Are Low Volatility ETFs Actually Safer?

Investors who have jumped into low volatility equity ETFs believing that they’d get market returns at a fraction of the risk might now be getting a lesson in how these funds really work. With market volatility at record low levels, low volatility ETFs have looked more like S&P 500 index funds in 2017. The 14% year-to-date return of the PowerShares S&P 500 Low Volatility ETF (SPLV) trails the S&P 500 (SPY) by 3%, as tech and healthcare, two areas not typically favored by low volatility funds, have outperformed.

But low volatility ETFs aren’t sold on their returns. They’re sold on their risk reduction capabilities. These funds should be expected to underperform in bull markets, when their more traditional value investing style falls out of favor. It’s in down markets when low volatility funds earn their keep. But even in up markets, those lower returns should be offset by lower risk, producing risk-adjusted returns that should be at least comparable to the broader market, right?

Well, lately that hasn’t been the case.

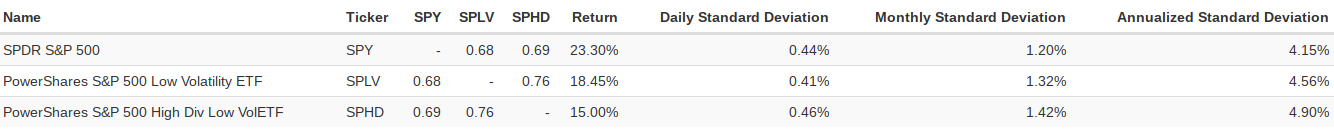

It’s been about one year since the 2016 election, when equities really started rallying. During that time, the Low Volatility ETF has returned a total of 18% compared to a 23% return for the S&P 500. Again, that’s not surprising given that the growth style has significantly outperformed value. What is surprising is the risk profile of both the fund and the S&P 500 over that time.

The Low Volatility ETF has actually been MORE risky than the broader market. Low volatility ETFs that focus on higher yielders, such as the PowerShares S&P 500 High Dividend Low Volatility ETF (SPHD), have delivered an even lower return an an even higher risk level. Not exactly what investors in these funds signed up for, I’m sure. Also concerning right now is the fact that there doesn’t appear to be a whole lot of value in the fund right now. The Low Volatility ETF has a P/E ratio of 20.5 and a P/B of 3.22. Compare that to a 19.4 P/E and a 3.1 P/B for the S&P 500 and you’re looking at a fund that doesn’t have a good value proposition right now.

The good news is that this appears to be a short-term aberration. Go back to the fund’s inception in 2011, and the Low Volatility ETF beats the S&P 500 by 0.3% per year and does so with about 10% less risk. And that’s during a market where growth has outperformed and has pretty much gone straight up. In other words, exactly the type of market that the fund is supposed to not do well in.

Since the fund looks at the prior 12 months of volatility data and reconstitutes itself every quarter, it should be able to shake out any riskier plays pretty quickly. With the market working on its 9th consecutive year of gains, low volatility ETF shareholders could soon rediscover the benefits of owning a value-oriented fund again if the market starts to turn. The Low Volatility ETF is in a bit of a weird place right now being riskier and more expensive than the S&P 500, but once the ultra-low volatility environment begins to normalize, I think low volatility ETFs will be able to demonstrate their worth once again.

Disclosure: None.