BEA Estimates 2nd Quarter 2017 GDP Growth At 2.56% - Friday, July 28

In their first (preliminary) estimate of the US GDP for the second quarter of 2017, the Bureau of Economic Analysis (BEA) reported that the US economy was growing at a +2.56% annual rate, up +1.14% from a downward revised first quarter.

Consumer spending rebounded, growing at a +1.93% annualized rate during the quarter, up +1.18% from the prior quarter and very similar to the fourth quarter of 2016. The inventory contraction of the prior quarter essentially disappeared (-0.02%), as did the previous robust growth in commercial fixed investment (at only +0.36%). Governmental spending rose slightly (+0.12%), reversing the prior quarter's contraction, and the growth rates for both exports (+0.48%) and imports (-0.31%) moderated.

The BEA's "bottom line" (their "Real Final Sales of Domestic Product", which excludes inventories) was nearly unchanged from the revised prior quarter at +2.58%.

Real annualized household disposable income dropped roughly $75 to $39,286 (in 2009 dollars). The household savings rate dropped -0.1% from a sharp downward revision (-1.2%) for the prior quarter.

For the second quarter, the BEA assumed an effective annualized deflator of 1.01%. During the same quarter (April 2017 through June 2017) the inflation recorded by the Bureau of Labor Statistics (BLS) in their CPI-U index was a minuscule 0.06%. Over estimating inflation results in pessimistic growth rates, and if the BEA's "nominal" data was deflated using CPI-U inflation information the headline growth number would have been materially higher at a +3.53% annualized growth rate.

Concurrent with this report the BEA revised all of their data back through 2014. A more comprehensive revision of data back to 1929 will be published next July. On average the annualized quarterly headline growth rates were revised upward by +0.06%, although some individual quarters saw significant changes (e.g., the growth rate for the third quarter of 2016 was revised downward by -0.74%, while the growth rate for the second quarter of 2016 was revised upward +0.83%). Although in general, the revisions tended to smooth the growth data between adjacent quarters, it is notable that late 2015 and the most recent prior two-quarters were revised downward. All of our tables below reflect the revised numbers.

Among the notable items in the report :

-- The headline contribution from consumer expenditures for goods was reported to be +1.02% (up +0.91% from the prior quarter).

-- The contribution to the headline from consumer spending on services also strengthened to +0.91% (up +0.27% from the prior quarter). The combined consumer contribution to the headline number was +1.93%, up +1.18% from 1Q-2017 and very similar to 4Q-2016 (+2.00%).

-- The headline contribution from commercial private fixed investments dropped to +0.36%, down a significant -1.35% from the prior quarter. That change came from a reported contraction in residential construction.

-- Inventory turned neutral (with a -0.02% contraction). This was a +1.09% improvement from the prior quarter. It is important to remember that the BEA's inventory numbers are exceptionally noisy (and susceptible to significant distortions/anomalies caused by commodity price or currency swings) while ultimately representing a zero reverting (and long term essentially zero sum) series.

-- Governmental spending was reported to be growing slightly, at a +0.12% rate. This was a +0.28% improvement from the prior quarter.

-- Exports contributed +0.48% to the headline number, down -0.34% from the prior quarter.

-- Imports deducted -0.31% from the headline, which was up +0.28 from the prior quarter. In aggregate, foreign trade added +0.17% to the headline number.

-- The "real final sales of domestic product" grew at an annualized 2.58%, up +0.05% from the prior quarter. This is the BEA's "bottom line" measurement of the economy and it excludes the inventory data.

-- As mentioned above, real per-capita annual disposable income dropped materially (by $74 per annum). At the same time, the household savings rate was reported to have dropped by -0.1% from a sharp downward revision (-1.2%) to the prior quarter. It is important to keep this line item in perspective: real per-capita annual disposable income is up only +7.11% in aggregate since the second quarter of 2008 -- a meager annualized +0.77% growth rate over the past 36 quarters.

The Numbers, Including Revisions to All Historic Data

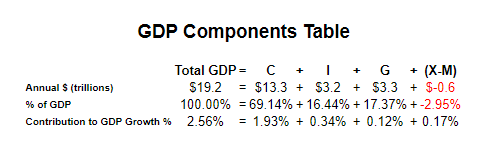

As a quick reminder, the classic definition of the GDP can be summarized with the following equation :

GDP = private consumption + gross private investment + government spending + (exports - imports)

or, as it is commonly expressed in algebraic shorthand :

GDP = C + I + G + (X-M)

In the new report the values for that equation (total dollars, percentage of the total GDP, and contribution to the final percentage growth number) are as follows :

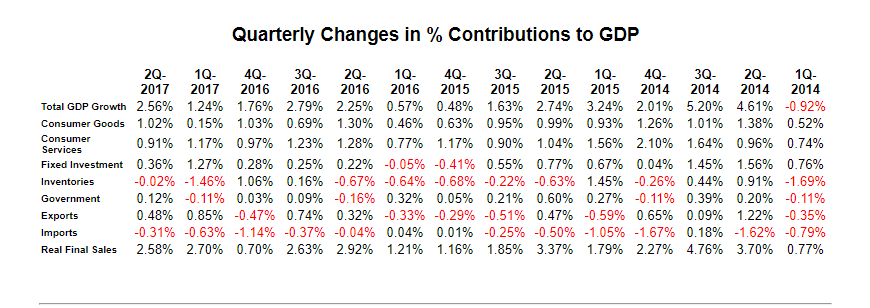

The quarter-to-quarter changes in the contributions that various components make to the overall GDP can be best understood from the table below, which breaks out the component contributions in more detail and over time. In the table below we have split the "C" component into goods and services, split the "I" component into fixed investment and inventories, separated exports from imports, added a line for the BEA's "Real Final Sales of Domestic Product" and listed the quarters in columns with the most current to the left :

Summary and Commentary

At first reading, this report shows moderate growth buoyed by somewhat stronger consumer spending. The notable takeaways from this report are :

-- Consumer spending growth recovered to the range typically seen in 2016.

-- Commercial fixed investment cooled materially from the number reported for the prior quarter. This was accompanied by a contraction in residential construction.

-- The distortions contributed by inventory swings temporarily disappeared.

-- The revisions to the historic data were not as dramatic as we have seen in prior years, and those revisions tended to smooth out the data series. This is, in fact, a reasonable result, since recently it has been likely that the real economy had more momentum quarter-to-quarter than the BEA's data might have suggested.

US consumer spending seems to have rebounded into more normal ranges. That and a 2.5% overall growth rate are certainly positive for the economy. It could be that US consumers have simply shrugged off the unrelenting domestic political drama and moved on to more normal spending patterns. In any event, this report should provide the Federal Reserve with the data needed to justify moving forward with their "normalization" campaign.

Disclosure: None