Best & Worst Stocks To Buy In Large Cap

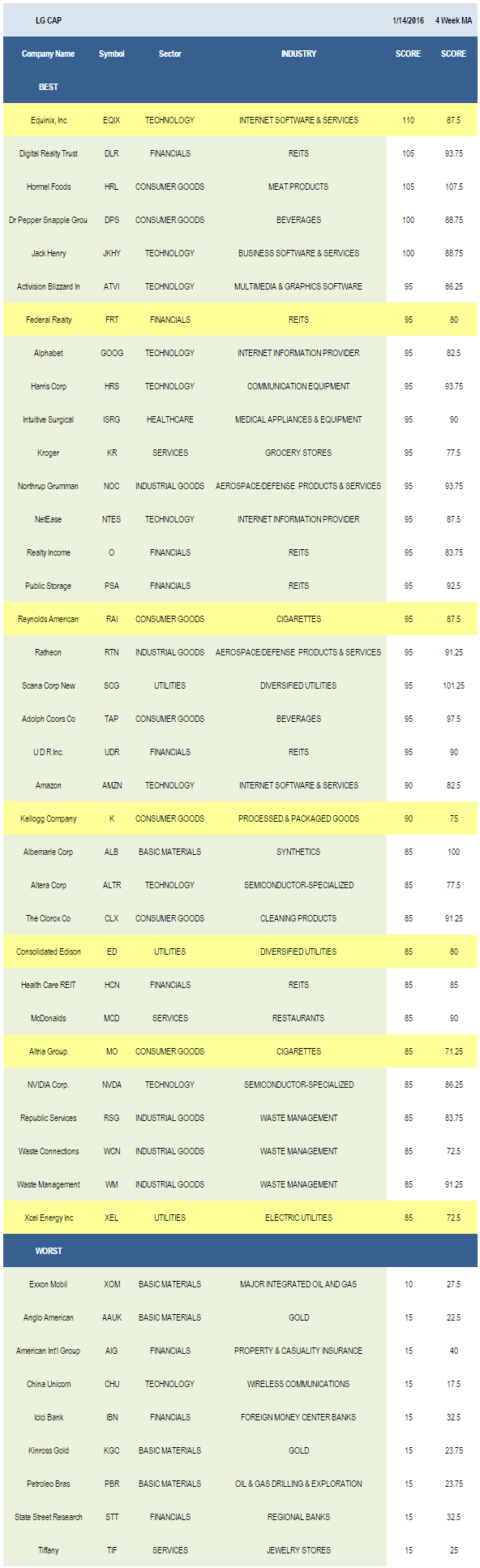

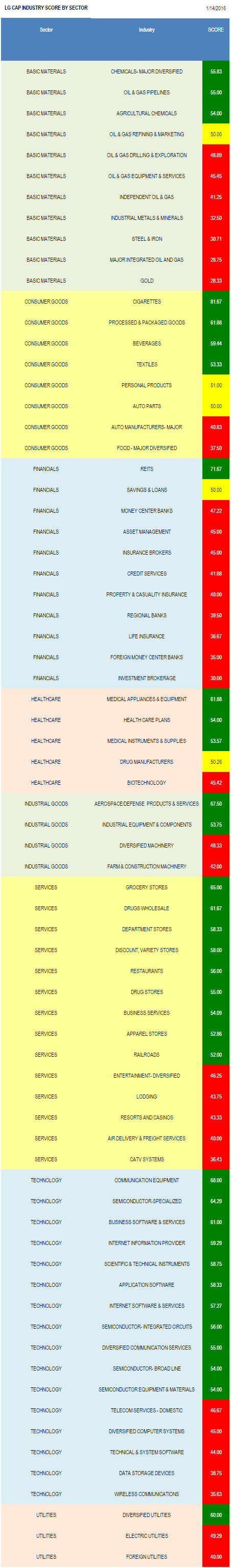

- The best large cap sector is consumer goods.

- The top large cap industry is cigarettes.

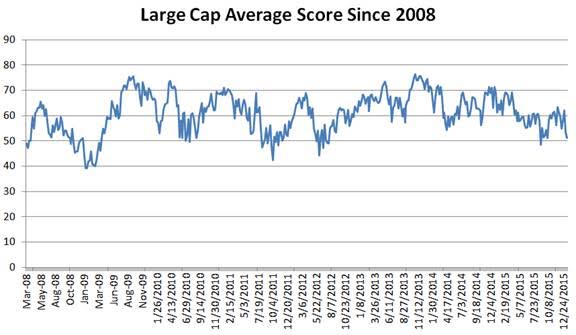

The average score across large cap is 50.86 and that's below the four week average score of 55.79. We are getting closer to an actionable level on large cap (see later in today's report), but the all-clear isn't flashing (yet).

The average large cap stock in our universe is trading 26.01% below its 52 week high, -10.18% below its 200 dma, has 4.38 days to cover held short, and is expected to deliver EPS growth of 9.93% in the coming year.

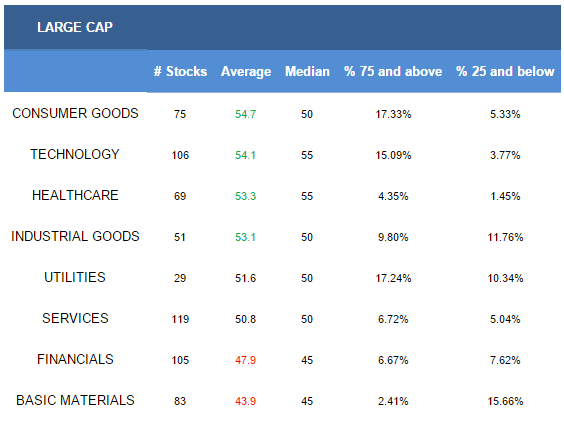

Consumer goods, technology, healthcare, and industrial goods score above average this week. Utilities and services score in line. Financials and basics score poorly.

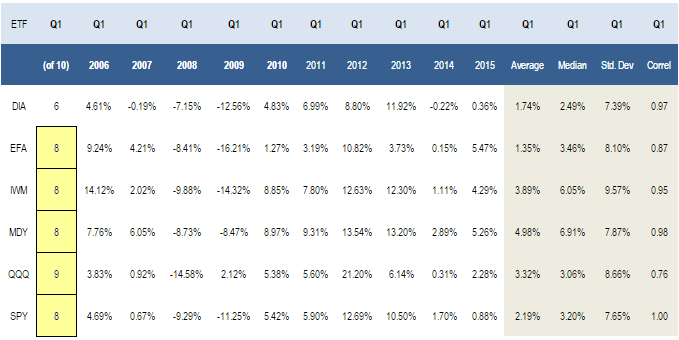

The NASDAQ 100 offers the best Q1 seasonality of the major market ETFs. In the past 10 years, it's finished higher 9 times. Mid and small cap stocks; however, tend to generate the greatest median return in the quarter.

Historically, risk/reward begins shifting favorable when average large cap scores get below 50. We are currently at the lowest reading since the August low in score, which coincided with a short term market low (note: the SPY double bottomed in the mid 180's). You'll notice in the following chart that large cap scores can get into the low to mid 40s; something that hasn't happened since 2012.

The industry ranking shifted defensive with cigarettes (RAI, MO), REITs (DLR, UDR, PSA, O, FRT, HCN, AVB), and grocers (KR) among the top five baskets.

Wait for riskier industries to re-exert in the ranking or for average scores to signal that we're turning higher before committing all your dry powder. Communication equipment (HRS, GLW) and aerospace/defense (RTN, NOC, LMT, COL, BA) are also among the top scoring large cap baskets this week.

Basic materials scores remain anemic, so there's still little incentive to bargain hunt in this basket. Major chemicals (APD, ASH), pipelines (SE), and ag chemicals (AGU) are the exception. Cigarettes, processed & packaged goods (K, CPB, MKC), and beverages (DPS, TAP, STZ) are the best scoring consumer goods stocks. In financials, concentrate attention on REITs. Medical appliances (ISRG, ZBH, VAR, EW), healthcare plans (CI, AET), and medical instruments (BDX, BCR) score strongest in healthcare. Aerospace/defense and industrial equipment (ROP) are top scoring in industrials. Grocers, wholesale drugs (CAH), and department stores (KSS) can be bought in services. Communication equipment, specialized semi (NVDA, MCHP), and business software (JKHY, FISV) are best in technology. Diversified utilities (SCG, ED, NI) can also be bought.

Disclosure: None.