones managed to close at its all-time highest level of 26,810 points.

(Click on image to enlarge)

So, the Federal Reserve seems likely to continue raising their interest rates at a moderate pace in order to keep inflation in check, regardless of the impact that it may be having on other countries.

Amazon's Wages

Bringing joy to many, the retail super-power Amazon has announced that is raising its minimum wage for employees in the USA to $15 an hour and for employees in the UK to £9.50.

This bold step should go a long way towards thwarting criticism that they mistreat their employees and could also help the company in their efforts to staff up before the holiday season.

Amazon also announced that they will start lobbying the federal government to raise the national minimum wage in the USA as well, which currently stands at $7.25.

AMZN shares did end up falling throughout the day as this will notably impact their profits.

Though this is really amazing, have no doubt, this will bring on a larger level of inflation. More people spending more money will almost assuredly put upward momentum on prices.

Crypto Iran

In a country where the government controls the narrative, the threat from Donald Trump to renew sanctions is impacting local markets in a big way.

Currently the hashtag "The Fall of the Dollar" is trending and is loaded with images of people dumping the buck. Then this showed up in the local media. You don't need to read Farsi to get the gist here.

It appears to be a coordinated Dollar FUD on a national level.

This reached a peak yesterday as the US Dollar plunged against the Iranian Rial in the black market.

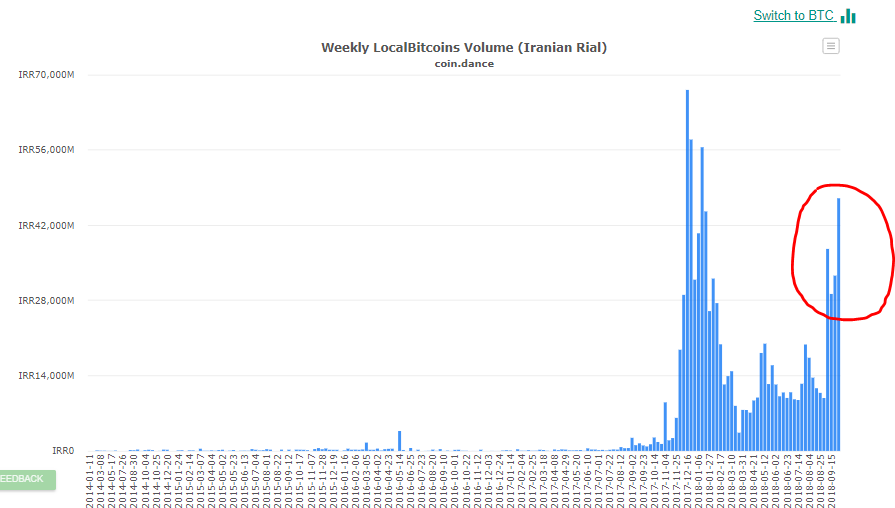

It's no wonder that the peer-to-peer website localbitcoins is reporting a sustained spike in bitcoin volumes over the last month...

(Note this graph shows IRR volumes for impact but even the amount of BTC traded on the site in September more than doubled compared August.)

According to a well-connected source in the Iranian BTC community, Iranians aren't using the localbitcoins website above. Even though the overall BTC volumes would be impossible to track, due to the anonymous nature of cryptocurrencies, the feeling is that usage is growing significantly in the country.

See, it's as I've been telling you all along, as long as the US Dollar is seen as a stable safe haven, bitcoin's value drops in comparison. However, as soon as that dynamic starts to break down, bitcoin's use as a steady store of value suddenly shoots through the roof.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more