Another Rough Week For Junk Bonds

DoubleLine Capital’s Jeffrey Gundlach says that it’s too early to start buying junk bonds. Although below-investment-grade fixed-income securities have been sliding for more than a year, the negative momentum may not be over yet, he explains. “I’ll think about buying when it stops going down every single day,” he tells Reuters.

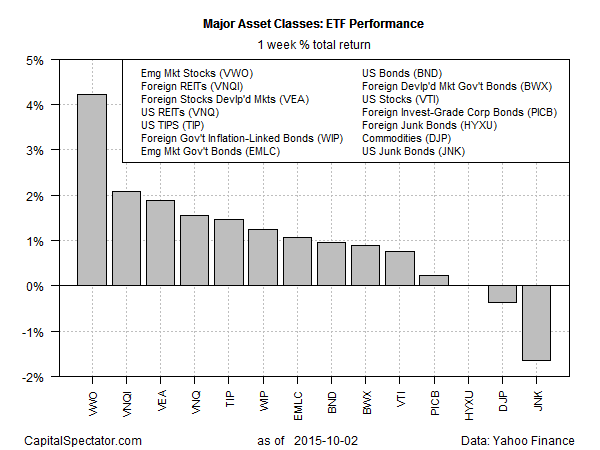

The trend isn’t looking any better on a weekly basis. Junk was last week’s loser by far among a set of exchange-traded proxies for monitoring the major asset classes. The SPDR Barclays High Yield Bond ETF (JNK) shed 1.6% (based on total return) for the week through Oct 2–the third straight weekly decline.

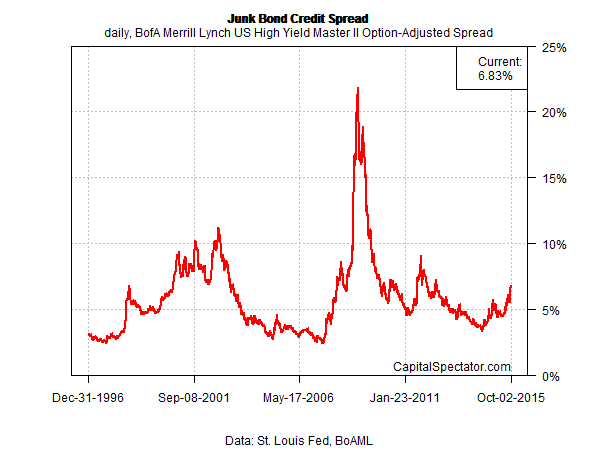

The risk-off bias in junk bonds is taking a toll on prices these days. The byproduct: a rising and relatively elevated yield premium. The BofA Merrill Lynch US High Yield Master II Option-Adjusted Spread increased to 6.83% on Friday (Oct. 2)—a three-year high and nearly double the level from mid-2014. That’s still low in comparison with the nose-bleed heights reached during the Great Recession, when spreads briefly soared above the 20% mark. In context with the relative calm of the last several years, the recent rise is still striking. The catalyst for the attitude adjustment? The crowd’s demanding a bigger discount on risky assets when it comes to estimating the potential blowback from macro trouble.

Junk yield spreads are looking relatively attractive these days, but they may become even more attractive in the weeks (months?) to come. Indeed, JNK’s technical profile still looks ugly. The ETF closed last week at well below its 50- and 200-day moving averages and the 50-day average is well under its 200-day counterpart.

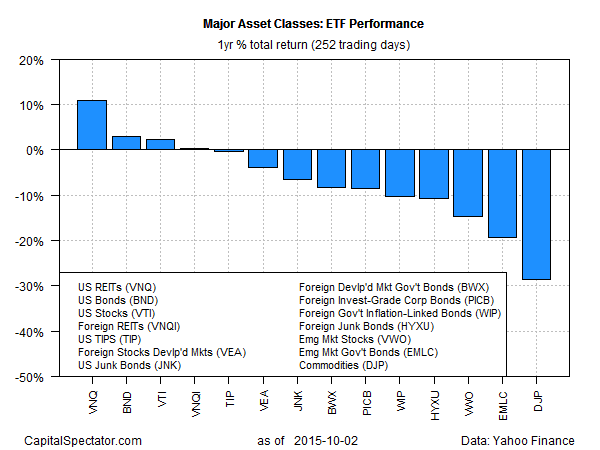

Turning to the trailing one-return summary adjusts JNK’s loss to something approximating a middling decline. The prize for the deepest slide for the trailing 252-trading days through Oct. 2 still goes to a broad-based definition of commodities. The iPath Bloomberg Commodity ETN (DJP) is in the hole by nearly 30% for past year. By that standard, JNK’s 6.6% one-year decline through last week looks mild.

Disclosure: None.