Alternatives As A Bear Market Protection Plan

While the Nasdaq index has continued to march higher in recent days and closed at another new all-time high yesterday, the rest of the major indices appear to remain stuck in a sideways trading range. And with the earnings parade about to begin and another troubled Italian bank trying to raise capital, the back-and-forth action could easily stick around awhile. As such, let’s continue our exploration of the alternative investing space.

So far we’ve established that investors began to seek other “alternatives” to the traditional alt classes such as gold, commodities and REITs, after devastating bear markets occurred in commodities and gold in recent years. In response, a new category of alts has sprung to life including strategies such as Managed Futures, M&A Arbitrage, Long/Short Equity and Credit, Global Macro, etc.

To review, these new-age alternatives are supposed to provide (a) non-correlated positions in a portfolio, (b) a hedge against big, bad bear markets, and (c) a way to “print money” – i.e. an alternative to bonds. Again, sounds good, right?

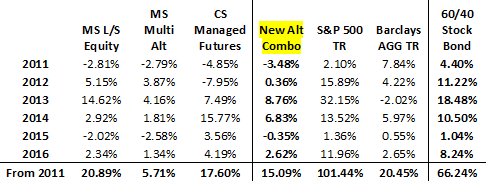

However, as we discussed yesterday, the returns of these new-age alts have been more than a little underwhelming. Since the inception of the CS Managed Futures index in 2006, a combination of Morningstar’s Long/Short Equity, Morningstar’s Multialternative, and CS Managed Futures indices would have produced a cumulative return of +15.09% from 2011 through 2016 – a far cry from the +101% gain seen in the stock market.

New-Age Alternatives

Therefore, I believe it is fair to conclude that, so far at least, the new-age alts should not be viewed as an alternative to the stock market – the numbers just aren’t there.

However, a combination of REITs and Gold actually has done a decent job of competing with the stock market. Since 2006, the combo would have produced a cumulative return of +118.8%, which is in line with the S&P 500 return of +125.4% and well above the AGG’s gain of +59.7%.

Bear Market Protection Plan?

But before we give up on the new-age alts, let’s remember the other two prongs of the pitch. First, alts are supposed to provide protection during bear markets. And second, that the new-age alts should really be looked at as an alternative to bonds.

So let’s go to the numbers. Unfortunately, the CS Managed Futures Index wasn’t around in 2008. However, the Morningstar Multialternative and L/S Equity category benchmarks were. Below is a summary of the returns in calendar year 2008.

2008 Returns:

- S&P 500 TR: -36.55%

- Barclay’s Aggregate Bond TR: +5.24%

- Morningstar L/S Equity Category: -15.40%

- Morningstar Multialternative Category: -22.14%

- REITs/Commodities: -34.39%

- Gold: +4.96%

- Combination of L/S Equity, Multialternatives, REITs and Gold: -19.6%

- 60/40 Stock/Bond: -16.02%

My apologies for bringing up the horror of 2008 again. However, my takeaways from numbers above are (a) the only classes that actually gained ground in 2008 were bonds and gold, (b) L/S Equity lost less than half the S&P, (c) the Multialternative Category lost less than the S&P but more than 60/40, and (d) a combination of L/S Equity, Multialts, REITs and Gold also lost less than the S&P but also more than 60/40.

So, as a protector against big, bad bear market, I’m going to give the new-age alternatives a grade of C-. Sure, they lost less than stocks. However, I don’t think most investors would view a loss of -22.1% in 2008 for the multialt category as a “win.”

New-Age Alts vs. Tactical Risk Management Strategies

My big takeaways from the analysis of new-age alternatives as a protector against bear markets are (a) the results are not exactly compelling and (b) that risk management strategies are probably better suited for the job.

Generally speaking, protecting against the downside of the stock market is what most of these tactical risk management strategies are DESIGNED to do. And frankly, 2008 is what most of these strategies are benchmarked against. I.E. If they can’t protect in 2008, why bother?

Everybody knows that a risk management strategy is a little like homeowners insurance. It is great to have when the block burns down but it does come at a cost, which has traditionally been a degree of underperformance to the upside when compared to the stock market.

For me, the bottom line here is the performance of the new-age alts has been woefully short of the stock market and they have not done a great job of protecting against the downside in stocks. Yes, my sample size is small. And yes, next time could very well be different. But my point is that if you are looking for an alternative to equities that also attempts to protect against the really big, really bad bear markets, there are other approaches that might make more sense. Well, to me, anyway.

Next week, we’ll continue our exploration by looking at alts as bond alternatives and giving some thought to the idea that “50/30/20 is the new 60/40.”

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the “Trump Trade”

2. The State of Global Central Bank Policies

3. The State of U.S. Economy

4. The State of Bond Yields

Thought For The Day:

“What the world needs is more geniuses with humility, there are so few of us left.” – Oscar Levant

Disclosures: Modern times demand modern portfolios!

Thanks for sharing

Thanks for sharing