All Major Asset Classes Continue To Post 1-Year Declines

Several pieces of the major asset classes rebounded sharply last week, based on a set of representative ETFs. But the revival wasn’t strong enough to wipe away the red ink for the trailing one-year period. For the second week in a row all the major asset classes are posting varying degrees of loss when measured in total returns.

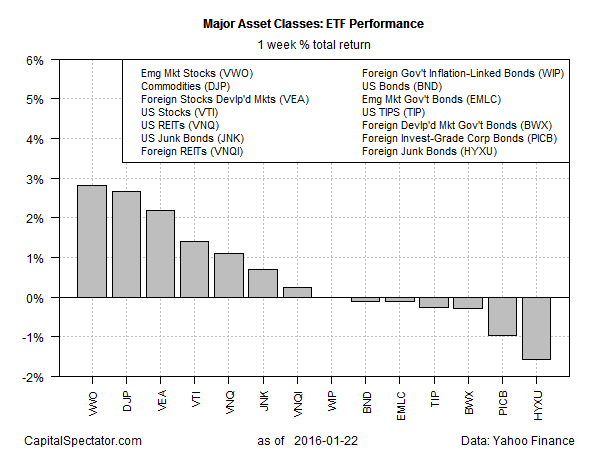

Let’s review the numbers, starting with the trailing one-week period through Jan. 22, which was nipped to a four-day week in the US because of the Martin Luther King, Jr. holiday. Vanguard Emerging Markets (VWO) led the winners higher last week, rising a strong 2.8%. At the opposite end of the weekly return spectrum: high-yield bonds in foreign markets via iShares International High Yield Bond (HYXU), which slumped 1.6%.

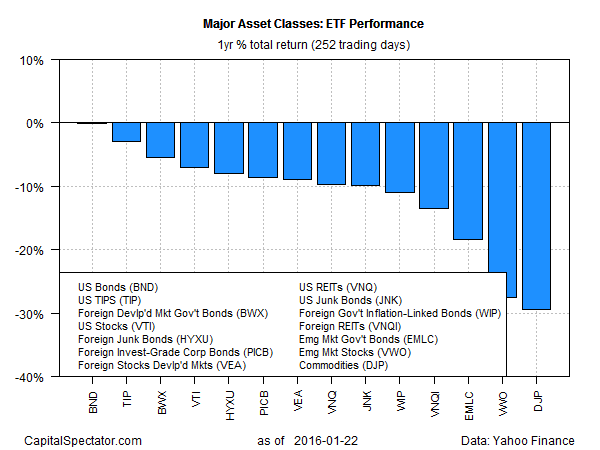

Despite the latest upturn, all the major asset classes continue to nurse losses in the one-year column. The best performer on this front, which is to say the fund that lost the least: a broad measure of US investment-grade bonds, based on the Vanguard Total Bond Market (BND). This ETF is close to unchanged, posting only a fractional loss through Jan. 22. Meanwhile, the worst performer in the one-year column is a world away. Broadly defined commodities by way of the iPath Bloomberg Commodity (DJP) is off more than 29% over the past year through Jan. 22.

The one-year return summary reminds us that negative momentum continues to dominate markets across the globe and throughout the asset-class spectrum. Consider that only two of the 14 proxy ETFs listed above—BND and VNQ–are currently posting 50-day moving averages that are above their 200-day averages (based on total-return prices as of Jan. 22). That’s no guarantee that prices will continue to trend lower. But until we see convincing signs of stabilization, the odds continue to favor the forces of gravity overall.

Disclosure: None.