Apple Stock Rallies On Buyback Despite Weak Iphone Sales

Apple Utilizing Cash To Push Stock Up

There were a lot of worries about Apple’s iPhone sales headed into this quarter as a few suppliers missed their estimates because of the iPhone. This caused analysts to lower their estimates for iPhone sales heading into this quarter. Overall, Apple reported decent results, but the iPhone shipments missed even the lowered bar. This was smoothed over by a generous capital return plan which sent shares 3.66% higher after hours on Tuesday. This is causing some to claim Apple has gone from a smartphone company to a financial engineering company. I disagree with that slightly. Apple is simply utilizing the tools it has at its disposal to make shareholders happy. It’s leveraging its past success to push the stock up.

The company needs to deal with the fact that the smartphone market is mature. It’s really tough to find high ROI projects to invest capital in which is why I think this buyback is the right decision. I think the company needs to invest heavily into AI, but there will be capital left over no matter what it invests in unless it makes a major acquisition which would probably be a mistake. Those asking Apple to buy Netflix are completely wrong because Netflix has massive unfunded content costs that Apple won’t want to take on. Furthermore, since Apple hasn’t bought the firm in the past 5 years, it won’t suddenly change its mind.

The Specifics Of The Quarter

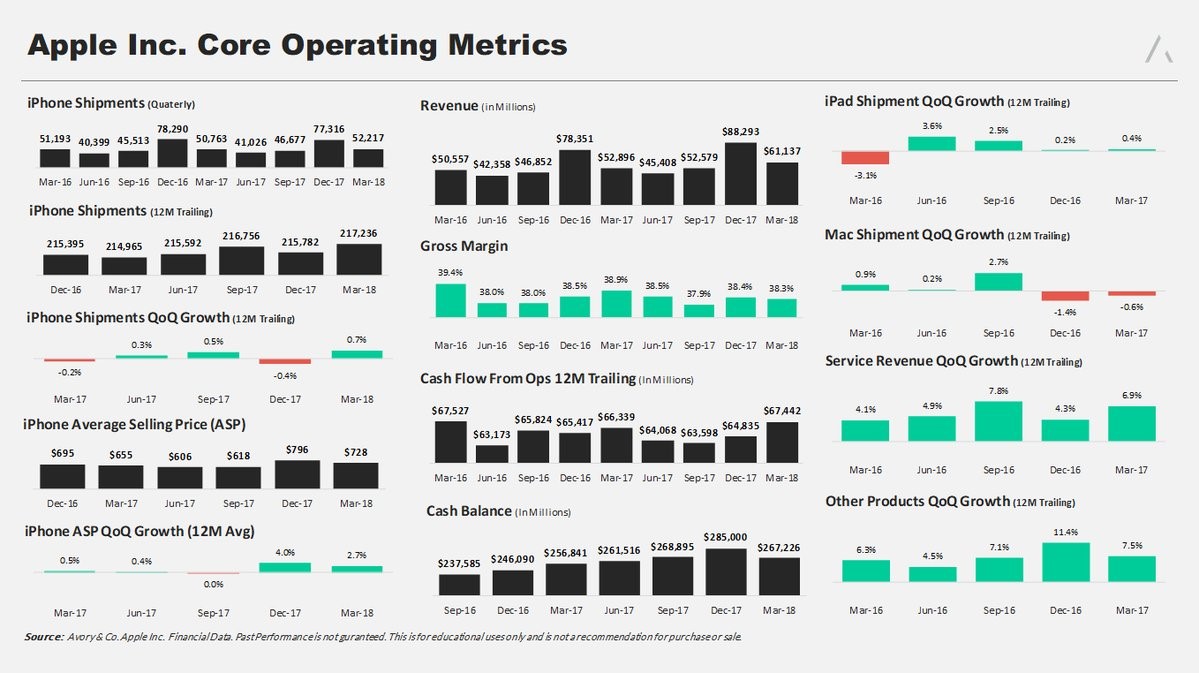

Apple beat EPS estimates by 6 cents as it reported $2.73 in earnings. Revenue was $61.1 billion which was better than the $60.82 billion that was expected. iPhone sales were 52.2 million which missed estimates for 52.54 million. To me, this is a big miss because estimates had been falling for the past few weeks. The bar was lowered, but apparently not enough. Fiscal revenue guidance was $51.5 billion to $53.6 billion. The mid point is above the expectation for $51.61 billion in revenues. The net income was $13.82 billion which is up 25% from last year.

The charts below show the summary of the results. The iPhone shipments last quarter were down year over year, but they were up 2.8% this quarter. That’s improvement. It’s all you can expect based on this current product offering. Some analysts believe Apple will discontinue the iPhone X based on this poor response. I think it’s a reasonable assertion because there’s no way it will keep selling two models without the infinity screen. The iPhone 8 and iPhone 8 Plus are priced as premium devices, but they have very dated designs. There needs to be an improvement for those high end phones. Apple can still differentiate with a very high end phone, but not at the expense of the slightly lower priced phones’ designs.

The high price was a problem for buyers after the initial surge of iPhone X buyers last quarter. The average selling price fell from $796 to $728. That’s an 8.5% decline. Last year the Q1 to Q2 ASP decline was only 7.5%. I am very skeptical about Apple’s ability to raise its ASP overtime. The smartphone is becoming a more important device, but the space is competitive. Apple has a moat with its iOS software which is unique because unlike Android, the firm controls both hardware and software, making the experience seamless. Apple also has more gravitas than Android in terms of privacy since Alphabet is an advertising company. However, the improvements in these Android devices still puts pressure on Apple to deliver value.

(Click on image to enlarge)

It’s disappointing to see the increased iPhone ASP isn’t translating into higher margins. Operating margins fell 60 basis points from last year even though the iPhone’s average selling price was up $73 from last year. On the call, Tim Cook stated "I don't buy the view that the market's saturated. I think the smartphone market is sort of the best market for a consumer product company in the history of the world." He’s right that the smartphone is the best product ever. It is probably the most important one as the power of the mobile internet is impossible to overstate. That being said, the total devices sold fell 0.5% globally in 2017 according to the IDC, so saturation is here.

The good news is other products like the HomePod and the Apple Watch have room to expand sales. The “other products” revenue of $3.9 billion beat estimates for $3.7 billion. Apple Watch and AirPods saw growth of almost 50%; the wearables and home products category accounted for 90% of the growth in the “other products” category. If I was an investor in Apple I’d be worried about Amazon’s lead in the smart speaker category.

As I mentioned, the firm made up for the weakness in iPhone unit sales by announcing a massive cash return plan. The firm raised its quarterly dividend 16% to 73 cents per share. It also announced a $100 billion buyback. I’m excited by this buyback as it will support shares until the next product releases this fall. The chart below shows the size of the $210 billion in capital returns Apple will have delivered to shareholders by June 2018. That’s larger than all but 19 firms in the S&P 500. Apple has $267 billion in cash currently.

(Click on image to enlarge)

Conclusion

Apple could be a good stock to own, but a bad business. Apple’s stock will be buoyed by the massive buyback, but the saturation in the smartphone market hurts its ability to grow. There probably will never be a device like the smartphone, making the profit growth irreplaceable. Apple really isn’t a services company yet. This is mostly spin to make the weakness in iPhone shipments more palatable. That’s not to say the 6.9% trailing 12 month quarter over quarter sales growth isn’t impressive. It just doesn’t move the needle. A positive Apple stock is good for the S&P 500, but I don’t think it’s enough to help the market reach a new all-time high.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more

While #iphone sales are not as high as some hoped, I think too many are over reacting. #Apple is still an attractive company with a rabidly loyal fan base. The company is still making a ton and due to various tax benefits, are about to overloaded with cash. $AAPL

#ipad and #iphone were #Apple's cash cow for a long long time. But sales are drying up. The company has a loyal fan base, but most won't continue to upgrade as long as their older products still work so well. Apple needs to find the "next big" product if they want to stay on my buy list.

As long as Apple intentionally slows down it's older products, users will be forced to upgrade.

This is why I switched to #Android and tell others to do the same. Why buy a product when the company cares so little about its customers, that they will intentionally break that product to force you to buy more from them... knowing it will just happen again.

#Apple LOST my loyalty with this move. Bearish on $AAPL.