Bitcoin, Ripple, Ethereum See No Support From Whales – Levels

However, digital coins turned down in the wake of the new week. Some suspect that this is a necessary correction. After all, cryptocurrencies have not hit new lows. Others suspect that this is just a dead cat bounce before another fall.

According to one theory, crypto whales, or the big boys, are dumping digital coins to cause panic and a sell-off, only to begin re-accumulating. Some thought this moment of buying has already begun. However, even if the whales are not dumping further cryptos, they are not buying either and seem to be on the sidelines.

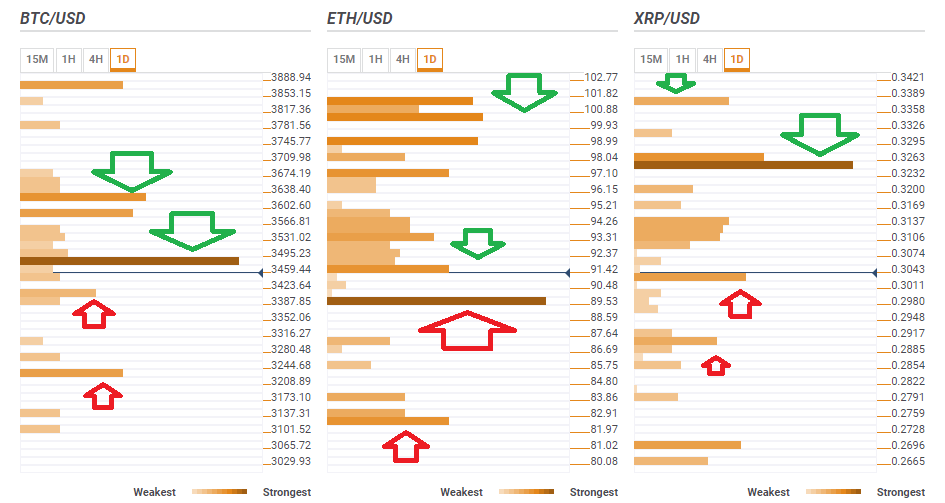

The technical levels do not bode well for any of the top 3 cryptos. Here are the levels to watch on Bitcoin, Ethereum, and Ripple.

(Click on image to enlarge)

BTC/USD faces a hurdle at $3,480

Bitcoin sees a significant hurdle at around $3,480 where we see a dense cluster including the Bollinger Band 15-minute Middle, the Fibonacci 23.6% one-week, the Simple Moving Average 5 one-hour, the previous month low, the SMA 10-1h, and the Fibonacci 61.8% one-day.

The next substantial cap is around $3,585 where we see the convergence of the SMA 5 one-day, the Fibonacci 23.6% one-day, the Bollinger Band 4h-Upper, and the BB 1h-Upper.

Looking down, weak support awaits at $3,403 which is the meeting point of the 4h-low, the Pivot Point one-day Support 1, and the BB 15m-Lower.

$3,223 is the last noteworthy support line, including last week’s low and the Fibonacci 161.% one-day.

ETH/USD stands out with support at $89.53

Ethereum stands out from the crowd by enjoying significant support, but the upside is not that easy.

At $89.53 we see the meeting point of the PP one-day Support 1, the previous daily and four-hour low. Further down, at $82.50 we see the previous weekly low, the Fibonacci 161.8% one-day, and the Pivot Point one-day Support 2.

Some resistance to ETH/USD awaits at $91.42 where we see the Fibonacci 23.6% one-week, the previous 1h-high, the BB 15-minute Middle, the SMA 100-1h, and the SMA 5-1h.

The road to the upside is packed with resistance lines and the most significant one is at the very round number of $100 which is the Pivot Point one-day Resistance 1, the previous daily high, the SMA 50-4h, and the SMA 200-1h.

The prospects for Vitalik Buterin’s brainchild has somewhat improved.

XRP/USD continues facing the $0.3250 hurdle

Ripple has some support at $0.3025 where we see the confluence of the SMA 5-15m, the previous daily low, the PP one-day Support 1, and the Bollinger Band 1h-Lower.

At $0.3250 we continue seeing a cluster of critical levels: the Fibonacci 38.2% one-week, the PP one-day R1, and the previous monthly and daily lows.

$0.3374 we see the meeting point of the PP one-day R2 and the SMA 10-one-day.

Low support is at $0.3030 which is the convergence of the previous weekly low, the Fibonacci 161.8% one-day, and the PP one-day S2.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more