Bear Market Opportunity: Earn A Safe And Growing 24% Yield

Hop on this once-in-a-decade opportunity to earn a 24% and growing yield from an ETF that only owns companies with stable, fee-based revenues. With little downside risk to the dividend being reduced, this is a best buy stock on sale today.

With the recent declines in the stock market, I have been spending a lot of time talking with subscribers and followers about investing through this type of market and not giving in to the desire to sell and lose money. As a dividend-focused investor, I want to take advantage of periods when share prices are down; buying shares of high quality income stocks at a discount and with higher yields.

An important point to keep in mind is that when the stock market corrects or goes even deeper into bear market territory, almost all share prices drop. The fear selling that drives this type of market does not differentiate between solid, stable companies and those that may be affected by whatever economic factor triggered the sell-off.

The steep drop in crude oil prices has been the catalyst for a bear market in the energy sector. The Energy Select Sector SPDR ETF (NYSE: XLE) is down 45% from its June 2014 peak. This decline has included every stock that is related to energy, from oil drillers to pipelines to refining companies. The overall sector drop has produced a buying opportunity in those companies/stocks that provide necessary infrastructure services. These services include pipelines, storage facilities, loading and unloading terminals, and processing plants. As long as we continue to drive cars, transport goods, turn on the lights, and heat our homes, the energy infrastructure companies will have steady business operations.

A large portion of the U.S. energy infrastructure assets are owned by publicly traded master limited partnerships (MLPs). Investors buy MLPs to receive high current distribution yields and growing dividends over time. The drop in energy prices has hurt some MLPs, forcing distribution reductions or suspensions. However, a significant portion of the MLP space has been able to continue with their business plans, growing revenue, and distributions paid to investors. The energy sector bear market has driven down the values of all MLPs, resulting in very high yields on the quality energy infrastructure companies that are still able to pay and grow distributions.

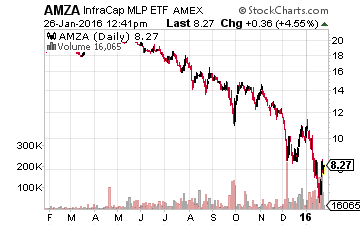

One way to invest in the MLP sector is through an MLP focused exchange-traded fund or ETF. An MLP ETF will track one of the sector indexes. The InfraCap MLP ETF (NYSE: AMZA) offers a high-yield way to invest in the largest energy infrastructure MLPs. Here are some details about the fund.

- The AMZA portfolio is based on the Alerian MLP Infrastructure Index (AMZI). The 20-25 largest infrastructure MLPs make up the components of the index.

- AMZA is a new style of ETF that has an active management component. The active management feature allows fund managers to own different weightings of the AMZI component MLPs, and to own related companies such as publicly traded general partnerships.

- The AMZA charter allows the fund to sell call options against its holdings. This strategy is commonly known as covered call writing, and can significantly boost the yield on an income portfolio.

Currently, AMZA yields 24% compared to just under 10% for the AMZI index. This is a relatively new ETF, but it has increased its dividend rate by 1% (4% annualized) every quarter since it launched in October 2014. I recently contacted the fund managers and was told that the fund’s option strategy was working as planned and providing significant additional value for investors.

I don’t have the foresight to predict the end of the energy sector bear market. There are signs that crude oil may be reaching a bottom, which should be good for share prices. Yet, I do know that receiving a 6% dividend every quarter is a pretty nice way to ride out the share price volatility in the energy sector until that time when the stock market realizes that the world still runs on oil and natural gas and share values start to again move higher.

Disclosure: Long AMZA