Are Financials The Sector To Be In?

The 10-year bond continued its rally on Wednesday as its yield has fallen about 22 basis points from its high in mid-March. This is a powerful signal that the market has soured on the reflation trade. It has begun to reject the notion that 2017 GDP will accelerate from the morbid growth of 2016. To me, this reaction is delayed because GDP estimates for Q1 had been falling before mid-March. The delay may be related to the internal mechanics of the market as there have been many traders on the short treasuries bandwagon.

With the ECB cutting its monthly bond buying from $80 billion to $60 billion in April and the Fed preparing to raise rates by 25 basis points in July again, stocks will need to rely on earnings growth to continue this lengthy bull run. The chart below breaks down the growth estimates for 2017 earnings by sector. If any of the sectors miss expectations, another sector will have to make up for its underperformance

I’m looking for the consumer discretionary sector to miss the current 5.8% growth estimate. Brick and mortar retail sales have been as bad as the depth of the 2008 recession on a non-seasonally adjusted basis. I previously showed the spiking bankruptcies in retail in 2017. The chart below shows the spiking number of retail store closures announced in 2017. Bebe and The Limited are closing all their stores. The total retail store closures is over 3,500 stores. The decision to close stores is probably a good one for individual firms which will improve profits, but it is a signal consumer shopping trends are headed south. While closing an underperforming store in a mall is good for that specific firm’s bottom-line, the other stores feel the effect of weaker mall traffic as a result.

The weakest segment of retail, which is brick and mortar, is the first to feel the pain before the stronger part, which is online, sees weakness. It is shocking to see consumer sentiment at cycle highs with all these store closings happening. Consumers are hoping to spend more money in the future when they get a tax cut, but these retailers needed sales improvements to happen last year to prevent closures.

With consumer discretionary missing estimates, another sector will need to beat estimates to make up for the difference or earnings growth will fall short of the 9.8% expectations. Most investors expect financials to beat estimates. I’m basing this on their stock performance since the election. Since November 4th the XLF financial ETF is up over 20%. Since March 1st, the ETF is down over 6% because of the negative trends which I will discuss. If my opinion on financials is correct, the entire market will fall.

Net interest margins are increasing with Fed rate hikes. The repeal of Dodd-Frank will also help small banks’ profitability. However, if the bread and butter of financials which is lending starts to wane, these positive factors will be mitigated. Default rates increasing hurt profits and causes banks to tighten their standards which lowers revenues.

As I mentioned in my last article, credit card charge-offs rates are accelerating to the highest rate in years. This chart relates to both the retail sector and the financials since shrinking consumer credit growth from credit cards means consumers will have less money to spend at retailers. It also means banks are also going to see higher delinquencies.

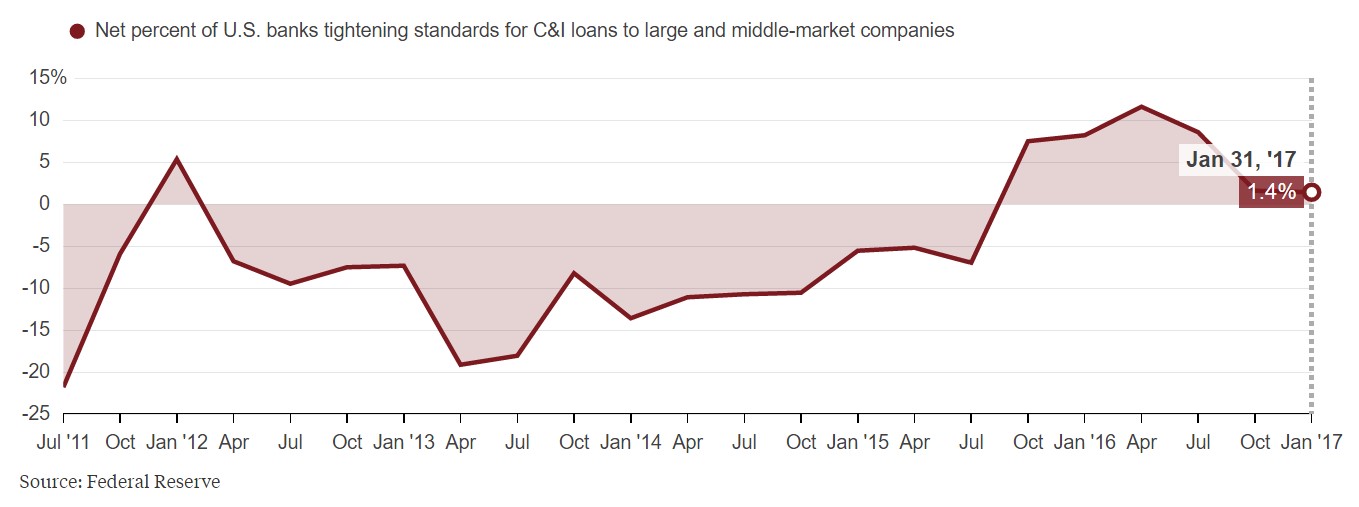

As you can see in the chart below, tightening lending standards is leading to slowing loan growth. The amount of banks tightening their standards has improved since April 2016, but it’s still a negative signal to see more banks tightening their standards than loosening them. It will be interesting to see if the latest increase in charge-offs leads to a renewed number of banks tightening their standards. The charts seem to be correlated.

Total loan and lease creation growth has fallen from about 8% year over year in 2016 to 4.2% growth. Commercial and industrial lending has decelerating from growing at a 13% clip year over year to growing 2.9%. This is in stark contrast to the ISM surveys we’ve seen which show business activity is at a 12-month high. This is the sentiment driven hope trade which has been in place since the election. If commercial bank lending continues to decline, it signals to me the ISM survey isn’t an accurate indicator of the economic reality. Surveys are supposed to signal how the economy is trending, so if they aren’t accurate they should be ignored. Trusting the ISM data or the loan growth data is the fundamental choice investors must make when deciding whether to have a bullish or bearish bias.

The auto loan bubble also plays a role in the profitability of banks in 2017. When incentives to buy cars come off their record peak, car sales will decline which will hurt auto loan growth. As you can see from the chart below, the deceleration in commercial auto loan creation on a year over year basis already started in late 2016 even with the record incentives.

The used car price index is crashing at a similar speed to when it crashed in 2008. This is being caused by the increased amount of cars coming off leases. With demand not growing as fast as supply, prices are coming down. This isn’t to say another recession is here because the index also fell in 1996. The decrease means that lease prices need to be raised to account for the weak used car market. Lease price increases mean lower car sales which hurts the auto manufacturers and the auto parts firms.

Conclusion

Brick and mortar sales and used car prices are declining. This can be the result of specific aspects of those industries or it can be the result of broader economic weakness. The deceleration of loan growth and the tightening of lending standards are better measures of the economy. They are signaling the economy is weak. These trends also hurt bank earnings which are supposed to be the powerhouse of 2017 earnings growth. The recent selloff in the bank stocks could be a result of the recognition of this trend, but it’s tough to make that conclusion because stocks didn’t fall (besides brief corrections) during the 2015 earnings recession.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more