Apple's Balance Sheet Math: Does Apple Really Have $203 Billion In Usable Cash On Hand As Widely Reported?

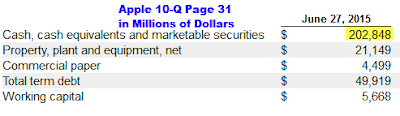

Apple's latest 10-Q quarterly filing shows that it has nearly $203 billion in cash or cash-equivalents.

10-Q Page 31

Current Assets

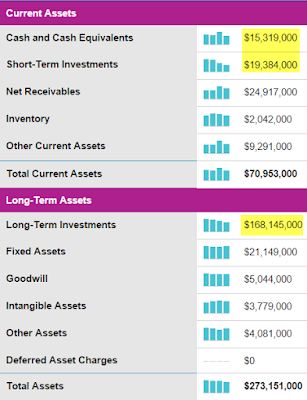

Diving into a more colorful Nasdaq Summation I made the following clips (highlights in yellow are mine).

Totaling actual cash, short-term investments, and over $168 billion in long-term investments, we arrive at the $202.848 billion number on the 10-Q.

Current Liabilities

Cash Much Smaller Than You Think

I don't often dive into balance sheets, but did so after reading a Market-Watch opinion by Brett Arends.

Arends writes Apple’s real cash pile is 99% smaller than you think.

Actually I can quibble with that number a bit, but right off the top one can easily subtract liabilities to get a better picture of what Apple really has.

Subtract all the liabilities and you are at $55.374 billion.

That's a very good number, but a far cry from media hype. For example CNN Money points out Apple has $203 billion in cash.

The title is "technically" accurate, but CNN Money ignores the debt while making the claims "It's fair to wonder why Apple needs all this cash. It's one thing to save for a rainy day. But Apple seems to be acting like Noah and preparing for a 40-day flood. Apple may face even more pressure to do something productive with its $200 billion war chest instead of letting it collect dust in Ireland and other tax havens."

Tax Haven Math

Returning to the 10-Q we see this note: "As of June 27, 2015 and September 27, 2014, the Company’s cash, cash equivalents and marketable securities held by foreign subsidiaries were $181.1 billion and $137.1 billion, respectively, and are generally based in U.S. dollar-denominated holdings. Amounts held by foreign subsidiaries are generally subject to U.S. income taxation on repatriation to the U.S."

Arends points out the tax liability on that $181.1 billion held offshore is $59.2 billion.

Maybe there is another tax repatriation holiday, but maybe not. And if not, there is another $59.2 billion liability to deal with.

In short, Apple could not spend its alleged cash-on-hand without going deeper in debt.

Some of the numbers I took from Nasdaq do not precisely match Arends'. For example, he notes $31.5 billion in “off-balance-sheet” liabilities. That's a number suspiciously close to $31.296 billion in "other liabilities" as noted in my clips.

If “off-balance-sheet” is not included in my totals, then subtract another $31.5 billion.

Distortions of Reality

The key point is that all of these glowing "cash-on-hand" reports that you read are distortions of reality.

The primary distortion is reported cash positions ignore debt. I have gone through this exercise before, and after subtracting liabilities, US corporations actually have negative net cash in aggregate.

The secondary distortion, as Arends points out, but I have not done so previously is reported cash positions fail to take in tax liabilities.

The last time I conducted my analysis was in 2013, so perhaps it's time for an update. See Cash Cow: Of the 50 Largest US Companies, Who has the Cash? Who has the Debt?

A small handful of companies actually have positive net cash. Apple was one of them then, and is one of them now. But at that time, net cash was -849.93 billion.

Yes, companies in general could spend the reported cash numbers, but to do so would further leverage their balance sheet with debt.

Mike "Mish" Shedlock

Disclaimer: The content on the Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All ...

more