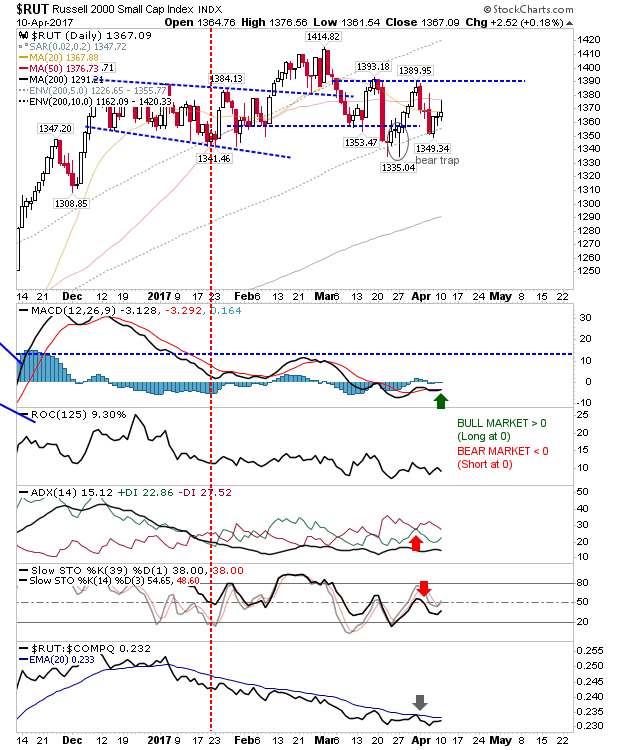

Buyers Tried To Revive Russell 2000

There wasn't the reaction two days of narrow trading had presented into Monday's open, but the Russell 2000 made a good attempt at trying to rally. However, it tagged the 50-day MA, then headed back to its starting point. The only change on the day was the MACD trigger 'buy'. With two spike highs in less than a week the next move to look for is a challenge on the 'bear trap'.

The S&P posted a third successive doji with the 50-day MA holding as support. Volume has steadily dropped, which runs the risk of seeing prices head lower in the absence of buyers (not necessarily active selling). There is a squeeze coming up with channel resistance converging with the fast rising 50-day MA.

The Nasdaq had a similar day to the S&P, instead, it has the support of the 20-day MA to lean on. Key resistance at 5,930 is the line to cross to generate a breakout - and the 20-day MA is putting the squeeze on.

For tomorrow, look for breakouts in the Nasdaq (for longs), or a drift below the 50-day MA in the S&P and Russell 2000 (for shorts).

Disclosure: None.