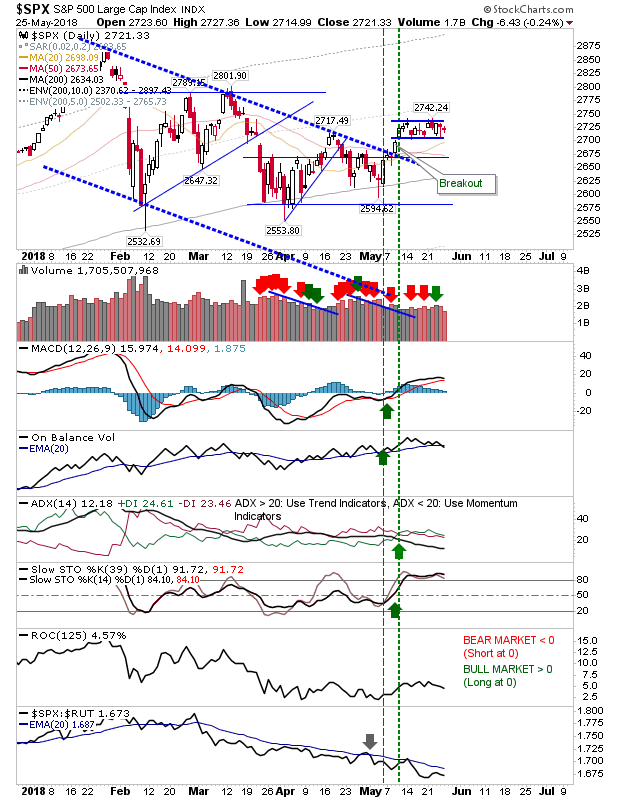

Base Building Continues

Another Day inside the trading range, another day of waiting. Not a whole lot to say about Friday. The S&P remained tightly bound and confined to a narrow horizontal range. On-Balance-Volume switched to a 'sell trigger' as other technicals remained positive. The preferred trade is still an upside breakout from the hande.

(Click on image to enlarge)

The Nasdaq almost delivered a handle 'breakout' but wasn't able to put some distance from the handle. Any additional upside should be enough to deliver the breakout. Unlike other the S&P, supporting technicals are all positive.

(Click on image to enlarge)

Contributing to Nasdaq strength is the near 1% gain in the Semiconductor Index. It's close to challenging the 'bull trap' as it delivered the handle breakout the Nasdaq was so close to creating.

(Click on image to enlarge)

The Russell 2000 is still protecting its breakout and is the index best placed to reward momentum traders. Look for further upside.

(Click on image to enlarge)

The Dow Industrial Average is also working a minor breakout of its own. This is a better value play as it looks to shape a right-hand-side base up to January's highs.

(Click on image to enlarge)

The relationship to the Transports also looks positive with a fresh breakout in the ratio; buy the strength.

(Click on image to enlarge)

For tomorrow, continue to look for bullish handle breakouts from indices which have yet to deliver.

I invest in my pension fund as a buy-and-hold.