Brent Oil Hits The Highest Level Since November 2014

Brent Oil Price Increase Drives Inflation Expectations

The worst sectors were real estate and consumer staples as they fell 1.89% and 1.5%. The best ones were energy and tech which increased 1.47% and 0.31%.

As you can tell, oil prices and interest rates affected stocks on Monday. Brent oil peaked at $81.39 which was its highest level since November 21st, 2014. This was the beginning of the oil price collapse.

It closed at $81.2 which was a 3.2% increase. WTI oil increased 1.8% to $72.8 which was its highest close since July 10th. This oil price spike was catalyzed by OPEC leaders signaling they won’t immediately boost output. The supply glut is long gone.

The U.S. sanctions on Iran will eliminate 500,000 to 1 million barrels per day of the 2.1 million barrels per day Iran produces. An oil spike will increase interest rates and inflation which is bad for real consumption growth.

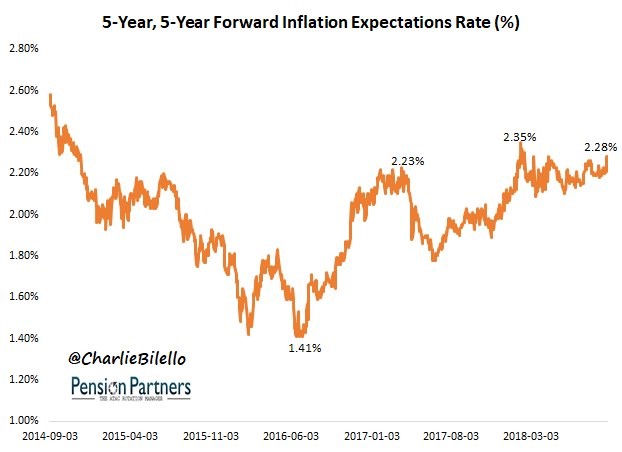

As you can see from the chart below, the 5 year forward inflation expectations rate has increased to 2.28% which is near the highest rate since 2014.

We’re nowhere near the set up in 2007 and 2008 where oil prices spiked and housing tanked. However, this is a new negative which can keep a lid on future equity gains this year.

Brent Oil - Treasury Yields Increase

With oil prices causing inflation expectations to increase, it’s no surprise that treasury yields also spiked on Monday. This explains why real estate was the worst sector.

The 2 year yield increased 2 basis points to 2.82%, which is another new cycle high. The 2 year yield started the year at 1.88% which means it’s up almost a full percentage point this year.

It is a lock that the Fed will raise rates Wednesday as the chances are 100%. There’s even a 6.2% chance rates are hiked twice. The chance of at least 2 more hikes this year are the highest yet as the odds are now at 82.8%. There’s even an 8% chance for 3 more hikes this year.

It’s interesting to see how the fear of rates being too close to the zero bound before the next recession has completely evaporated.It seems the Fed funds rate could get above 3% by the end of this hike cycle.

If oil drives headline inflation, real rates adjusted for headline CPI won’t become positive. A headline inflation spike is a new wrinkle to consider now that OPEC and the sanctions on Iran are driving up oil.

The best part of this spike in yields over the past 2 months is that the curve has steepened which pushes off the chance of a recession. The 10 year yield increased 3 basis points to 3.09%. This is just 2 basis points away from the cycle high.

I didn’t think the 10 year yield would break its cycle high, but this oil price spike is a game changer. The difference between the 10 year yield and 2 year yield is 27 basis points.

A difference that's a 9 basis point swing since late August. It’s an amazing turnaround given the fact that 2 more hikes this year are almost full priced in. The chance of the yield curve predicting a recession in 2020 has take a sharp nosedive.

This reiterates the point that you can’t just extend trends. Sometimes they reverse.

Brent Oil - Monday Pullback

The stock market declined Monday because of worries about tariffs. It also declined because it was overbought heading into the week. Finally, because of fear that an oil price spike will hurt economic growth.

The S&P 500 fell 0.35%. The fact that the Dow underperformed the Russell 2000, falling 0.68% versus a 0.41% decline, gives you a hint that the decline was trade related.

Caterpillar and Boeing are two trade bellwether names. They fell 1.51% and 1.14%. The CNN Fear and Greed index fell 5 points to 70, but still signals greed.

Therefore, I’m still bearish on stocks in the near term. The Nasdaq was the only major index that was green as it was up 8 basis points.

Brent Oil - A Potential Pair Trade

The chart below shows the ratio between bank stocks and utilities in comparison to the 10 year yield. Banks are supposed to rally and utilities are supposed to fall when the 10 year yield increases.

The banks like higher yields and a steepening curve, while the utilities are similar to bonds, so they don’t like the competition of higher treasury yields.

Because the ratio has recently lagged, you can buy banks and short utilities since the gap should close. Obviously, if the 10 year yield falls, the gap will close the other way.

Brent Oil - Trade War Gets Worse

Stocks finally recognized how badly the negotiations between America and China are going.

The National Trade Council director, Peter Navarro, said, "The challenge is they've engaged in so many egregious practices that it's far more difficult to make a deal with China than it would be with Mexico."

It’s not a surprise to see the author of the book “The Coming China Wars” is hawkish on trade. Rather, it’s a reminder that a very hawkish official is in a position of power in the White House.

The latest round of tariffs, which are a 10% tariff on $200 billion worth of Chinese goods and a tariff on $60 billion worth of American goods, went into effect on Monday.

Each new tariff and hawkish statement make it less likely that there will be an agreement in the near term. Each negative economic report from China makes it more likely a deal will be struck.

The potential 25% tariff on Chinese goods would be like a $2.5 billion tax on the homebuilder industry.

A firm in the Dallas Fed manufacturing survey stated, “Prices for steel have increased by 30 percent due to import tariffs.

This has cut operating margins for the past four months and will continue to have an effect until these fixed-price bids are completed. New contracts will reflect higher raw material costs and higher prices to our customers.”

The statements by firms affected by metals tariffs are important because they will be replicated by firms in industries affected by the latest round of tariffs.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more