Are US Interest Rates Close To A Peak? Housing Is Being Hurt By The Fed Rate Hikes

“Consistent with its statutory mandate, the (FOMC) Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced. In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 2 to 2-1/4 percent.” (Federal Reserve Press Release Nov.8, 2018.)

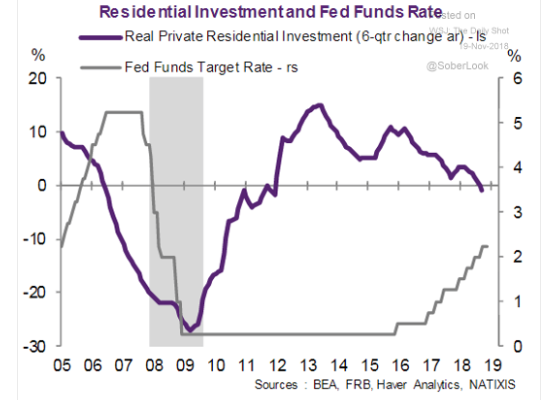

It is no accident that since the Fed began to hike its interest rates, US housing construction has decelerated and has become a net negative in terms of the growth of the overall economy.

The federal funds current target is currently 2.00 to 2.25%. The Fed is expected to raise its benchmark rate again this month. Consequently, it is perfectly appropriate to ask whether the Fed is being too aggressive in its tightening policy?

The Fed has been raising its policy interest rate (the federal funds rate) since 2016. The justification the Fed has advanced for desiring to normalize interest rates during an extremely strong and fully employed economy is very credible.

One of the arguments is that higher federal funds rates are needed because the economy is on the verge of over heating. There is the related argument that the Fed needs higher rates in order to have leverage to lower them should that be required when the next economic crisis occurs.

Of course, even after seven consecutive rate hikes, interest rates are still low.

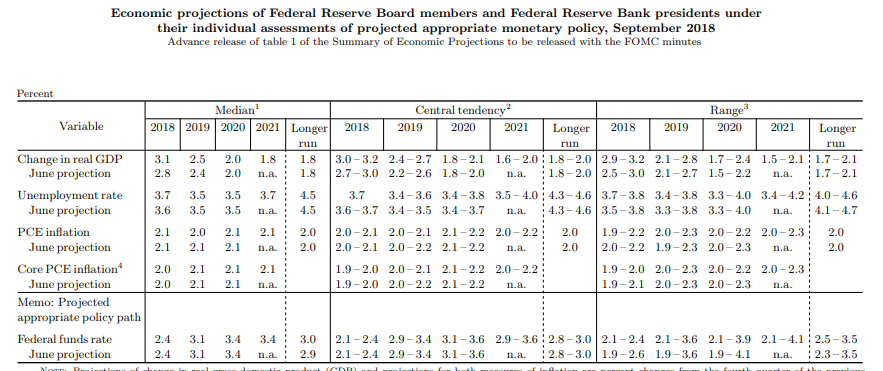

The Fed seems to be using its estimate of a neutral or natural federal funds rate as a potential policy target. In theory, a neutral or natural rate of interest is the benchmark rate which is associated with real GDP growing at its trend rate and with a stable rate of inflation.

In other words, if actual rates are too low, this would potentially shift the economy into an inflationary cycle; while too high market rates would propel the economy into a recession.

While a neutral federal funds rate is a hypothetical construct and subject to some ambiguity, nonetheless the Fed projections set out in the following table suggest that it is in the 2.5 to 3% range.

In other words, we could be very close to the top of the interest rate cycle, at least in Federal Reserve terms.

Disclosure: None.