Aussie Dollar: Potential Wedge Breakout Nears

The Australian Dollar has seen some relatively strong swings over the past 24 hours as world currency markets have been beset by both ongoing volatility from a potential Brexit, and a rampantly bullish US Dollar. However, despite the recent falls, the pair still remains within a tightening wedge pattern that is likely to bring about a strong breakout in the days ahead.

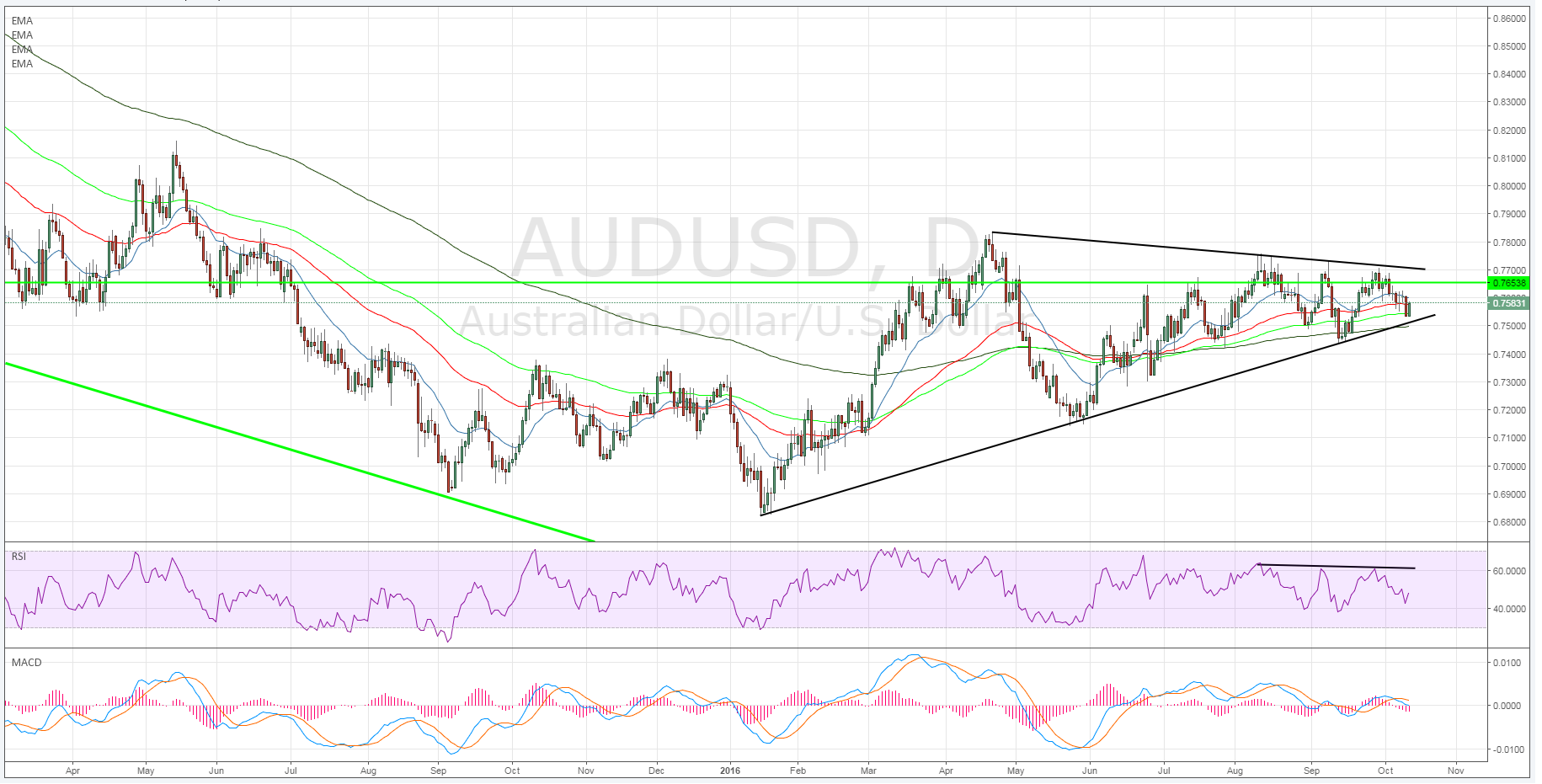

In particular, the daily chart demonstrates the tightening wedge pattern which has been constraining the pair’s price action over the past few weeks. Subsequently, the recent volatility has taken price action relatively close to the bottom constraint and there now remains only 100 pips within the tightening range.

(Click on image to enlarge)

Therefore, a breakout before the end of the trading week is the likely outcome and it would appear that the upside is the probable direction of the move. Supporting the bullish contention is the fact that price action is currently rising sharply and has just broken above the 100 Day MA. In addition, the RSI Oscillator has also started its uptick, within neutral territory, and has plenty of room to move before entering overbought status.

Looking ahead, the key battleground is likely to be the zone of resistance around the 0.7653 mark, and the top of the wedge pattern by extension. A concerted breach of this key level will result in a sharp move towards our initial target at 0.7751, and then 0.7832 in extension. However, given the recent gains in the greenback any additional moves are likely to be defeated in short order. So keep a close watch for any failures around the resistance levels.

From a fundamental perspective, there is little Australian economic data due for release in the remainder of the week so the focus will be primarily on the bevy of US macroeconomic indicators. In this vain, Thursday and Friday will be highly active days with the Unemployment Claims and Core Retail Sales figures due to print. Subsequently, keep a close watch for any volatility upon their release as a strong result could see the technical case for a rally wilt in due order.

Ultimately, whilst the Australian Dollar remains within the tightening wedge, the pressure will continue to build and the likely direction is clearly a bullish one.

Disclosure: Forex and CFDs are leveraged products and you may lose your initial deposit as well as substantial amounts of your investment. Trading leveraged products carries a high level of risk and ...

more