Can Micron Beat The Street Again?

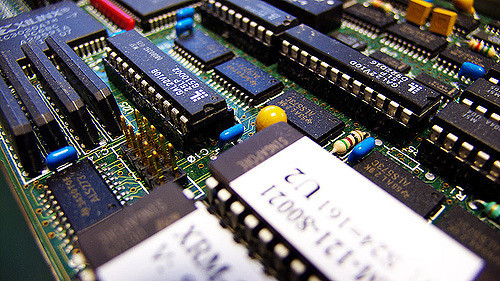

(Photo Credit: Brian Ng)

Micron Technology Inc. (MU) will release FQ3’17 earnings after the market closes on Thursday, June 29th. Micron has been showing a strong upward trend since FQ4’16, beating the Street every release, and the same can be seen for revenue. For this upcoming quarter, the Estimize community has come to a consensus of $1.52 for EPS, which is $.03 higher than the street. On the revenue side, Estimize is also slightly more bullish, predicting $5,471M vs. $5,402M for Wall Street. Estimize data also highlights that Micron sees positive price movement after an earnings release 55% of the time.

Micron Technology manufactures various memory and storage technologies, these technologies are necessary for computers and mobile devices. Micron continues to see increased demand from these devices, and with higher demand, the price of their DRAM (dynamic random-access memory) continues to increase. DRAM encompasses around 66% of Micron’s revenue and Micron has seen 86% growth in revenue since last year. There has been some worries of Chinese firms coming in and undercutting Micron, however, their R&D continues to keep them ahead of the curve. The 1yr target for Micron sits at $38.00 which is about a 16% upside from where the stock stands now.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.