Biotech Stocks Best Chance For Breakout!

Since January, the Biotechnology sector, as represented by the Nasdaq Biotechnology Index ETF (IBB), has been trading in a range that has become narrower. The lower bound has continued to rise while the upper bound has faced significant resistance at the 52-week high level of around 300. The index has attempted to make new 52-week highs but has retreated each time after touching the level.

The price action is suggestive of a coiled spring, where the biotechnology sector is benefitting from investor cash inflows to arrest the declines around the lower end of the range of 280, while such buying power wanes as the index approaches the top of the range. As one can observe, the bottom end of the range has further risen to 290 level creating a narrower trading band.

A catalytic event has the potential to push the IBB index forcefully through the resistance level and set new 52-week highs.

We look at what can be a few potential catalytic events for the sector and the likelihood of their occurrence in the near future.

Favorable Backdrop for the Stock Market

The investing environment has become more favorable, as Earnings, Economy, and Monetary Policy, continue to be supportive of higher valuations.

In our recent article, Lessons from a Trump Presidency, we had noted that these three plinths of the market remain favorably aligned:

In the US, we have been in a somewhat Goldilocks scenario, where economically the key supports have been optimally positioned for the market - earning growth, a mild interest rate environment, and the promise of more pro-growth policies. This is a heady combination for generating investment returns...May 2017

The earnings for the first quarter have come in quite strong, at nearly 14% for S&P 500 companies, and well ahead of recent expectations in April 2017 of 9% growth. The 14% growth rate is the highest earnings growth rate in over 5 years for S&P 500 (SPY). The interest rate policy remains benign and on-track for a rate increase at the FOMC meeting on June 13-14. There appears to be no urgency for the Federal Reserve to revise its rate increase count upwards from the present 3 hikes for 2017.

Positive Flow of Industry News

The annual ASCO conference was held from June 2 to 6, in Chicago. The premier oncology conference had investors and companies riveted to the various presentations, which largely was upbeat and delivered positive news in many instances.

Besides the large cap companies like Merck (MRK) and its blockbuster immuno-oncology drug, Keytruda, as well as Incyte and its IDO1 drug Epacadostat which is being tested in combinations with Keytruda, as well as Bristol-Myers Squibb's (BMY) Opdivo, there were a number of small and mid cap companies as well that took the spotlight with their positive news.

The CAR-T companies, which have been hounded by concerns relating to Cytokine Release Syndrome, had strong data to report progress on their programs and safety profiles. CAR-T represents a new kind of innovative therapy where healthy T-cells from a patient's own immune system are extracted, modified, and reintroduced in the patient to target cancer cells, and stands for Chimeric Antigen Receptor T-cell therapy.

One of the leaders, Kite Pharma (KITE), provided strong remission data for its Phase I study of lymphoblastic leukemia, and Bluebird (BLUE), which is partnered with Celgene (CELG), also provided an upbeat assessment on its multiple myeloma program using CAR-T therapy. Even Juno Therapeutics (JUNO), which last year confronted a failed trial that claimed lives, provided positive news in its early-stage non-Hodgkin lymphoma study using CAR-T therapy.

Loxo Therapeutics (NASDAQ:LOXO) provided strong data on its Tropomyosin Receptor Kinase (TRK) fusion program for its lead drug Larotrectinib - LOXO 101, which witnessed high remission rates across different tumor types. Similar to the approach of Merck's Keytruda, which was approved for a genetically defined use rather than a particular organ or site use, Loxo is targeting the TRK biomarker across different tumor types. Investors saw the potential in the new approach and results, delivering an over 50% gain the next trading da.

The positive news flow raises interest level in the sector, which continues to see more IPOs and financings this year than last year.

Potential Market Catalysts

The biotechnology sector consolidating over many months can use a catalyst to provide the momentum to rise above its resistance level.

M&A activity can be a catalyst, particularly a large transaction. Gilead Sciences (GILD) has been often mentioned as a candidate in an urgent need to acquire a product line to offset its rapidly declining Hepatitis-C franchise. Many larger pharmaceutical and biotech companies like Pfizer (PFE), Novartis (NVS), Amgen (AMGN), Biogen (BIIB), Eli Lilly (ELY), have indicated their intent to be on the lookout for candidates. Potential large candidates mentioned in the past have been Incyte (INCY) and Vertex Pharmaceuticals (VRTX). But there are a number of midcap and smaller cap companies that can come into play, particularly as they continue to report positive data on their pipelines.

Nonetheless, in spite of many compelling reasons, M&A has not picked up the pace yet. As mentioned in the article, Biotech At An Inflection Point, the M&A transaction value in Q1:2017 was well below the same time last year. The present quarter should also track lower. The slow pace can be partly explained by the uncertainty around the health care policy relating to price regulation, and the future of the Affordable Care Act. However, as Gilead noted in its recent earnings call, acquisitions are dictated by business needs and policy uncertainty is something that the health care industry is accustomed to.

Considering that M&A timing is unclear, hard to predict, and may not prove to be an imminent catalyst, we believe there are other potential catalysts that may emerge sooner.

In our opinion, the most important imminent catalyst can be a forceful advance by the market after the testimony from former FBI Director Comey does not reveal anything damaging beyond what has already been disclosed. The testimony will be largely viewed by investors through the lens of whether it raises the potential impeachment risk through the obstruction of justice argument. If it doesn't, then the market will heave a sigh-of-relief, and reinforce its uptrend. This will benefit the biotech sector as well, providing the momentum to reach higher ground beyond the 300 level on IBB.

However, news perceived "bad" will cause the market to react accordingly, and so will the biotech sector.

Watching the Small Caps

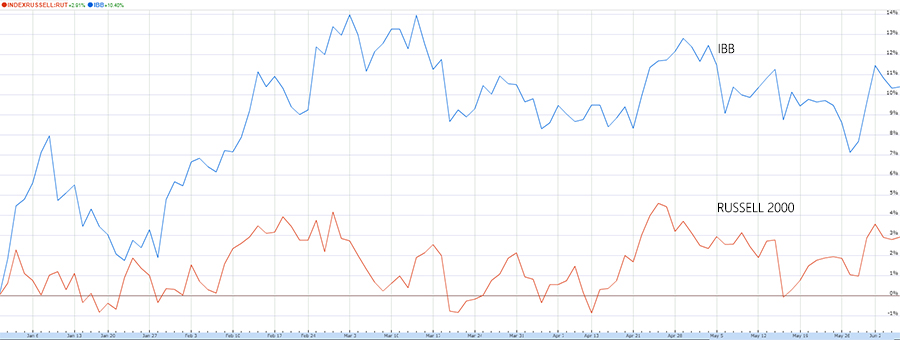

There is a significant degree of correlation that appears to exist between the small cap stocks, as represented by the Russell 2000 index (IWM), and the Biotechnology sector. Besides the fact that many of the biotech companies are small-and-midcaps, the correlation also reflects a risk appetite for the speculative segment of the stock market.

If the Russell 2000 index, which has been going through its own consolidation since last December, forcefully breaks out this month with a broader market rise, in large part due to the Comey Rally, the biotechs should follow-through with their own breakout.

We believe a sharp market advance at these levels offers the best chance for Biotech indexes to break into the new higher ground.

Health Care Legislation

Clarity on health care legislation can be another catalyst to trigger a sector advance.

Even though the rhetoric about price regulation has been aggressive, the truth is that all the policy-related positions of the new administration have thus far been supportive of bringing down drug costs using a more expeditious and efficient approval system. The recent appointment of Scott Gottlieb as FDA Commissioner further strengthened the viewpoint. If a new health care policy supporting this line of thinking becomes clearer, it will lift a cloud of uncertainty looming over the sector and pave the way for a sharp rise in biotech and pharmaceutical valuations.

However, with the ACA repeal-and-replace bogged down, policy attention to the pricing subject may not come for some time. In addition, the health care sector remains sensitive to tweets from our mercurial President, who may remain vociferous of the industry "getting away with murder." At this point, health care policy clarity does not appear to be a near-term catalyst.

Conclusion

We believe Biotech's best chance for breaking out of its trading range rests with a sharp broader market advance, and this may well ensue if the testimony from former FBI Director Jim Comey is considered priced-in news.

The biotechnology sector has lagged the broader market's march towards all-time highs, and are overdue for a rally. Portfolio allocation to this promising sector makes sense. In 2017, the biotech sector, as represented by IBB, has risen +8% and our Prudent Biotech Portfolio has risen +13%. This compares to a rise of 1% for the small-cap Russell 2000 Index, and +13% for the Graycell Small Cap Portfolio.

There are many promising companies to form an attractive portfolio. A few such names include Regeneron (REGN), Exact Sciences (EXAS ), Vertex Pharmaceuticals (VRTX), Supernus Pharmaceuticals (SUPN), Grifols (GRFS), Tesaro (TSRO), Kite Pharmaceuticals (KITE), Aeri Pharmaceuticals (AERI ), Novocure (NVCR), Foundation Medicine (FMI), Akebia Therapeutics (AKBA ), Loxo Therapeutics, and TG Therapeutics (TGTX ).

However, one has to keep in mind that time may run out for Biotechs if the broader market decides to take a pause from its upward trend and retreat in the second-half. This may happen if the President's miscues pile up sufficiently high to derail the pro-growth policy agenda. In the Market Outlook For 2017, we had noted that:

At this time, we believe the first-half will be better for stocks, than the second half, primarily because of fear of unrealized expectations.

Those unrealized expectations can pose the biggest risk for the stock market in the second-half. However, such risks are not yet imminent. In the meantime, let us see how the market passes judgment on the Comey testimony, which offers the best chance for a near-term catalyst to push biotechs higher.