Best & Worst Small Cap Stocks To Buy

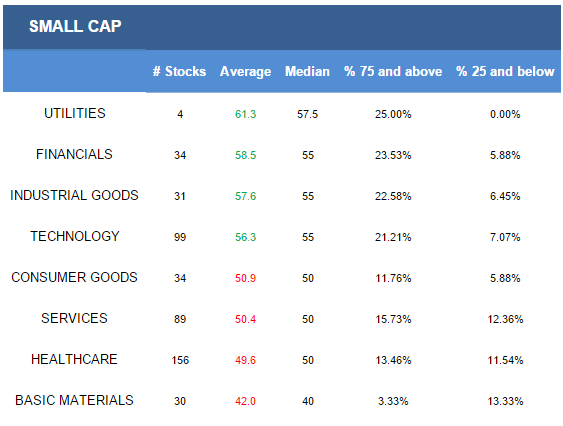

· The strongest small cap sector is utilities and financials.

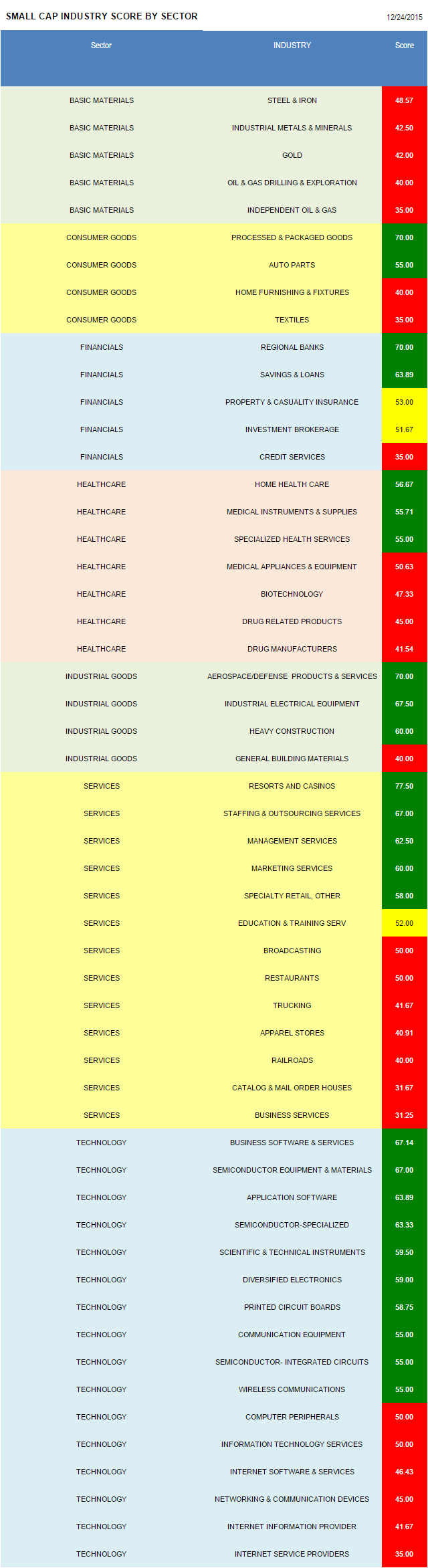

· The best small cap industry is resorts & casinos.

The average small cap score is 52.02. The average small cap stock is trading -33.37% below its 52 week high, -8.25% below its 200 dma, and has 8.14 days to cover held short. The strongest sectors are utilities, financials, industrial goods, and technology. Consumer goods, services, healthcare, and basics score below average.

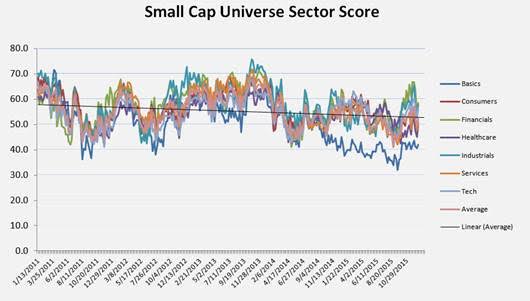

The following chart shows historical small cap scores by sector.

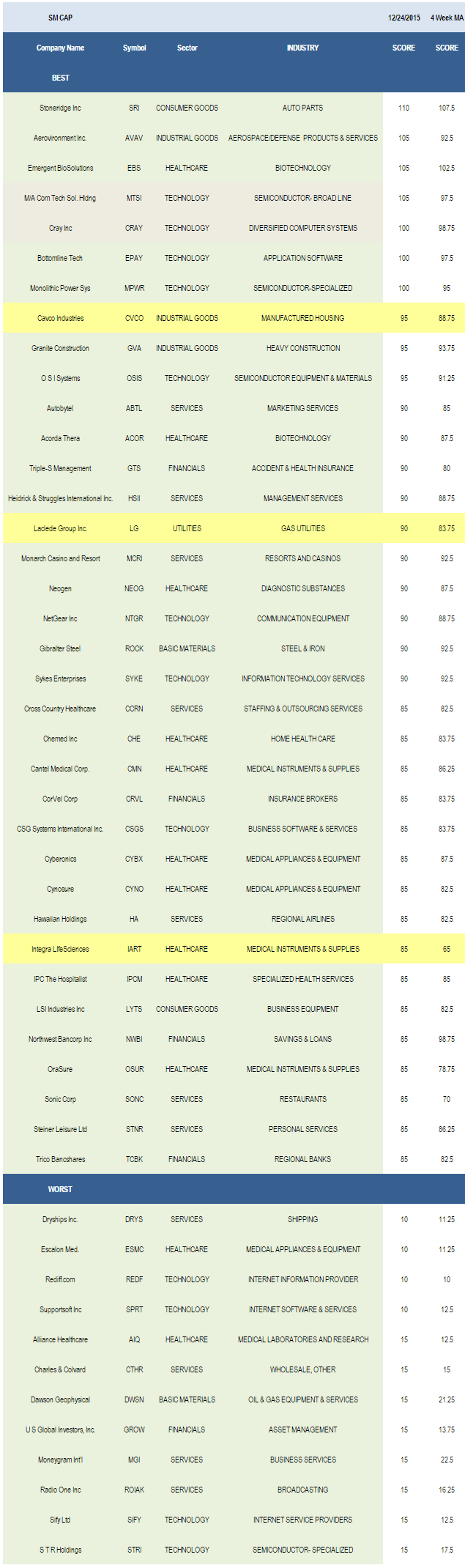

Resorts & casinos (MCRI, BYD, CNTY), aerospace & defense (AVAV, AIR), processed & packaged goods (DMND), regional banks (TCBK, CFNL, BBCN), and industrial electrical equipment (ULBI, BGC) score highest.

No small cap basics baskets score above average. Remain on the sidelines until scores improve.Processed & packaged goods and auto parts (SRI, SMP) are best in consumer goods. The top financials baskets include regional banks and savings & loans (NWBI, PROV, OCFC, FBC). Home healthcare (CHE, LHCG), medical instruments (OSUR, IART, CMN, MGCD, LMNX, VASC), and specialized health services (IPCM, AHS) are best in healthcare. Aerospace/defense, industrial electrical, and heavy construction (GVA) are strong scoring in industrial goods. The top services groups include resorts & casinos, staffing (CCRN, KFRC), and management services (HSII). The best technology industries are business software (CSGS, TSYS, PRFT, EBIX), semi equipment (OSIS, UTEK), and application software (EPAY, LOGM, ELLI, PRO).

Disclosure: None.