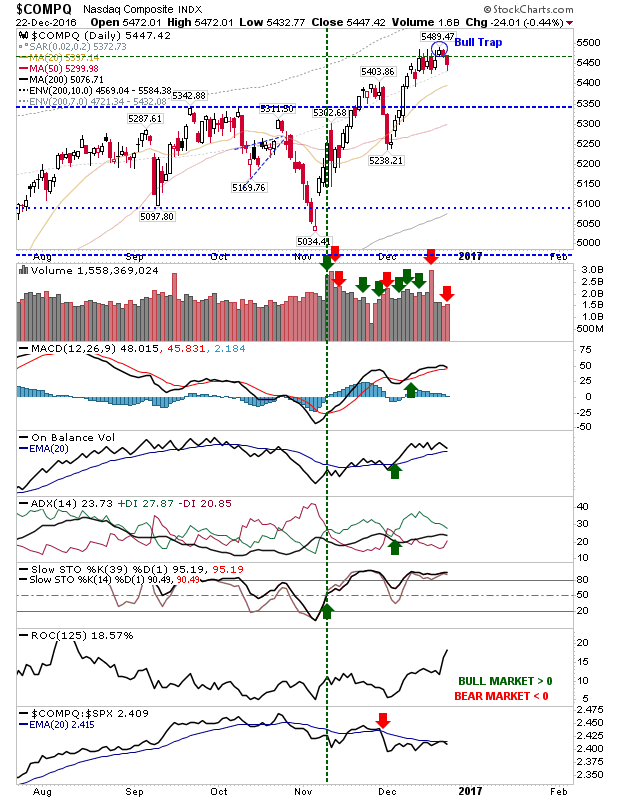

Bull Trap For Nasdaq?

The initial upside breaks from the coils are faltering a little. The index showing the most vulnerability is the Nasdaq. There was some recovery before the close of business, but the damage has already been done. Technicals are still holding on the bullish side, with the exception of relative performance (against the S&P). Volume climbed to register distribution, but in holiday volume terms.

The S&P hasn't quite confirmed a 'bull trap,' but it's close. The MACD triggered a 'sell' in favor of further weakness, but other technicals are hanging on. On the flip side, the S&P is about to turn bullish against the Russell 2000.

The Russell 2000 almost took a 1% loss, but a drop below 1,354 would begin a sequence of lower highs and lower lows. The MACD has already generated a 'sell' trigger, and it's on the verge of a 'sell' trigger in relative performance (against the Nasdaq).

With the festive season in full swing, it's probably going to be January before the next trend move occurs. Early indications suggest bulls are losing momentum, having failed to add to the classic coil breakout.

Disclosure: None.