Big Pharma Companies Are Betting On Regenerative Medicine, Should You?

William Haseltine, the renowned founder of Human Genome Sciences, first coined the now ubiquitous phase "regenerative medicine" in 1992, according to Wikipedia. Specifically, the terminology "regenerative medicine" first appeared in an article published by Leland Kaiser, best known as the highly acclaimed expert in hospital management.

The most intriguing parts of the paper can be found towards the end, where the paper points out future technology impacting hospitals in a big way. Now, I won't be going into those details because apparently, that future appears to have already arrived.

Nonetheless, one statement worth noting from the paper is the one that states, ''a new branch of medicine will develop that attempts to change the course of chronic disease and in many instances will regenerate tired and failing organ systems."

So what exactly is regenerative medicine?

Regenerative medicine is organized around medical technologies potentially possessing the answers to reversing the human aging process. It is described as a medicine with the unique ability to repair, replace or regenerate deteriorating tissues and organs affected by either injury, disease or simply due to the natural aging process.

Regenerative medicines can be applied in a wide variety of disorders including neurodegenerative diseases like Parkinson's and Alzheimer's Diseases, among others. Often these are chronic diseases, which in many cases tend to come at later stages in life. Other potential applications of regenerative medicine include cardiovascular, hepatic, dermatological and orthopedic disease and disorders.

This industry has existed for more than two decades with the majority of early entrants concentrated around the use of stem cells, but growth has only started to pick up over the last few years driven by developments in specific areas of technology, such as tissue engineering, improved stem cell therapies, nanotechnology and electroceuticals.

The rapid aging of the global population and the increasing prevalence of obesity is leading to a significant and growing rate of inflammatory and degenerative diseases of all types. These demographically driven changes are generating significant interest from large, multi-national pharmaceutical companies now targeting small biotechnology start-ups engaged in developing diagnostics and treatments for these degenerative diseases.

Some of the notable companies already showing interest in regenerative medicine research include Pfizer (NYSE:PFE), Johnson & Johnson(NYSE:JNJ) and Celgene (NASDAQ:CELG), among others.

So why exactly are big pharma companies investing heavily in regenerative medicine?

I pointed out at the beginning that regenerative medicine technologies and treatments could possibly replace current methods of treatment in the coming years. While current technologies are treating symptoms of disease or injury, it's not curing the underlying pathology, which explains why the process of aging remains such a huge quandary to human existence.

However, with regenerative medicine, the possibility exists of regenerating deteriorating tissue and potentially slowing the rate of deterioration or even curing the basic pathology permanently.

The Big Pharma companies know precisely how people value life and thus would embrace the process of living a longer healthy life with open arms. Take an example of America alone, where people spend more than $300 billion on healthcare every year. Everyone would be looking to cut down on spending by using regenerative medicine to cure chronic conditions they suffer from, rather than continually seeking general medicine on a yearly basis.

Therefore, this indicates early industry players are far likelier to benefit more than companies coming in later stages, especially given the vast number of people already suffering from various diseases. Additionally, the industry is attracting all types of players from large cap companies to SME's and private startups. This means an open arena still exists for savvy operators to venture into endless possible capacities.

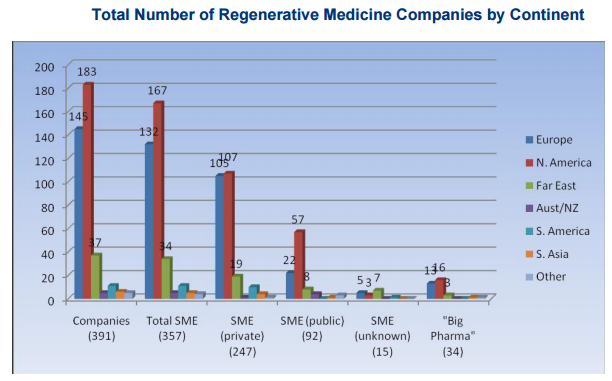

Credit: This is per research done by the UK government in 2011.

Generally, small startup biotech companies are leading the way in terms of research in this new market, while big pharma offers the financial muscle required for financing clinical trials for commercializing potential products. This is why we are seeing a lot of collaboration between the big players and small biotech companies.

There are already consolidations and partnerships in regenerative medicine research taking place to allow these companies to position themselves for early entry into the market. Notably, a few players already have products in the clinical pipeline while others are still at preclinical stage.

For instance, Celgene recently announced a 4.5% stake in Mesoblast (OTCPK:MBLTY), which is one of the leading players in regenerative medicine research. Celgene's investment is geared towards the development of an Acute Graft Versus Host Disease "GVHD" program, which is now in Phase III.

Click on picture to enlarge

The price of Mesoblast rallied following Celgene's announcement, which was an indication of investor approval. The company definitely needs funds to conduct the clinical trial and subsequent pursuit of FDA approval, but Celgene certainly does have the finances to pursue this path.

Another major player, Teva Pharma (NYSE:TEVA), already holds about a 20% stake in Mesoblast and is a major partner in the Chronic Congestive Heart Failure "CCHF" program, which is also in Phase III. This is an excellent example of how major pharmaceutical companies are eyeing stakes in the regenerative medicine space; especially after the startup biotech's establish positive grounds for clinical trials.

In another example, Pfizer has created a unit of its own dedicated specifically to regenerative medicine research. The company initiated operations in Cambridge, MA in 2008 for the sole purpose of regenerative medicine research, but now that unit, Neusentis, has grown to include other types of therapies.

Since 2011, Neusentis' main research areas have been in therapies for pain and sensory disorders. Neusentis is currently developing cell based therapies for age related macular degeneration.

Lastly, Johnson & Johnson invested $12.5 million last year (and that could rise to $325 million based on milestones) in a stem-cell therapy program being developed by startup company Capricor Therapeutics (NASDAQ:CAPR).

The program, which has also attracted $20 million in support from the California Institute for Regenerative Medicine is set to begin a Phase II trial for cardiovascular disease in 2016.

It is worth mentioning that while most Big Pharma players are investing in more traditional cell-based therapies, GlaxoSmithKline (NYSE:GSK) is heavily investing in a new field called "bioelectronics" or "electroceuticals" by establishing a $50 million strategic venture capital fund. The purpose of this fund is to finance companies whose technologies use electrical signals in the body to target diseases. SetPoint Medical was the first company to receive a $5 million investment from GlaxoSmithKline to develop implantable devices for immune system disorders like rheumatoid arthritis and Crohn's disease.

In a nutshell, it remains pretty clear the research and development process of regenerative medicine requires significant capital and extensive testing before getting the product to market. However, one of the companies in the sector Endonovo Therapeutics (OTCQB:ENDV) claims that it has already created a new and less invasive way to treat chronic and inflammatory diseases using electroceutical™ technology originally developed at NASA that could prove to be more affordable and safer alternative for patients once their products are on the market.

In contrast to other treatments being explored, Endonovo's technology does not require the injection of stem cells; instead, it directly up-regulates several beneficial genes, stimulating the cells and causing a regenerative cellular response. The beauty of this treatment is it's not only cheaper; it is also safe and non-invasive and can therefore be administered at home.

Therefore, while companies continue to conduct research and development on new regenerative technologies and products, it is obvious that this industry can be approached in more than one or two ways. It will be interesting to see how things develop for Endonovo in the coming years, with potentially significant milestones in the treatment of acute and chronic inflammatory conditions of the liver expected to be achieved within 2-3 years.

In a report published in January by Market Research Reports, estimates in the report indicate the regenerative medicine market reach $67 billion within the next five years, from $16.4 billion in 2013.

Additionally, small molecules and biologics segment which holds a massive share of the overall regenerative medicine market is expected to register a CAGR of 18.9% over the next five years.

This indicates that stem-cell research will be on top of that growth expected in the next few years, which again supports the decision taken by big pharma companies in terms of interest in the regenerative medicine market.

So should you bet on regenerative medicine?

There is definitely a massive opportunity in the regenerative medicine industry. In fact, Endonovo Therapeutics recently announced its intention to begin pre-clinical testing of its electroceutical technology to treat and reverse acute and chronic inflammatory liver pathologies. Here we are talking of tissue repair/replacement, which means diseases such as nonalcoholic steatohepatitis "NASH" and human cirrhotic liver disease, could soon be cured in such a fashion.

The American Liver Foundation estimates that up to 30% of the population is affected by non-alcoholic fatty liver diseases such as NASH, and with up to 25% of NASH cases resulting in scaring of the liver and cirrhosis if left untreated, a number of acute cases have ended up requiring liver transplant.

That is an expensive and difficult treatment choice for patients, and therapies that could reliably treat NASH in early onset would significantly improve the clinical outcome of these patients. Additionally, early intervention is vastly preferable by payers and providers and avoids the significant costs and difficulties of intervention at the end-stage of diseases.

Regenerative medicine certainly is poised to provide significant cost savings while addressing a significant unmet need that is attracting large investments from multi-national companies.

Large companies have the financial muscle, but will only commit funds on what appears to be a realistic case scenario. On the other hand, startup research companies have been leading in preclinical research in the market, and become significant targets once they get their products to stages warranting the attention of the big players.

Now, as for investors, this market is in its infancy and as we all know thereby presents the most attractive opportunity to invest in regenerative medicine. Nonetheless, just as the large players have shown trepidation in investing in this industry, investors should also be cautious and further research a potential company they intend to invest in.

After all, many promising start-ups have generated substantial interest in the marketplace only to fail at the last hurdle. The regenerative medicine market offers a genuine opportunity for investors, but identifying what companies to use as investment vehicles in the market remains crucial to success.

Conclusion

The bottom line is that as a strategic investor, you will be looking at the magnitude of the opportunity at hand and assessing the level of risk involved. In biotech, investors always tend to have a huge appetite for risk due to the enormous potential return once a product reaches the market.

Looking at the current opportunity in regenerative medicine, the opportunity is massive, but the risk could be very high depending on your choice of investment vehicle and timing. Nonetheless, if this market really was to live up to expectations and change the course of the medical industry, then I bet every investor would want to take a keen look and weigh up their options.

The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does it ...

more