Analysts Have Mixed Reviews On Long-Term Health Of General Motors Company

General Motors Company (NYSE: GM) has been struggling with the reputation of being a GM "value-trap" company for quite some time. The stock appears to be cheap and has only been trading just 7.5 times forward earnings. The only way out of this plague is for GM to prove to investors that progress can be made on self-help initiatives through an upbeat earning reports.

GM last closed at $36.37 on June 23, virtually the same price one year ago. The company’s stock has remained fairly stagnant, with a 52 week range of $28.82-$38.99.

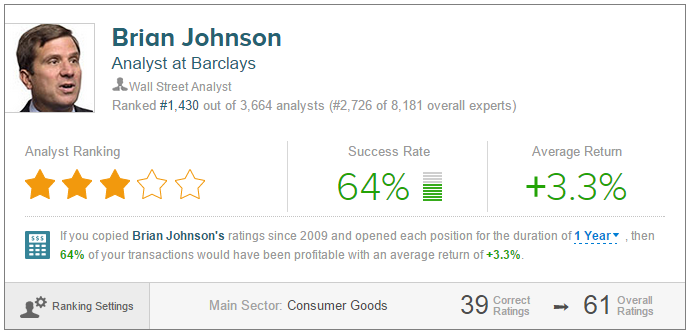

Barclays analyst Brian Johnson weighed in on GM on June 23, reiterating an Overweight rating on the stock with a $44 price target. The analyst noted, "it is increasingly clear to us that there is likely little near-term that can help to shed the value trap image, and thus drive upside for the stock". The analyst believes that GM’s upside potential would be powered by energetic monthly sales data for the U.S., especially if accompanied by a favorable pickup environment.

The downside of GM’s shares also appears to be limited as the stock already has a cheap valuation, alluring dividends and ongoing share buybacks. However, while profit is expected to remain stable in North America, the analyst believes that intensive pricing pressures and weak volumes in General Motors’ China operations could result in negative earnings revisions.

However, Johnson called GM a “show me story,” citing that “real upside for the stock won’t be achieved until GM strings together several quality beats, proving that progress is being made on self-help initiatives”. He added that investors are “skeptical that GM’s forthcoming product upgrades will lead to lasting improvements in variable profits per unit”.

Brian Johnson currently has an overall success rate of 64% recommending stocks and a +3.3% average return per recommendation.

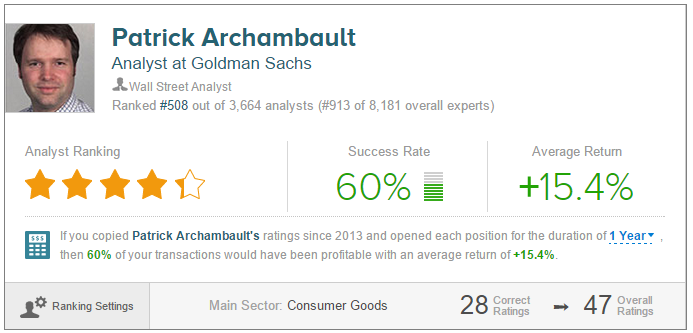

On the other hand, Goldman Sachs’ analyst Patrick Archambault downgraded his rating on GM from Buy to Hold on June 23, citing that he would prefer Ford to GM. He points out that Ford’s North American profitability is likely to grow next year and that the company is less dependent on China than GM.

Patrick Archambault has a 60% overall success rate recommending stocks and a +15.4% average return per recommendation.

On June 25, the company is scheduled to host a “behind the charts” conference call to shed light on the long-term outlook of the company. It is intended for institutional investors and analysts to provide insight with regard to GM’s financial reporting as well as answer frequently asked questions from the investment community.

Out of eight analyst polled by TipRanks, four are bullish on General Motors, three are neutral and one is bearish. The 12-month average price target is $43.60, marking over a 20% potential upside from where the stock is currently trading. On average, the all-analyst consensus is Hold.

Disclosure: To see more visit more