Are The Media Exaggerating The Bull Market?

Notorious bears like Peter Schiff and John Hussman have been warning about the bull market’s inevitable demise for many years. Ignoring their gloom-n-doom predictions has been the better way to go. After all, six years of zero percent interest rate policy by the U.S. Federal Reserve successfully reflated portfolios heavily tilted toward U.S. equities.

On the other hand, the fact that the financial media focus so heavily on the largest U.S. corporations is a monstrous disservice to investors. The “presenters” did not always avoid global stocks and commodities. In the previous bull market period (10/2002-10/2007), television and radio hosts extensively covered foreign developed markets as well as emerging markets. They even gave us a variety of ways to profit from the commodity boom. Why? Because that’s where all the big-time gains were!

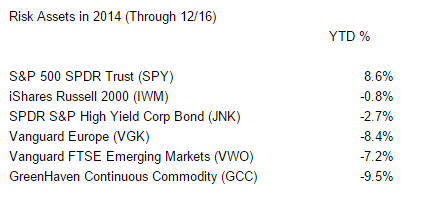

Since 2011, however, all you hear about is the Dow, the S&P and the NASDAQ. Is the current broadcasting a function of American ethnocentrism? If that is the case, then why did the theme of foreign and emerging market growth receive so much attention in the mid-2000s? Perhaps the spotlight on large-cap indexes alone is a deliberate effort to sidestep increasingly bleak price movement in other risk assets.

Although there has been a variety of writers and talkers like myself who have talked about “canaries in the coal mines” – high yield bonds, small caps, commodities, foreign/emerging stocks – the discussions are largely dismissed when U.S. large-caps turn upward. It is not that those who are responsible for covering market-based securities deserve blame or shame. Nevertheless, those sickly birds have not exactly been restored to health.

If we really want to talk about a bull market in equities, then the fairest measure might be an all-world index like Vanguard Total World (VT). This exchange-traded tracker seeks the performance of the FTSE Global All-Cap Index – a market-cap weighted index that incorporates developed markets as well as still-developing markets. How is VT performing? Not quite as well as SPY or the Dow Jones Industrials ETF (DIA).

In my estimation, the media are indeed exaggerating the bull market. Granted, the S&P 500 via SPY has been defying the odds for so long, few seem to remember what a 10% correction or a 20% bear or 40% disaster looks and feels like anymore. Equally important, the mid-single digit returns for DIA combined with zero percent returns for IWM and VT portray a very different picture than media cheerleaders portray.

And then there’s the kicker. The FTSE Custom Multi-Asset Stock Hedge Index (FTSE Custom “MASH”) is up 7.2% through 12/16. This is the index that my company, Pacific Park Financial, Inc., created for investors to consider investing in a combination of currencies, commodities, foreign debt and U.S. debt. The purpose? Provide a wide range of asset classes (excluding equities) that, historically, have little to no correlation with equities; thus, one is able to hedge against stock risk without relying on a single asset, leverage, shorting or inverse products.

The FTSE Custom MASH Index may have a direct ETF/ETN rollout in 2015. In the meantime, investors concerned about a moderate or severe downturn in the equity markets can consider using a separately managed account for a portion of their overall portfolio. One can contact my colleagues at Pacific Park Financial, Inc. Others may be more inclined to invest in some of the asset class components directly. You would want to look at iShares 10-20 Year Treasury (TLH) as well as iShares National AMT-Free Bond (MUB). You would also want to consider the beneficiary of an unwinding of the yen carry trade, Currency Shares Yen Trust (FXY).

One word of caution. FTSE Custom MASH has access to Japanese government bonds and German bunds on foreign exchanges. Due to liquidity restraints, I do not recommend the use of U.S. ETNs like Powershares DB German Bund Futures (BUNL) or PowerShares DB Japanese Government Bond Futures (JGBL).

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser ...

more