Can Chatham Keep Chalking Up Dependable Monthly Dividends?

I'll confess to you that one of my favorite monthly paying REITs is Chatham Lodging (NYSE:CLDT). While the Palm Beach-based Lodging REIT can't really compare to my classic (monthly) payer, Realty Income (NYSE:O), both REITs are considered top performers within their respective property sectors.

I have been researching Chatham for around two years, and around six months ago, I initiated a purchase at around $26.00 per share. Last week, I attended an Investor Presentation at REIT Week and I had an opportunity to meet with Chatham's CEO, Jeffrey H. Fisher.

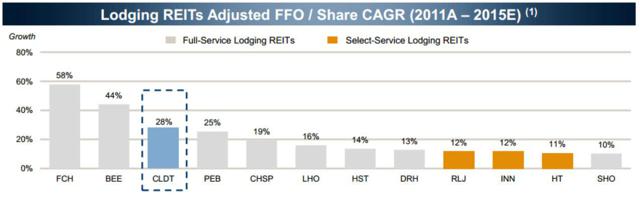

This was my first face-to-face meeting with Chatham management and I was able to dig-deeper into the business model in search of my quest for dividend sustainability. Since going public on April 16, 2010 Chatham has become an exceptionally profitable REIT - increasing adjusted funds from operations (or AFFO) by an average of 28% between 2011 and 2015 (estimated).

To put that into perspective, Chatham's AFFO per share CAGR is 3rd best in the lodging peer group:

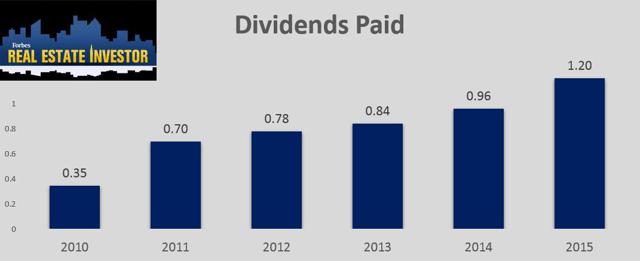

Obviously, my attraction with Chatham is the consistency of profit margins that have resulted in steady and growing dividends. In January, Chatham announced a 25% dividend increase that resulted in an annualized dividend payout of $1.20 per share.

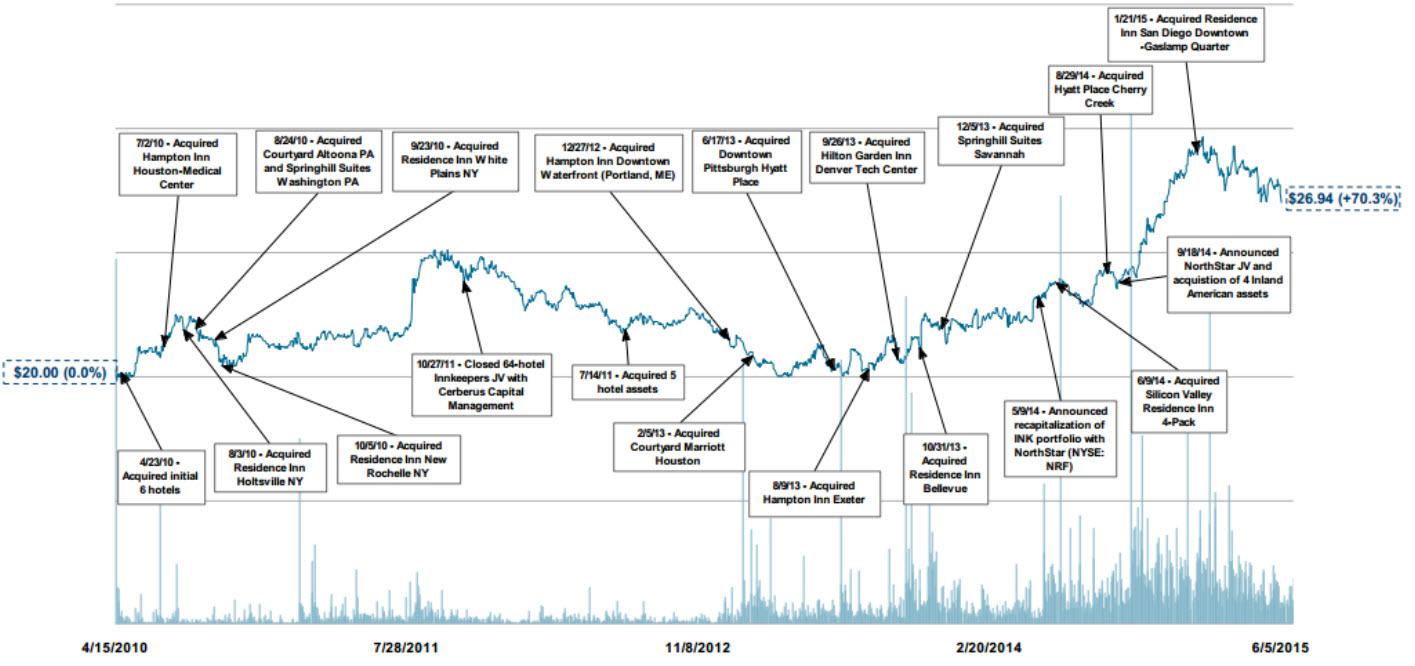

I'm not the only one chatting good things about Chatham. Mr. Market has also become attracted to the essence of Chatham's sources of differentiation. Since the company's IPO, the company has generated total shareholder returns of around 70%.

Click on picture to enlarge

Over the last 12 months, Summit Hotel Properties (NYSE:INN) is the only REIT that has outperformed Chatham:

Since my initial investment in Chatham (in December 2014), the market was less enthusiastic; even after a 25% dividend increase (in January), there has been no capital appreciation.

Consequently, it's now time to take a closer look at Chatham and determine if this REIT has the power to keep chalking up the dividends that are generated by this differentiated model of repeatability.

Differentiator 1: Coastal Markets

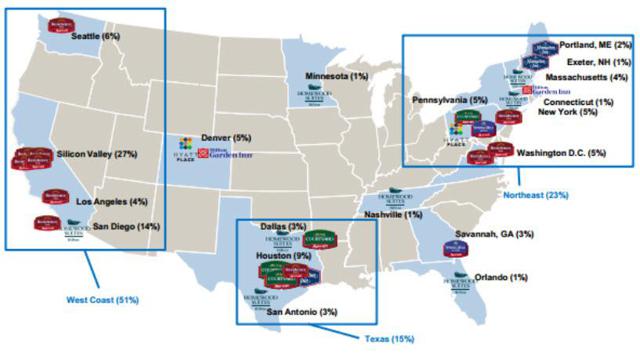

Chatham owns 35 hotel properties with a predominant presence in coastal markets. Around 74% of the company's properties are located on the Cost: 51% on the West Coast and 23% on the Northeast. Chatham has the second highest exposure to West Coast markets of all U.S. lodging REITs.

(click to enlarge)

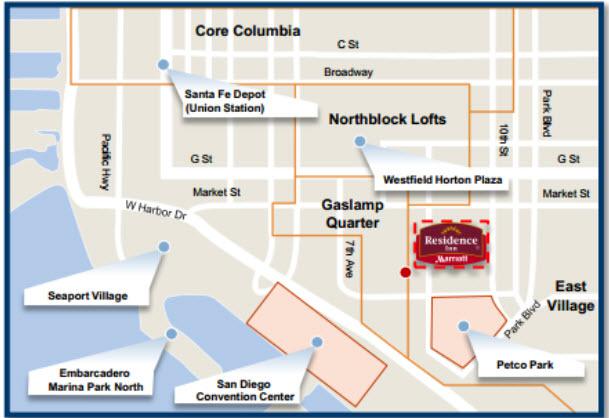

In February (2015) Chatham acquired the 240-room Residence Inn in San Diego Downtown-Gaslamp Quarter for $90 million, or approximately $375,000 per key. The 12-story hotel opened in 2009 and Chatham purchased the property at an estimated 2015 cap rate of 7.6%. This marks the second hotel in San Diego for Chatham and aligns with the company's strategy to acquire in0fill, premium branded, select service hotels in markets with string, growing demand.

Chatham has also added four Silicon Valley hotels (751 rooms) - all upscale, extended-stay brands with new 20-year franchise agreements. The hotels are located in one of the fastest-growing employment markets where there is low risk of new supply. All of the hotels are Residence Inns. RevPAR for the recently acquired Silicon Valley portfolio was up 12.8% for the quarter to $184, driven by occupancy growth (92%).

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more