Are Negative Interest Rates Coming To The US?

Negative interest rate bonds could soon be coming to the United States.

Though it may seem counter-intuitive, negative interest rates are not unheard of. In Europe, negative interest rates have been normal for quite some time, with Switzerland's central bank enacting a negative excess reserve rate after the financial crisis to encourage financial institutions to loan out their money instead of holding it. Other European countries have followed suit, and some investors even buy negative yielding bonds speculatively in anticipation of bond yields falling further.

Though it may seem counter-intuitive, negative interest rates are not unheard of. In Europe, negative interest rates have been normal for quite some time, with Switzerland's central bank enacting a negative excess reserve rate after the financial crisis to encourage financial institutions to loan out their money instead of holding it. Other European countries have followed suit, and some investors even buy negative yielding bonds speculatively in anticipation of bond yields falling further.

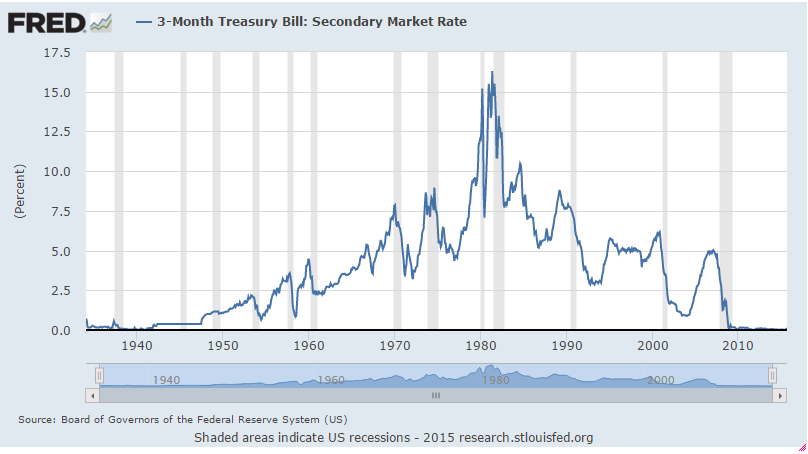

The United States is actually behind the curve in many aspects. For example. during the financial crisis, Congress granted the Federal Reserve the authority to give interest to banks who held excess reserves in the Federal Reserve above reserve requirements. Instead of charging a negative rate like Switzerland to encourage spending, the Fed enacted a positive rate of .25%, arguing that it would encourage banks to be safer and safeguard against anymore bankruptcies. To no one's surprise, deposits within the Fed jumped from $10 billion to over $2 trillion, worsening the credit crunch in financial markets. As a result, the Federal Reserve enacted round after round of Quantitative Easing, trying to get banks to loan out the trillions in dollars the Federal Reserve had just created for them. Now that banks are finally loaning money and turning a profit, it seems that the US government wants in on the action. Besides the benefit the government gets from having higher inflation rates, the government debt load also benefits from lower rates. Just this past month, the United States entered the "0% club" for the first time by issuing a 3 month treasury at 0% interest (yes, someone actually bought it). Interest rates have been hovering near all time lows since the financial crisis, but this is the first time the government actually received an interest free loan.

This begs the question: If someone is willing to give the government a loan for free, would someone also be willing to pay to give the government money for an investment? The short answer: maybe. The bond market is driven by a multitude of factors, and for interest rates to reach negative yields there must a perfect storm of these factors. These two things need to happen for interest rates to be negative in the United States:

1. The Federal Reserve must not raise rates. Not only does this keep alternative investments for investors with low yields, but it will push banks to pass along their increased costs from Dodd-Frank and other regulations along to their deposit holders. Dodd-Frank imposed rules on banks requiring them to keep hedge funds and some other investor funds 100% liquid, and most other institutional fund holders at 30%. This greatly increases banks capital requirements and imposes a tremendous cost onto banks. Banks are now passing along these costs to consumers, frustrated by the Fed's delay in rising rates. More and more banks are betting on the Federal Reserve keeping rates low, and in turn are finding other ways to turn a profit, with JP Morgan leading the way. If the Federal Reserve were to raise rates, however, banks could increase their profitability through normal operations and would not have to pass their costs along to large clients. Large clients accepting negative rates could only happen if negative rates on treasuries result in a smaller loss than the fees banks charge.

2. The stock market (and other substitutable financial markets) must continue to be volatile.

The recent volatility in the stock market was a direct cause of the recent decline in bond interest rates. Institutional investors turn to bonds and cash holdings as a way to minimize risk, and with a volatile stock market, more and more institutional fund holders will be taking money out of the markets and into safer investment vehicles, or at least taking money out of the market until volatility returns to normal. This reallocation of portfolios leads to movement of money out of the market. As this money exits the market, the cash will need to be stored somewhere. As more and more money enters banks coffers, banks will be more incentivized to charge fees on these large holdings which are so expensive for them. As a result, institutional holders will be more willing to invest in low yield safe bonds (US treasuries are still considered risk free). There may come a point, if all banks begin charging fees, that institutional holders are willing to accept a negative rate because it is still less than the fees they would have to pay if their money stayed in the bank. Furthermore, many institutional traders may see that more banks are in the process of doing this, and these fund holders may buy these negative yields in anticipation of rates falling even further.

So could these two factors occur simultaneously? It's very possible. The dollar has been gaining strength against other currencies, which puts US manufacturers at a disadvantage because their foreign competition sells goods for a comparably cheaper price. This is the US dollar index against other currencies for the past 5 years:

An interest rate hike by the Fed would only further strengthen the dollar and put more US companies in danger of becoming even more noncompetitive. It seems unlikely the Fed would risk a rate hike while other central banks around the world keep rates low and continue their monetary stimuli.

The next question is whether institutional fund holders will reallocate their portfolios due to volatility in the stock market. While high volatility was occurring earlier in the year, no one knows for sure how volatile the stock market will be going forward. If the increase in market volatility does remain high, however, we could be seeing negative interest rate bonds in the near future. The better bet for smaller investors may just be stuffing money in the mattress.

Nice article. I think the Fed, even though this is not the official position, is predisposed to keeping rates low. I wrote about massive demand for long bonds, and am interested to see if that can be quantified past 2016. Here is the article, Matthew: www.talkmarkets.com/.../fed-weakness-future-insatiable-bond-demand-with-short-supply So, there are many in the Fed that stick to the desire to normalize, but the numbers and the pressure is ever downward on yield. You bring up a really good point, that banks are not so interested in cash and will charge, and probably would rather sell you a bond with a negative rate than want to hold your money which could have been laundered. Lol. What a system! Following you, Matthew.

Well said, I'm now following you both.

I've added you to my follow list and am looking forward to more.

Very impressive!