Bond Sentiment Extreme Near A Cycle Turning Point

Bond Sentiment will lead to a Cycle Turn

The Bond market has obviously been in a strong rally since the April Investor Cycle Low (ICL). History teaches, however, that even during solid bull market moves, corrections into major Cycle Lows are a normal part of the Cycle flow process.

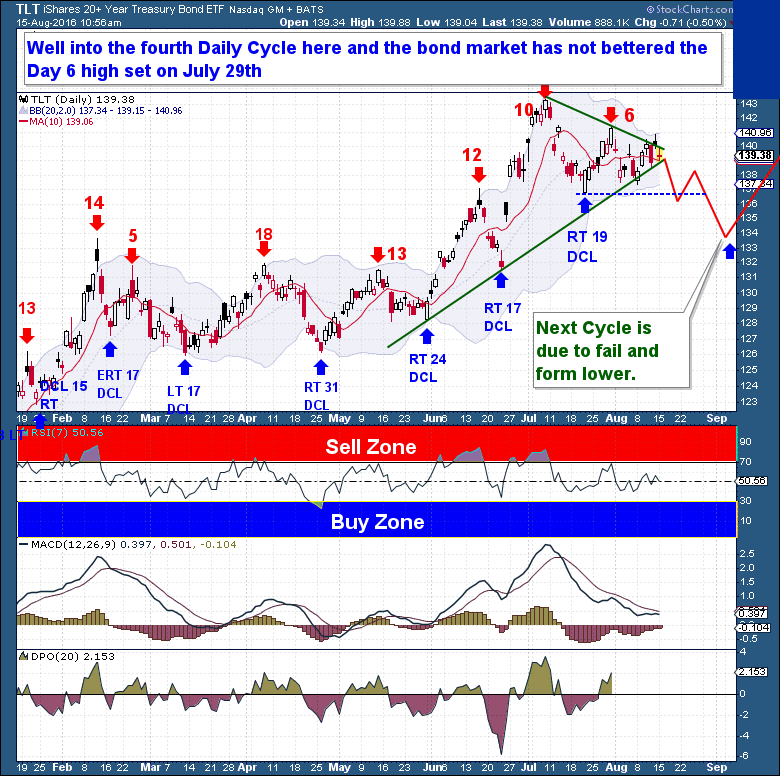

And this is where we find Bonds today. The Commitment of Traders report shows a massive Long speculative position, while overall Bond Sentiment remains sky-high. Weekly Cycle timing is well into its topping range, and the 4th Daily Cycle (shown below) is beginning to struggle. I would never count Bonds out, at least until we see a failed Daily Cycle, but I am starting to believe that a new down leg in Bonds is almost upon us.

A technical caution – if price were to move higher and exceed the current day 6 high, a bullish continuation is possible. For the bulls, loss of the 10-day moving average would be extremely negative, as it would signal a potential downturn and Left Translated Daily Cycle.