Breaking Down The Composite

Today affirmed for me once again the wisdom (for me, at least) of having a zillion little equity positions instead of one or two huge ones. To explain: before the opening bell, the ES was down good and hard, and I figured (with my 128 short positions) it would be a good day. It started off that way, but then, for absolutely no reason whatsoever, the market strengthened at once, and my beautiful profit had eroded into a small loss as the ES turned a disgusting shade of green.

Then, just as easily, the market started eroding, and by the end of the day, I had a big honkin’ profit (and had padded my portfolio with even more positions, ending with 135). I am highly confident that I would have freaked out early on if I had just one huge SPY short position, and I would have probably exited at the worst possible moment. As it was, I covered virtually nothing, and the day ended up great. So………take that, morning bulls.

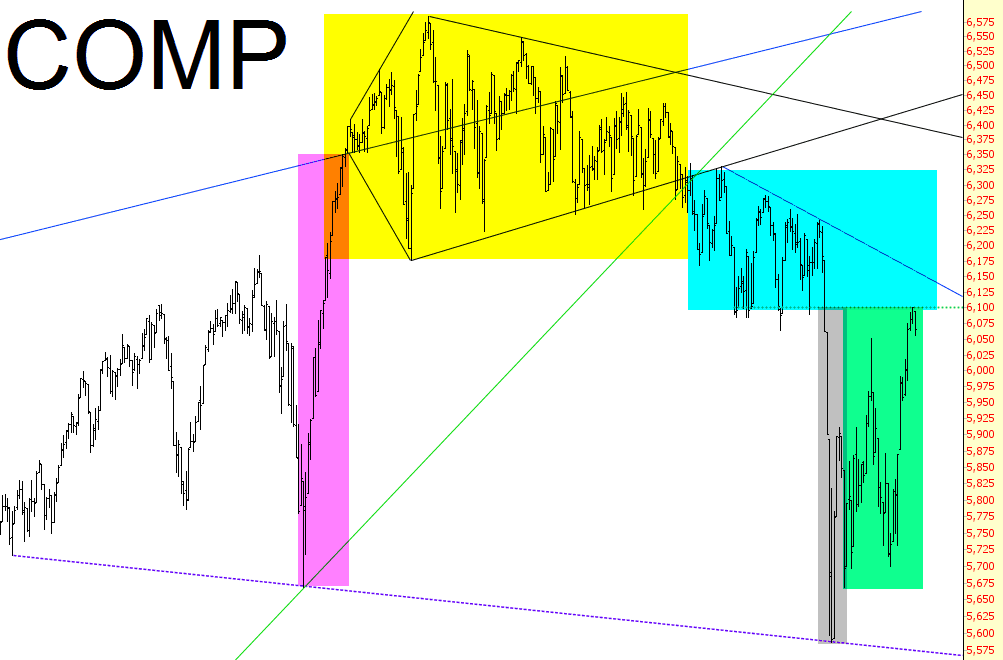

I think my portfolio, stated above, says more about my disposition on the market than just about anything, but I at least wanted to drag out our old friend the Dow Jones Composite to take another look at what I consider its core patterns of movement over the past couple years.

(a) the magenta portion represents the last, sickening lurch higher than the bulls enjoyed, spurred on by that Fed turd James Bullard. It remained a market of never-ending higher highs;

(b) the yellow is the Ichthus pattern I wrote about endlessly, only because the pattern seemed to go on endlessly. That was a tortuously long spell for the market to be in a very tight range, as we all waited for it to do something;

(c) the cyan marks the stage where the Ichthus at long last broke down and formed a right triangle. It was again a waiting game (although not as long as for the prior pattern);

(d) the grey was “the crash” (as crashes go, a fairly pathetic one, but it’ll do, pig, it’ll do), which bottomed on the early morning of Monday, August 24th.

(e) the green, where we are still bouncing, is “the healing” period following the crash, a period in which the VIX has collapsed by 70% and all the bulls have slithered back out to declare that everything’s great and that we’re just going to roar to new highs again.

I think there are two strong possibilities at this point. One of them is that we work our way back lower into the “green” range, and that we stabilize at the lower portion of that range. Maybe we’ll get close to the lower trendline, and maybe we won’t, but even if we just work our way to the lower portion of the range, that still makes for some nice short-side profits.

The second possibility is simply an extension of the first, which is that we’ll actually break the lows set on August 24th and make a somewhat lower low. I don’t think it’ll be much lower than the “crash” lows, but it will be enough to get the attention of The Powers That Be to puke up some new plan, or at least do some serious, serious jawboning.

Of course, the possibility that most are citing (that we simply leap higher from here, skipping, prancing, and getting our hair and nails styled as we reach new highs) is one I do not consider likely. I’ll just keep doing what I always do: let my positions take care of themselves, on a stop by stop basis, and, as with this morning, trust them to muster through repeated bouts of temporary insanity.

Oh, and as for the debate tonight, all I can say is that this comment from ZH is awesome:

This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more