As Good As It Gets

Overnight markets were mixed. The Trump tweet about Apple needing to make iPhones in the US hit Asia but Europe shrugs is off. The weather effect on statistics starts the day with Japan EcoWatchers bouncing in part because of such. One has to wonder if the same shows up in the China CPI and PPI. The inflation focus this week is key with US CPI/PPI later the driver for whether FOMC expectations about pausing in 2019 are realistic. The Turkey GDP coming in near enough to expectations was a relief trade for EM and the plans for shorting EM in September may pause accordingly. This means we are all going to return to watching the USD as a barometer and wonder if the US is at that dreaded as good as it gets stage or if we are in a world that is getting better all the time. This isn’t so easy to tell from the myriad of data points we all watch and collect. The USD up because of safe-haven flows, tax repatriation, FOMC rate hikes, and the carry trade – all that matters but its offset by the other story this week – namely, the big budget deficit in the US and its funding. Expect the focus on bills and bond sales to matter to the USD picture and to the favorite failed to trade for macro in 2018 – short US bonds. The 3.05% level in 10-year looks important still. What this means for the rest of the world seems obvious as well. Higher US rates equal more EM pain. For a rather quiet day after a busy week, markets are likely to tip-toe into new risks until after they hear from the BOE and ECB Thursday, all of which makes today perhaps the easiest day of the week. USD bulls can still see a way to 97 while the bears need a break below 94 to get seriously excited.

Question for the Day: Is weather the real driver of risk? The earthquake and typhoon last week in Japan hit the economy – just how much remains to be seen. The storm Gordon in the Gulf last week drove up and down the price of oil. The storm on its way to the US SouthEast is worth considering as the next risk for surprise in a market all but asleep with the view that divergence of capital flows to the US will remain until China or the US say something different.

What Happened?

- China August CPI rose 0.7% m/m, 2.3% y/y after 0.3% m/m, 2.1.% /y – more than 0.5% m/m, 2.2% y/y expected. The Jan-Aug CPI rose 2% after 1.5% in same period 2017. Food was up 1.7% y/y from 0.5% y/y. Non-Food was up 2.5% from 2.4%.

- China August PPI rose 0.4% m/m, 4.1% y/y after 4.6% y/y – more than 4.0% y/y expected. The year-to-date held 4% y/y. Fuel and power fell to 9.7% from 9.9% while mining and exploration fell to 12.1% from 13.4% y/y.

- RBA Deputy Bullock: Risk of broad credit crunch unlikely. Bullock also said that the RBA continues to monitor closely the risk of vulnerabilities from high household debt but doesn't think widespread financial stress among households is imminent. Household debt in Australia relative to income, has risen further in recent years to be at 190% currently from 160% in 2013, and from 70% in the early 1990s. "This raises potential vulnerabilities in both bank and household balance sheets. While the risks are high, there are a number of factors that suggest widespread financial stress among households is not imminent," Bullock said.

- Japan 2Q GDP revised to 0.7% q/q from preliminary 0.5% q/q – as expected. The annual rate rises to 3% from preliminary 1.9% - slightly better than 2.9% expected. Capex revised to 3.1% q/q from 1.3%, that added 0.5pp to GDP up from 0.2pp preliminary. Consumption unrevised at 0.7% q/q, adding 0.4pp. Net exports -0.1pp unrevised and inventories added 0% unrevised.

- Japan August EcoWatchers Current Index 48.7 from 46.6 – better than 46.7 expected – first rise in 2-months linked to weather improving. The outlook jumps to 51.4 from 49 – also better than 50.5 expected. High temperatures and humidity continued in August but the conditions were more bearable than in July in some regions. Construction firms

saw demand for rebuilding the areas hit by the killer rainstorms in July. The Cabinet Office upgraded its overall economic assessment based on the Economy Watchers Survey for the first time in five months, saying, "The gradual recovery continues." Previously, it also said there were signs that "the recovery was taking a breather." - Bank of France August 3Q GDP forecast unchanged at 0.4% q/q. The August manufacturing climate 103 from 101, services 102 from 102 and construction 103 from 104. Manufacturing capacity utilization rose to 81.6% from 80.7%.

- Turkey 2Q GDP rose 5.2% y/y after 7.4% y/y – near expectations. Private consumption, which is estimated to make up nearly two-thirds of the economy, grew 6.3 percent on an annual basis during the second quarter of the year, slowing from a revised 9.3 percent in the first quarter.

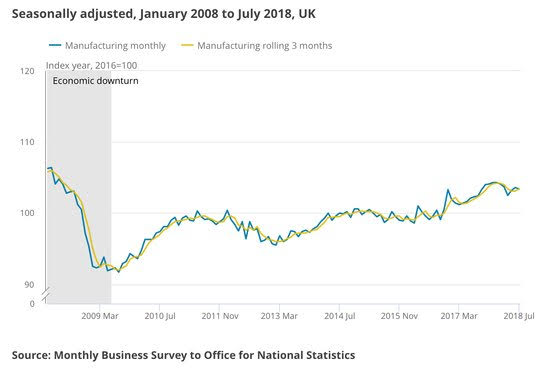

- UK July Industrial Production rose 0.1% m/m, 0.9% y/y after 0.4% m/m, 1.1% y/y – less than the 0.4% m/m, 1.2% y/y expected. UK July Manufacturing -0.2% m/m, 1.1% y/y after +0.4% m/m, 1.5% y/y – weaker than the 0.2% m/m, 1.5% y/y expected.

- UK July Goods Trade Deficit GBP 9.973bn after G10.679bn – better than GBP12.5bn expected. The total trade deficit narrowed to 0.111bn after 0.942bn in June – better than GBP1.2bn expected. The Non-EU trade deficit was nearly unchanged at GBP2.80bn from GBP2.856bn.

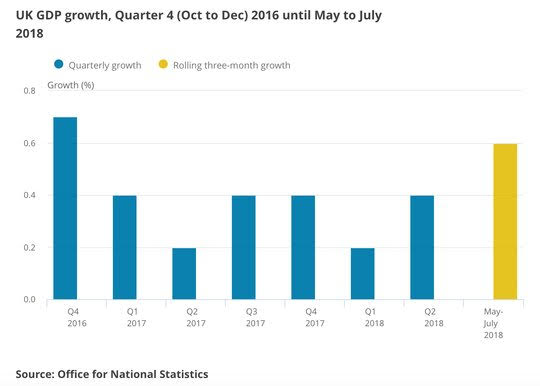

- UK July GDP rose 0.6% on q/q basis after 0.4% q/q – more than 0.5% q/q expected. The July monthly rate rose 0.3% m/m, 1.6% y/y after 0.1% m/m in June – as expected. However, a national statistics official noted that motor trade has been volatile over the past six months, prompting an examination of the respective seasonal factors.

Market Recap: Will return tomorrow – apologies to all for the shortened version today.

Economic Calendar:

- 0300 pm US July Consumer Credit $10.2bn p $12.5bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.