B.A. Blues

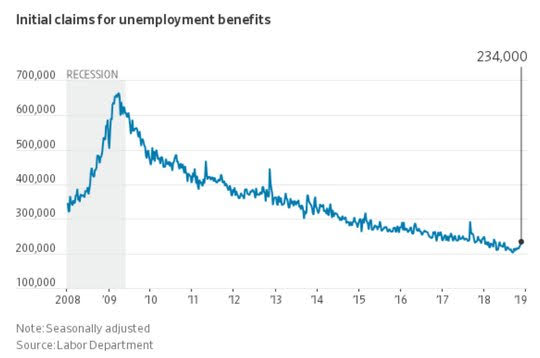

Forget the raft of economic data pointing to a slowing global economy from China to Europe. Ignore that blip in Japan industrial production. Don’t worry about inflation falling at core and headline in Europe even as the ECB plans to “normalize.” We are in a near neutral world. We are all focused on the summer weather in Buenos Aires where the G20 meets and we are all prepared to listen to the blues whether that is side deals between Saudi and Russia on oil, US and China on trade, Russia and Germany on Ukraine. Throw in UK May and the EU, Italy and the EU and you see politics more than consensus building. Markets are prepared to wait out this winter weekend in the Northern Hemisphere. The worsening world outlook includes the US and its showing up in the usual places – jobless claims. This is the best weekly indicator you can find on the health of the US economy and its flashing its first yellow signal in years, albeit from decade-low levels. The other signal still in play is the yield curve where lower oil prices have pushed down inflation expectations and policy tightening views just in time for FOMC Powell to find some dovish feathers in his sling of hiking arrows. Overnight, the hike from the Bank of Korea might be worth thinking about in the context of 2019 and emerging markets. The bounce back in risk this week has slowed a bit into the B.A. Blues and we are all waiting to see the way the G20 races like jockeys for comparative advantage on FX, trade, and global capital. Korea is a case in point. There is a long-term trend up for the USD but the noises from 2015 haven’t been repeated yet in FX, just like we are all waiting for 7 to break in CNY, so too, 1145 in KRW seems far away. To put this in perspective the flightless NZD and the KRW now have the same interest rate. The importance of global trade, oil prices and technology demand all are reflected in the KRW rate and that is singing the blues despite the BOK action.

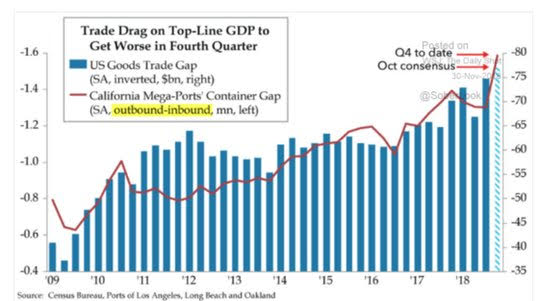

Question for the Day: What is the chance for a China/US trade deal? No one is going to sleep well with financial risk until there is clarity on the US/China tariff risks ahead. The odds of no deal are probably too low as many see Xi and Trump both wanting some financial market stability. US tariffs on $200 billion in Chinese goods are set to rise to 25% from 10% on Jan. 1. Trump has threatened additional tariffs on the rest of China’s $505 billion in imports to the US should no deal be made in Buenos Aires. The effect of such on global growth, inflation and capital investment is seen as hitting growth harder than the IMF or OECD forecasts for 2019.

The WSJ puts the odds of no agreement at 30%, of just a framework for more talks at 30% and a weak agreement with more talks at 35%. This suggests that the markets are biased to some relief rally after the weekend if these odds are accurate – but only a modest one with the bigger tail problem being what happens if Trump walks out of his Xi dinner and leaves. The issue of trade and markets isn’t going to go away either as most see little chance for a real comprehensive deal 5% - suggesting 2019 will see the same anxiety.

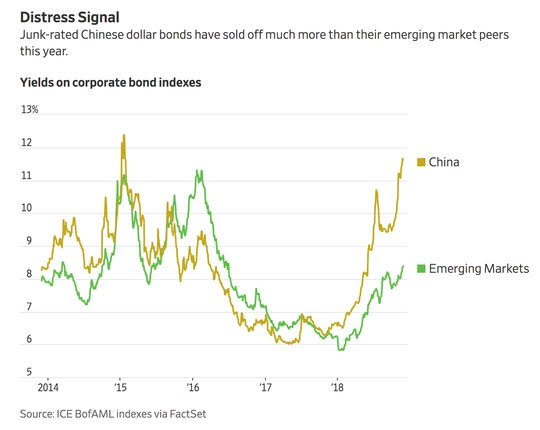

The larger backdrop for China and US is the USD and US rates with the corporate leverage issue in both nations on the radar screen but with China appearing more at risk for capital flight. The role of China in EM markets is not going to go away either.

What Happened?

- Japan November Tokyo core CPI 0.1% m/m, 1% y/y unchanged – as expected. The headline all-items 0% m/m, 0.8% y/y from 1.5% y/y while the core-core was up 0.1% m/m, 0.6% y/y. Food prices -1% m/m, housing 0%, Fuel up 0.6%. The biggest drop was in culture/recreation -0.5% m/m while furniture and household utensils rose 0.5% m/m.

- Japan October unemployment rate 2.4% from 2.3% - worse than 2.3% expected. The jobs/applications rate slows to 1.62 from 1.64. Employment rose 1.44mn y/y to 67.25mn while unemployment fell 180,000 y/y to 1.63mn.

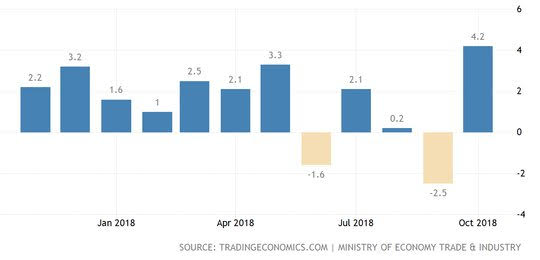

- Japan October industrial production up 2.9% m/m 4.2% y/y after -0.4% m/m, -2.5% y/y – better than +1.2% m/m expected – best since Jan 2015. The METI outlook for November is up 0.6% and December up 2.2% m/m. The government changed their assessment to say output is “picking up slowly,” the first improvement in a year. “Companies have been increasing production to make up for the delays caused by the disasters,” a ministry official said in explaining why the basic assessment was upgraded. The index of industrial shipments rose 5.4% to 106.6 and that of inventories was down 1.4% at 101.2.

- Japan November consumer confidence 42.9 from 43 – weaker than 43.3 expected. Overall livelihood slips 0.6 to 40.8, income up 0.5 to 41.8, employment down 0.2 to 46.6 and willingness to buy 42.4 unchanged. Price outlooks were higher 84.5% up jumping 1.6% while down rose 0.5% to 3.7%.

- Australia October private sector credit steady up 0.4% m/m, 4.6% y/y – as expected. The housing credit unchanged at 0.3% m/m, personal -0.1% after -0.2% and business steady at 0.6% m/m.

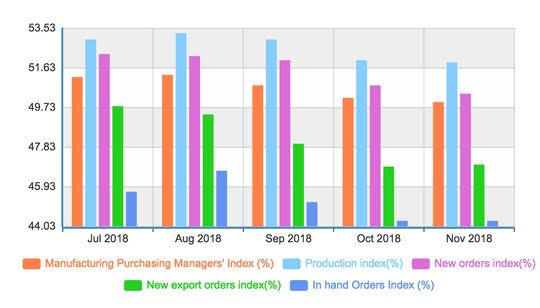

- China November CLFP manufacturing PMI 50 from 50.2 – weaker than 50.2 expected – worst in 2 years. The services PMI 53.4 from 53.9 – also weaker than 53.8 expected. The combined PMI drops to 52.8 from 53.1. Manufacturing New orders slow to 50.4 from 50.8 but export orders 47 from 46.9. PPI slips to 46.4 from 52, employment 483 from 48.1. The confidence index slips to 54.2 from 56.4. For Services, new export orders rose to 50.1 from 47.8 while employment fell to 48.7 from 48.9 and prices charged fell to 49.4 from 51.2.

- Korea central bank hikes 25bps to 1.75% - first hike in a year – as expected. 2 members of the 7 opposed the hike. "We will consider both macroeconomic conditions and financial stability for monetary policy next year," Lee told reporters after the decision. "We are still accommodative," he said, adding that the bank "has not yet reached the neutral rate level even after this hike." The BOK hike was aimed at slowing housing prices and stemming capital outflows similar to moves from Indonesia and Philippines.

- German October retail sales -0.3% m/m, +5% y/y after revised -0.3% m/m, -2.8% y/y –weaker than +0.3% m/m gain expected. September revised from +0.1% m/m. This is the strongest annual sales rate in 1 ½ years but the 4th consecutive drop in sales.

- German October import prices up 1% m/m, 4.8% y/y while exports up 0.2% m/m, 2% y/y – as expected.

- Swiss November KoF Economic Barometer slides to 99.1 from 100.2 – second monthly drop, now below long-term average. This month’s decline was in particular due to less favorable export prospects. The impetus from foreign demand is likely to weaken somewhat in the coming months. The development in the banking and insurance sector may lose some of its momentum. By contrast, slight support for the economy will come from the construction sector and private consumption. The manufacturing sector, in particular, is also resisting the downward tendency. However, indicators for employment in the manufacturing sector have slowed.

- Eurozone October unemployment rate steady at 8.1% - worse than the 8.0% expected. This is still the best since Nov 2008. The unemployed rose 12,000 m/m still off 1.121mn y/y to 13.172mn. Greece and Spain remain the highest jobless nations while Czech and Germany the lowest. Youth unemployment fell 78,000 y/y to 17.3% for the Eurozone an improvement from 18.1% in Oct 2017.

- Eurozone November flash HICP 2% y/y from 2.2% y/y – less than the 2.1% y/y expected. The core HICP drops to 1% y/y from 1.1% - also less than the 1.1% y/y expected. Services slow to 1.3% from 1.5% y/y, non-energy industrial goods steady at 0.4% y/y, energy 9.1% from 10.7% y/y, food 1.8% from 2.1% y/y.

- French November flash HICP -0.2% m/m, 2.2% y/y after 2.5% y/y – less than the 2.3% y/y expected. The national CPI slows to 1.9% y/y from 2.2% y/y.

- Italy November flash HICP -0.2% m/m, 1.7% y/y after +0.2% m/m, 1.7% y/y – less than the 0.2% m/m, 1.8% y/y expected. Core CPI rose 0.9% y/y from 08% y/y.

Market Recap:

Equities: US S&P500 futures are off 0.5% after losing 0.22% yesterday. The Stoxx Europe 600 is off 0.5% with banks and autos leading the weakness. The MSCI Asia Pacific is up 0.3% with Korea lagging on the BOK hike.

- Japan Nikkei up 0.40% to 22,351.06

- Korea Kospi off 0.82% to 2,096.86

- Hong Kong Hang Seng up 0.21% to 26,506.75

- China Shanghai Composite up 0.81% to 2,588.19

- Australia ASX off 1.48% to 5,749.30

- India NSE50 up 0.17% to 10,876.75

- UK FTSE so far off 0.75% to 6,986

- German DAX so far off 0.55% to 11,236

- French CAC40 so far off 0.40% to 4,985

- Italian FTSE so far off 0.10% to 19,149

Fixed Income: Month-end, G20 fears and a market watching weaker economic data drive bonds today. German Bund 10-year yields off 1.5bps to 0.305%, French OATs off 1.5bps to 0.68% and UK Gilts off 2bps to 1.345%. Periphery not as friendly with Italy flat at 3.20%, Spain flat at 1.50%, Portugal off 0.5bps to 1.82% and Greece flat at 4.23%.

- US Bonds bid into G20 and month-end – 2Y flat at 2.809%, 5Y off 0.9bps to 2.838%, 10Y off 1.6bps to 3.013% and 30Y off 1.4bps to 3.31%.

- Japan JGBs sold on IP and equities. 2Y flat at -0.136%, 5Y up 0.6bps to -0.11%, 10Y up 0.8bps to 0.081% and 30Y flat at 0.803% – BOJ cut its bond-buying frequency for longer-dated bonds as many expected but amounts unchanged – 10-25Y cut to 4 times from 5, 25Y and more cut to 4 times from 5.

- Australian bonds rally modestly, waiting for G20 – 3Y off 1.5bps to 2.005%, 10Y off 1bps ot 2.59%.

- China PBOC skips open market operations, month end squeeze seen – O/N rates jump 39bps to 2.63%, 7-day u 3bps to 2.68%. 1Y swaps flat at 2.77% but 2Y off 10bps to 2.65%, 5Y off 9bps to 3.09% and 10Y off 5bps at 3.33% (down 21bps on the month).

Foreign Exchange: The US dollar index is up 0.2% to 96.98 with 96.71-97.00 range – focus remains on 97.60 or 96.50. In EM – USD mostly bid – ZAR off 0.35% to 13.715, TRY off 0.1% to 5.17, RUB off 0.9% to 66.86; TWD flat at 30.82, KRW off 0.15% to 1120.50, INR up 0.4% to 69.58.

- EUR: 1.1366 off 0.2%. Range 1.1358-1.1400 – Merkel plane story, EU HICP flash, US FOMC hike talk – 1.13-1.1450 keys.

- JPY: 113.50 flat. Range 113.34-113.55 with EUR/JPY 129.05 off 0.2% - watching 130 there for upside break. 112.80-114 with equities key.

- GBP: 1.2765 off 0.2%. Range 1.2696-1.2753 with EUR/GBP .8905 flat. Waiting game with EUR driving and 1.27-1.2950 keys.

- AUD: .7300 off 0.25%. Range .7294-.7326 with sideways action and eyes on risk/crosses. NZD .6865 flat – watching .6880 for breakout.

- CAD: 1.3310 up 0.2%. Range 1.3273-1.3321 with US rates, oil driving – data today key for 1.3250 or 1.34 risks.

- CHF: .9975 up 0.15%. Range .9951-.9986 with EUR/CHF 1.1340 flat – watching KoF confirm GDP issues for 4Q and 1.00 as pivot for $.

- CNY: 6.9357 fixed 0.01% weaker, off 0.1% to 6.9460 with range 6.9380-6.9504 – rates squeeze and G20 key – CNY set for monthly gain.

Commodities: Oil lower, Gold lower, Copper lower (off 0.2% to $2.82750

- Oil: $50.48 off 1.85%. Range $50.43-$51.79 – fear from B.A., weaker shares and unwinding the technical bounce leave $50 as the pivot for a $48 risk. Brent off 1.55% to $58.58 with $58 similar key.

- Gold: $1222.15 off 0.2%. Range $1220.50-$1225 with focus on USD, global risks. $1215-$1225 keys. Silver off 0.45% to $14.24 with $14.20 pivot. Platinum off 1.2% to $810.10 and Palladium up 1.1% to $1195.85.

Conclusions: Will jobs be the key for the FOMC in December? The FOMC minutes yesterday were taken as a promise for a December rate hike. The only stop against that risk is in the data ahead. The drop in job gains maybe something to watch. The weekly claims have moved significantly from their lows near 200,000 but this is noisy data and the weather matters. So the larger unemployment report will likely be in play again next week as another part of the risk puzzle ahead of a Santa Claus rally hope.

Economic Calendar:

- 0830 am Canada 3Q GDP 2.9%p 1.9%e

- 0900 am New York Fed Williams speech

- 0945 am US Nov Chicago PMI 58.4p 59.0e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.