How Firing CEO Will Impact Ford Motor

Ford Motor Company (F ) produces cars and trucks. The company and its subsidiaries also engage in other businesses, including manufacturing automotive components and systems and financing and renting vehicles and equipment. The company is divided up into the following four operating segments: Automotive, Visteon Automotive Systems, Ford Motor Credit Company, and The Hertz Corporation.

Fear of potential disrupters/newcomers like Tesla Motors has claimed another scalp in the auto industry today, as the Ford Motor Company fired CEO Mark Fields and replaced him with James Hackett. Fields was let go by a board fearful that the company was not moving fast enough to face threats from driverless cars, electric vehicles, etc.

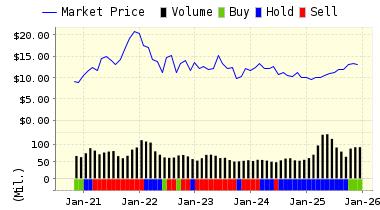

In addition, Chairman William Ford Jr. noted that the company needed to increase the speed of its decision-making process, and “really invest in the performing parts of the business.” Since Fields first became CEO three years ago, Ford shares have fallen @40%. That share-price decline resulted in the Detroit giant falling behind the newcomer Tesla.

Like Microsoft to Apple, the old-line auto manufacturers have a bad reputation as being stodgy, uninspired, and failing to innovate. This is despite their massive businesses and global reach. Threats no longer include just other car makers, they also include tech firms such as Google, Uber, etc. And, making money is no longer enough. Ford weathered the Bush recession without taking bailout monies and under Fields it has produced handsome profits. But, for many on Wall Street, past performance does not make for a good investment "story."

For our models, however, the stock remains a BUY.

Below is today's data on Ford (F):

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on FORD MOTOR CO for 2017-05-19. Based on the information we have gathered and our resulting research, we feel that FORD MOTOR CO has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

10.97 | 0.94% |

|

3-Month |

10.94 | 0.67% |

|

6-Month |

10.68 | -1.74% |

|

1-Year |

12.10 | 11.29% |

|

2-Year |

10.83 | -0.40% |

|

3-Year |

10.25 | -5.75% |

|

Valuation & Rankings |

|||

|

Valuation |

21.49% undervalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

0.94% |

1-M Forecast Return Rank |

|

|

12-M Return |

-16.96% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

0.02 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

0.33% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

21.20% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

8.06% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

41.84 |

Size Rank |

|

|

Trailing P/E Ratio |

7.51 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

6.95 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

0.93 |

PEG Ratio Rank |

|

|

Price/Sales |

0.27 |

Price/Sales Rank(?) |

|

|

Market/Book |

1.37 |

Market/Book Rank(?) |

|

|

Beta |

1.07 |

Beta Rank |

|

|

Alpha |

-0.32 |

Alpha Rank |

|

Disclaimer: ValuEngine.com is an independent research ...

more