Biggest Structural Risks Facing The Market

Structural Risk: Trade Wars

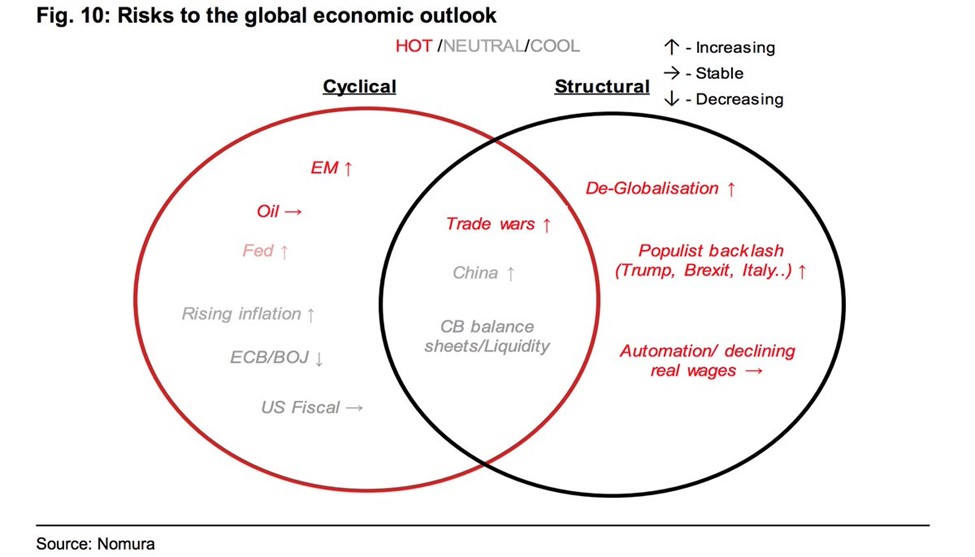

In a previous article, I reviewed the cyclical risks in the Venn diagram below. Now let’s review the middle risks which are both structural and cyclical. The trade wars are considered cyclical because Trump is going to be President for another 2.5 years or 6.5 years. Without him, these tariffs wouldn’t be in place. They are also structural because real wage growth has been mediocre and manufacturing jobs have been outsourced.

(Click on image to enlarge)

With such poor economic performance for working people, there are political consequences. Usually something gets the blame for hardships. It could be the rich which would cause heavier taxation on them or it could be international trade partners. Trump has discussed eliminating the income tax and replacing it with high tariffs. There would also need to be lower spending in that scenario, but Congress and the White House don’t seem to be following that part of the plan since the latest budget increased spending.

The risk is red hot because the negotiations keep leading to higher tariffs. It’s the biggest headline risk facing the market. With the economy being near the end of the cycle, investors are wondering if they should just take their gains and sell because a recessionary bear market is coming soon. Even though the risk is hot, it is increasing because there are more tariffs coming down the pike. We can’t ignore the possibility that the situation will be resolved quickly, but for now we need to deal with the risk.

The charts below show the European auto and auto parts companies compared with the STOXX 600. As you can see from the bottom chart, the relative performance has declined from 20% outperformance in January to nearly flat because of the tariffs Trump has threatened to put on European car companies. He threatened a 20% tariff, but nothing is set in stone. If this doesn’t get enacted, these stocks will rally sharply.

(Click on image to enlarge)

China Risk

China is considered a structural and cyclical risk as well. It is a cyclical risk because the economy is always changing. There is a bout of weakness coming after a strong Q1 which saw 6.8% GDP growth. The issue is also structural because China has been undergoing GDP growth deceleration for years. The worry about China is it becoming the next Japan which has seen stagnation after a huge burst in growth. This will occur if it can’t get its lower class people into the middle class. The population growth is already stagnant so there’s not much room for error.

Chinese GDP growth is only expected to be 6.5% in 2018 after it grew 6.9% in 2017 which was the first growth acceleration in 7 years. The State Information Center of China put out an article saying annualized GDP growth in Q2 will fall to 6.7%. Since the government is in the know and can manipulate the numbers if it wants, I trust that will be the reported number.

I don’t buy into the argument that Chinese growth is always amazing because America only wishes it can get to that level. China needs to grow quickly to get its people in the middle class and move towards being reliant on the services sector rather than manufacturing. It would be a disaster if growth was somewhere between 2% and 3% like it is in America. If America grew 6.7% in Q2, there would be rampant inflation as demand for commodities would soar to levels which couldn’t be met by the supply chain; the economy would create much more jobs than there are workers to fill them. There are already more jobs available than workers looking for employment.

Another interesting factor that some investors are missing is a big portion of the emerging market weakness is coming from China. There are other countries seeing weakness such as Turkey, Brazil, and Venezuela, but the chart below shows that the MSCI emerging markets index excluding China is actually outperforming the S&P 500 index. As you can see, when you include China, the performance collapses.

(Click on image to enlarge)

China is considered a neutral risk which is increasing. I disagree with this categorization. I think China is a hot risk which is increasing because of the sharp deceleration in growth this year. In previous articles we’ve reviewed the weakness in fixed investment growth and retail sales. The silver bullet regarding this risk is it might put China in such a weak position that it gives in to Trump’s demands. The Shanghai Composite index supports this weakness I have been discussing as it is down 21.7% since its peak in January 2018. It is at its lowest level seen since January 2016.

Central Bank Balance Sheets/Liquidity

Central bank policy is considered a low risk. I’m not sure why there isn’t an arrow next to this one. I’m in the camp that thinks balance sheet changes’ effects on the market are over exaggerated. As you can see from the chart below, the QE bond buying saw the 10 year rate go up when it should go down. The 10 year bond yield declined during the purple area which shows the tapering. However, the action has been inconsistent on that front as yields rose in 2017 and early 2018 rose when the balance sheet was maintained and then started shrinking. With the gradual approach the Fed is taking, the effects on treasury yields are mitigated. The ECB has already announced the end of its QE program and probably won’t be selling any bonds for over a year. I think this policy is priced in. The main risk is if political volatility in Italy occurs, the ECB won’t be able to quell the fear. As for now, I agree that central bank policy is a low risk.

(Click on image to enlarge)

Conclusion

I reviewed the threats to the market which are both structural and cyclical. When investors see the tariffs, they sell first and ask questions later. However, we need to understand the driving force behind tariffs to qualify the risk. Inequality and the Trump presidency are driving these trade battles. After Trump is no longer in office, there will still be inequality. The risk is the ire of American workers shifts to the rich because that potentially means higher corporate tax rates.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more