Bearish Beneath The Nominal Context

Guest post by Alhambra Investment Partners

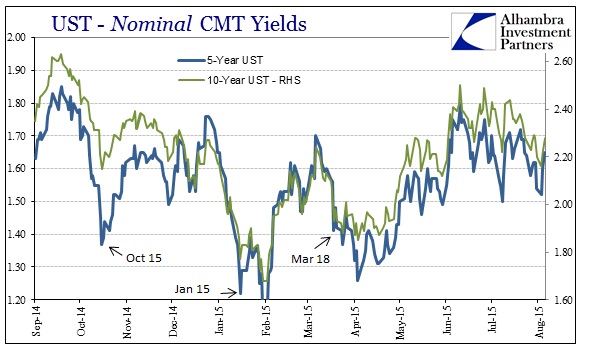

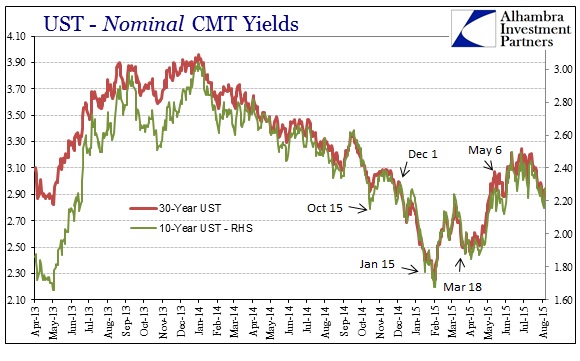

The broad survey in funding terms suggests that funding markets have been more disturbed in the past few weeks than broader credit markets. That isn’t to say that credit is unaffected, only the degree is in argument. The treasury curve has renewed its flattening tempo and nominal rates are somewhat leaning in the lower direction. The difference may simply be threats, or perceptions of them, to ZIRP via Federal Reserve noise. Unlike funding markets, depending more on dark leverage and math, credit markets have a fundamental contradiction to work through here – rates “want” to decline with funding problems (flight to safety, but not really) but have to bear in mind nominal rates and the relation to monetary policy (which is an illusion, but still a powerful one).

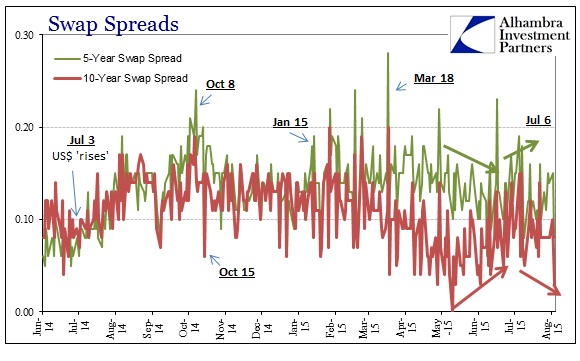

Whatever the case, credit markets since about July 6 have re-attained their prior bearish bias to varying degrees. I think the direct link to funding can be viewed from swap spreads, as both the 5-year and 10-year swap rates and spreads have undergone a noticeable shift from the preceding few months.

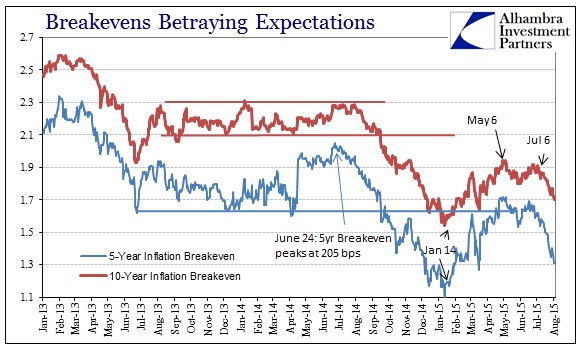

In conjunction, it was around July 6 that “inflation” breakevens started dropping once more; being a bridge, in some respects, between financial factors in the crude market and those picked up on hedging for fixed income.

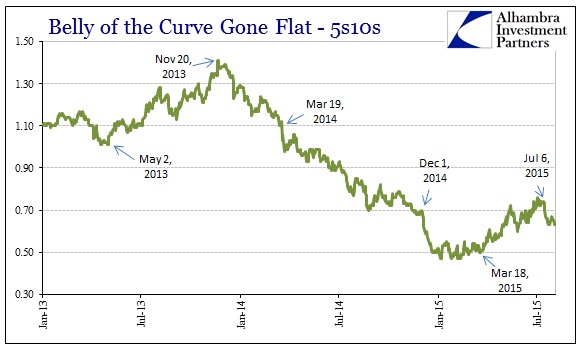

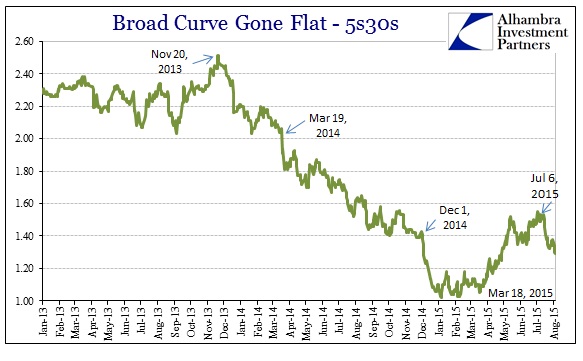

Nominal interest rates on the treasury curve have been fairly contained in a narrow range, but the bearish bias is showing much more noticeably in the curve shape itself. The curve, whatever nominals do, has been flattening.

In my view, again, that suggests fixed income more broadly is synchronized to the idea or message of funding markets but not quite sure how to express that in the nominal context.

Disclosure: Subscribe to more