Appreciation: Volatility And Trading Significant Volatility Spikes

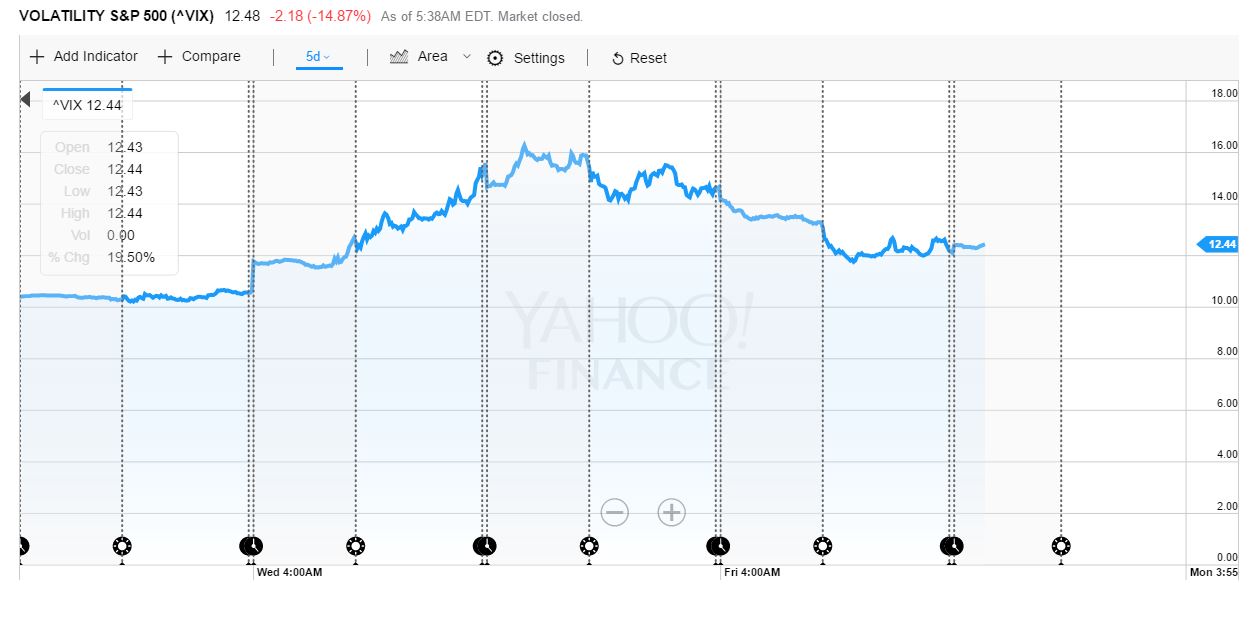

That was quite the interesting trading week was it not? Up until Wednesday, the markets looked as if it was going to be just another earnings week with major retail chain operators like Target (TGT) and Wal-Mart (WMT) reporting their Q1 2017 results. But things took a turn for the worse on Wednesday and after it was reported that President Trump had possibly asked then-Federal Bureau of Investigation Director James Comey to stop an investigation into Russian interference into the U.S. presidential election. This threw a “monkey wrench” into the market as many feared the implications from such a reported claim. And it’s with that reported headline concerning President Trump that the Dow fell over 300 points on May 17, 2017, taking the S&P 500 and Nasdaq indices down with it. But one index did rise and rise at a rate it had not seen in nearly a year, the VIX. The chart of the VIX below helps to recap the week that was.

(Click on image to enlarge)

The CBOE Volatility Index or VIX was up about 46%, at 15.59 on Wednesday. That is its biggest daily move since June 24 when the index jumped 49.3%, according to FactSet data. You might recall this was the first trading day that followed the Brexit Vote and found global equities pressured mightily as a result from the vote.

Sitting in the driver’s seat of the Golden Capital Portfolio that invests heavily in volatility from the short side, one may initially think the spike in volatility expressed last Wednesday would have caused me great concern, even pain. To the contrary, however, such volatility events are actually those I long for…get it, long for? Don’t worry; the jokes get worse as we go along. But in all seriousness as someone who shorts volatility it should be extrapolated that higher volatility brings with it higher prices for VIX-leveraged ETPs and thus an opportunity to short from such higher prices. “But what if things surrounding the President Trump/investor sentiment situation worsened”? That’s a great question and one I certainly pondered myself. Before answering that question more publicly though let’s quickly review my activity going into and following the Brexit Vote. Yes, vote is capitalized as it became a proper noun in my books.

I denote to readers/investors how I was participating and positioning in lieu of the Brexit Vote. I will summarize as follows:

“I, Seth Marcus Antonio Fernando Golden, being of sound mind and body, shorted shares of ProShares Ultra VIX Short-Term Futures ETF (UVXY) going into, through and post the Brexit Vote”. Try filling out official forms, by the way, with that full name. Well, now that you know a little bit more about me and a lot more about how I invest capital for clients participating with Golden Capital Portfolio, let’s move along and get back to the former question within.

“But what if things surrounding the President Trump investor sentiment situation worsened Seth”? My opinion to this proposed question is that things could get worse or they could vanquish altogether. But here’s the reality of such a situation surrounding the political turmoil and a better question one should be asking: How does the political turmoil affect earnings? Despite the sentiment of the day or day-to-day, markets follow earnings. The better earnings are or are forecast to be the better the markets perform and the higher the major averages climb. Quite literally, that is the history of global markets and the major indices. Over the long haul, it’s all about the earnings picture and while political events can throw a monkey wrench into the long-term picture on any given day, markets quickly recover to resume their tracking of earnings. So with Brexit I presume it to be with the sentiment surrounding the political turmoil in the U.S., as neither truly impact the S&P 500 earnings forecast. And as such, I hold and held logical confidence as I carried through my investing strategy with regards to shorting volatility and especially when volatility spikes.

Last Tuesday during the after-hours trading session, I took my first additional UVXY position outside of my core short UVXY holdings. My order was executed at $12.21 and all my trades during this volatility spike can be reviewed via my Twitter feed. On Wednesday following the political headlines surrounding President Trump and James Comey, I added more shares short at $13.30 and $15.01. Sorry, sometimes I’m supercilious about highly round numbers…not a joke, but you can laugh. In the after-hours trading session I added what would turn out to be a final short position at $16 a share. To take a short story and make it short (get it, short position, shorten the verbiage), shares of UVXY finished the week at $12.95 a share. And as such, finding the most recent spike in volatility as well as my volatility trading strategy optimal for investors and traders alike.

Having said all of that, for those who chose a long position in UVXY going into the most recent volatility spike, kudos. I sincerely hope the profits were reaped quickly due to the nature of how quickly VIX gains can evaporate. It’s for such a reason that most traders short VIX-leveraged ETPs rather than try to time a long VIX-ETP entry and a long exit point. I’m not smart enough to be able to do so and fortunately for me ProShares offers designed short volatility ETFs like UVXY. Yes, designed and as articulated in the S-1 of the instrument.

So what may come our way in the markets is anybody’s guess and as earnings season winds down. With President Donald Trump abroad and a Special Counsel now assigned by Deputy Attorney General Rod Rosenstein, maybe the political anxiety will fade surrounding the Trump Administration. If that is the case, investors will more broadly focus on the variables most closely associated with earnings and the economy.

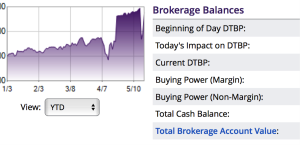

As it pertains to the Golden Capital Portfolio YTD performance, despite the clawing back of lost momentum in the markets last week, the major averages didn’t quite recapture all they had lost by the end of the week. The VIX didn’t quite give up all it had gained either. With that in mind Golden Capital Portfolio finished the week giving up some of its ROIC gains YTD...for the time being. By Monday, the Portfolio had achieved a ROIC YTD performance gain of nearly 75 percent. After a tumultuous week, albeit a welcomed one, the Portfolio finished the week giving up roughly .8% of its YTD gains. The brokerage account chart below identifies the dip in account value mid-week, last week and the resurgence to end the week slightly lower than the previous week. But enough about the weeks as it makes me sound weak.

Whenever I compose my analysis, thoughts, forecasts and the like I always try to offer my readers information and/or strategies for investing and trading. Because of my investing style and analytics, I’m largely found to be in the minority with my style and strategy.

Alongside this narrative and recap from the previous week’s turbulent market I will be delivering an interview this coming week with David Moadel concerning Target Corporation. David is a great resource and knowledge base for investors and traders and he offers a platform to deliver such information with a plethora of videos and tutorials on his YouTube channel. In my last interview with David, I discussed all that has been ailing the retail sector and a more focused discussion about Target Corporation. Since Target delivered its better than expected Q1 2017 results last week, I’m hoping to update my views on the retailer with David’s assistance.

So there you have it folks and if you think last week was a rollercoaster ride I’m sure that ride is far from over. This coming week is jam-packed with economic data, inclusive of FOMC minutes on Wednesday and a Q1 GDP revision slated for Friday. For those investors and traders who desire a closer look at the economic data calendar for the week ahead please review the calendar below offered by MarketWatch.

Disclosure: I am short UVXY

Sehr, thanks for sharing your insights. What are your thoughts on selling SVXY puts as compared to UVXY calls?

I don't really prefer using options for VIX-leveraged instruments as they can be restrictive and carry relatively high premiums. However if I was forced to define my risk I would probably utilize buy UVXY puts with long-dated strikes.