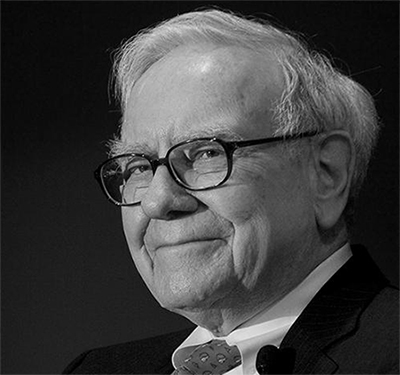

Buffett Sees It

Warren Buffett is a peerless value investor.

With his recent sweeping investment in the airline industry, Buffett has made it clear how he feels about the economy. Buffett’s investment timing in a highly cyclical airline industry can quite forcefully suggest one thing – Buffett views the economy as steady and strong going forward, and not heading for a cyclical downturn anytime soon.

Now Buffett’s investments always have had time on their side, and are typically held over many years. But even then, an investment in a cyclical sector with the economy into its ninth year of expansion, the third longest on record, is suggestive of Buffet’s confidence in the future.

No one likes to invest at a peak - not even Warren Buffett - particularly with the second longest Bull market already in place at 95 months.

The legendary investor has been increasing his stock positions quite meaningfully, including a quadrupling of the position in the technology giant Apple (AAPL).

Buffett's confidence in the economy may not be misplaced.

Continue reading on Seeking Alpha.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.