April 2017 ADP Job Growth Is 177,000 - Near Expectations

ADP reported non-farm private jobs growth at 177,000. This was a weaker report than last month but still very good.

Analyst Opinion of ADP Employment Situation

This month the rate of ADPs private employment year-over-year growth remained in the tight range seen for the last 10 months. Even though the employment gains were lower this month - the year-over-year growth was statistically the same as last month.

ADP employment has not been a good predictor of BLS non-farm private job growth.

- The market expected from Bloomberg / Econoday 110,000 to 200,000 (consensus 170,000) versus the 177,000 reported. These numbers are all seasonally adjusted;

- In Econintersect's April 2017 economic forecast released in late March, we estimated non-farm private payroll growth at 110,000 (based on economic potential) and 205,000 (fudged based on current overrun of economic potential);

- This month, ADP's analysis is that small and medium sized business created 79 % of all jobs.

- Manufacturing jobs grew 11,000.

- 93 % of the jobs growth came from the service sector.

- The March ADP report (last month), which reported job gains of 263,000 was revised to 255,000.

- The three month rolling average of year-over-year job growth rate is 1.9 % (insignificantly different than last month)

ADP changed their methodology starting with their October 2012 report, and ADP's real time estimates are currently worse than the BLS.

Per Mark Zandi, chief economist of Moody's Analytics:

Job growth slowed in April due to a pullback in construction and retail jobs. The softness in construction is continued payback from outsized growth during the mild winter. Brick-and-mortar retailers cut jobs in response to withering competition from online merchants.

Per Ahu Yildirmaz, VP and head of the ADP Research Institute.

In April we saw a moderate slowdown from the strong pace of hiring in the first quarter. Despite a dip in job creation, the growth is more than strong enough to accommodate the growing population as the labor market nears full employment. Looking across company sizes, midsized businesses showed persistent growth for the past six months.

Jobs growth of 150,000 or more is calculated by Econintersect to the minimum jobs growth to support population growth (see caveats below). The graph below shows ADP employment gains by month.

(Click on image to enlarge)

Employment is a rear view indicator, and looking at this ADP data - the overall trend for the year-over-year rate of growth has remained in a tight range for the last 10 months. (red line in graph below).

ADP Non-Farm Private Employment - Total (blue line) and Year-over-Year Change (red line)

(Click on image to enlarge)

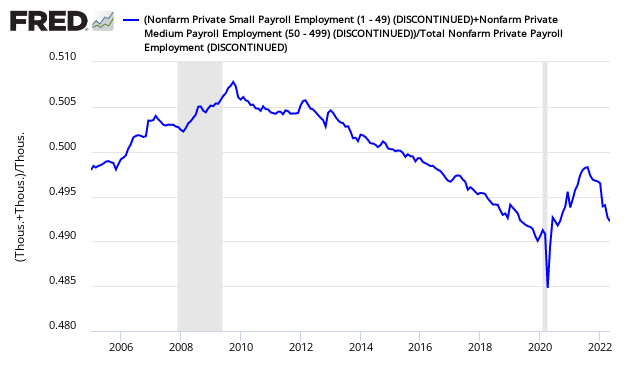

Small and medium sized business historically create most of the new jobs (analysis here) when using the ADP data.

Ratio of ADP Under 500 person Business Growth to Total Business Growth

(Click on image to enlarge)

The relative strength is in the service sector which has driven the jobs growth post Great Recession.

(Click on image to enlarge)

z adp3.png

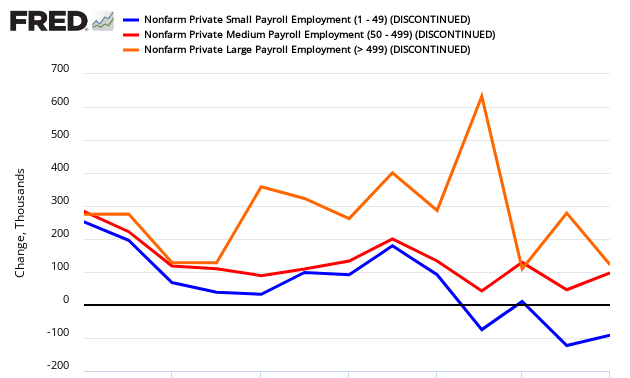

The graph below breaks down employment growth by size of company.

ADP Non-Farm Private Jobs Growth Per Month - Under 50 employees (blue line), under 500 employees (red line), 500 and up employees (orange line)

(Click on image to enlarge)

This month small business created the majority of the jobs.

(Click on image to enlarge)

Caveats on the Use of ADP Employment Data

For the last two years, ADP's estimates of the final BLS employment numbers have not shown to be accurate. Econintersect does not place much importance on the ADP's numbers since revising their methodology in 2012.

Historically employment is the confirmation that real economic growth is occurring. As background, many economic factors impact jobs growth. How many jobs businesses create in any one month is not directly dependent on these economic factors, but on individual decisions. The impact of all the economic factors is averaged out over many months.

Here is the revised methodology beginning with the October 2012 data:

Working in close collaboration with Moody's Analytics, Inc. and its experienced team of labor market researchers, the ADP Research Institute has further enhanced the monthly ADP National Employment Report® in order to more closely align it with the final print of the U.S. Bureau of Labor Statistics (BLS) numbers.

Beginning with its November 1, 2012 report, the ADP National Employment Report's new methodology now utilizes ADP payroll data, U.S. BLS employment data, and the Philadelphia Federal Reserve Bank's Aruoba-Diebold-Scotti Business Conditions Index.

In addition, the sample size of the ADP data set from which the newly enhanced ADP National Employment Report is derived has been expanded from 344,000 U.S. companies to 406,000, and from 21 million employees to 23 million, which accounts for more than 20 percent of all U.S. private sector employees. This larger data set is expected to help enable the ADP National Employment Report to more closely match the final print of the BLS numbers.

According to the new methodology, Moody's Analytics' monthly analysis for the ADP National Employment Report begins with processing ADP data according to the following steps:

- Classification by industry and size class based on the North American Industrial Classification system (NAICS)

- Creation of matched pairs for employment during the pay period including the 12th of the month

- Seasonal adjustment

- Removal of outliers

- Adjustments are made to match the industry and size distribution to the Quarterly Census of Employment and Wages (QCEW) industry and size data reported each March

- Regressions are run to predict the current month's BLS number by industry

- These are then aggregated to derive the growth in total nonfarm private employment

- Industry, size and total growth rate estimates are then converted into differences.

Additional information about Moody's Analytics' methodology can be found at ADPEmploymentReport.com.

Basically this employment index is designed to mimic BLS private non-farm employment - which does not include government employment. The headline BLS Employment Report includes government employment.

The graph below shows ADP's monthly change (blue line) versus BLS non-farm private change (red line).

ADP (blue line) versus BLS (red line) - Monthly Jobs Growth Comparison

(Click on image to enlarge)

There is now a known disconnect between BLS and ADP on the breakdown of jobs growth between small, medium and large business - as the graphs below illustrate. Basically the BLS sees large business as the employment driver, while ADP sees small and medium size business as the employment driver. For full details please read: BLS Experiments With New Data Series: Now I Am Confused.

Comparing Jobs Growth Per Month - ADP vs BLS

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

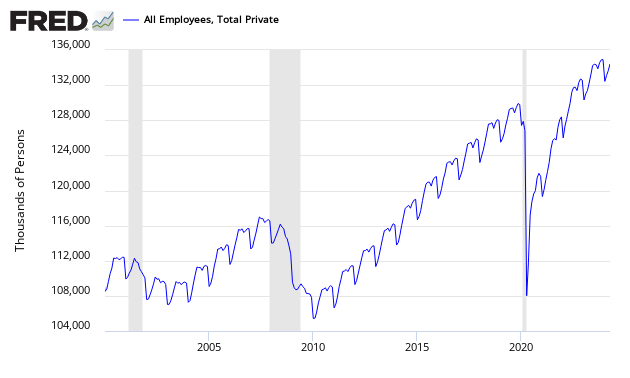

There is the proverbial question on what is minimal jobs growth each month required to allow for new entrants to the market. Depending on mindset, this answer varies. According to Investopdia, the number is between 100,000 and 150,000. The Wall Street Journal is citing 125K. Mark Zandi said 150K. Econintersect is going with Mark Zandi's number:

- If Econintersect used employment / population ratios to determine the number, the exact number seems to be between 140,000 and 160,000. The graph below uses the historical employment-population ratios to show jobs growth per month if the population was 300 million.

Historical Monthly Jobs Growth Comparison if Population was 300 Million

(Click on image to enlarge)

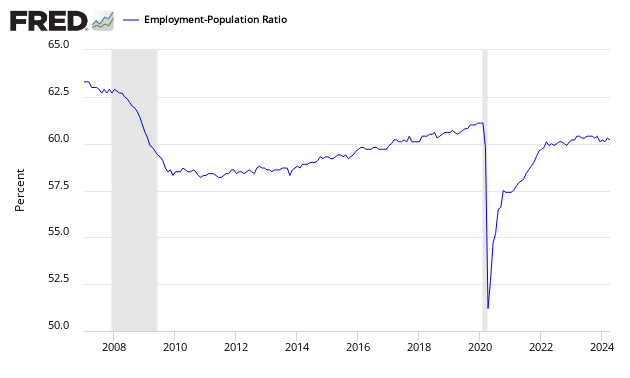

- If Econintersect uses employment - population ratios, the correct number would be the number where this ratio improved. Using the graph below, the ratio began to improve starting a little after mid-year. This corresponds to the period where the 12 month rolling average of job gains hit 150,000.

Employment to Population Ratio

(Click on image to enlarge)

Note: The ratio could be fine tuned by adjusting to the ratio of employment to working age population rather than the total population. However, this would not change the big picture that an increase of somewhere around 150,000 (+/-) is needed for the growing population numbers. We have estimated 140k - 160k. The number might possibly be within the range 125k - 175k. Econintersect cannot find reason to support the estimates below 125k.

The question of how changing demographics impact the employment numbers is at the margins of analysis. Econintersect will publish more on this fine tuning going forward, both in-house research and the work of others.

The following graph (not seasonally adjusted non-farm private payroll) shows that most of the employment growth are in the first half of the year, and there is little real growth of employment in the second half of the year. Therefore seasonal adjustment algorithms understate employment growth in the first half of the year, and overstate growth in the second half of the year.

Non-Seasonally Adjusted Employment - Private Sector

(Click on image to enlarge)

Disclosure: None.

This is good, but the labor force participation rate is just barely above nearly all time lows. We need much stronger growth to really help all the people without work.

this is a complex issue - i have a post which will be published on Saturday that details my position. most economists believe we are near full employment due to a demographic shift of the population [i do not but the demographic shift needs to be considered when using participation rates].

Yes but I was actually talking about the age 25-54 participation rate which should exclude things like retirees, etc.

your comment in this context is spot on.