All Assets "Bid": Trump Is The New Market Driver

There once was President Trump

Who hated it when stocks would "dump."

He promised largesse

To fix this fine mess

By launching a big fiscal pump.

With global markets raging higher since the election victory for Donald J. Trump, Wall Street has suddenly embraced the president-elect as the new messiah for returning global growth and propelling risky assets to all-time highs.

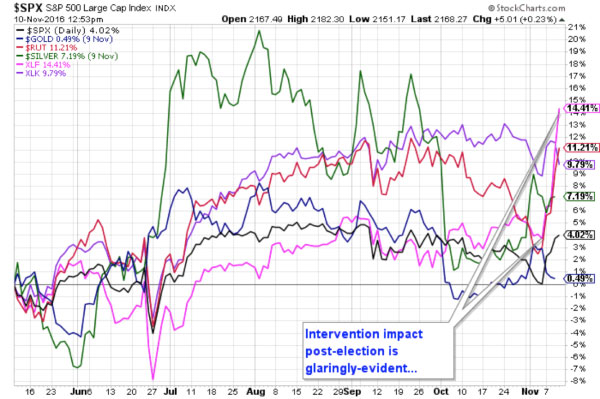

In the wee hours, after the election results were finalized, central bank trading desks around the world kicked into action, buying S&P futures and selling bonds, foreign currencies and gold and silver in order to keep the dream alive and avoid a North American "Brexit-style" crash in markets.

Forget Janet Yellen and the Fed; The Donald is now the new poster child for jawboning markets to new heights. He is the new Greenspan, complete with obfuscatory language, vagary of thought, and brashness of assertions. The markets love their new messiah, as the Dow has hit a record high led by guess who? Why the banks, of course, because higher interest costs for consumers is a bullish development for bank profits, and with the 10-year Treasury yield back above 2%, it represents a massive increase in borrowing costs.

However, this market is being driven by excess liquidity sloshing around in the system and as I have written about for years, one can "never underestimate the replacement power of equities within an inflationary environment." And DJT is all about spending and growth and walls and infrastructure build-out, all of which is inflationary (see chart above).

Global markets are advancing under the newly established meme that the next era in portfolio strategy is no longer central bank leadership but fiscal leadership. The Wall Street elite are now in the process of canonizing Trump as "The Growth President," such that the spin will deflect attention away from the ineffectiveness of the Great Central Bank Experiment, where $57 trillion in new currency was printed to avoid the disintegration of the banking system and instead focus on government expenditures—not unlike the Tennessee Valley Authority or the Civil Works Administration from the 1930s.

Sadly, this new regime is being orchestrated beautifully by the Working Group on Capital Markets, whose efforts to control gold, silver, stocks and bonds through the NY Fed has caused legendary bond investor Stanley Druckenmiller to change his views on gold. It has been reported that his fund (Duquesne) no longer owns gold, having dumped "all of my gold on the night of the election."

This, my friends, explains perfectly how the behind-the-curtain puppet-masters can influence markets. Had they not stepped into the dollar-yen and intervened in the S&P futures early Wednesday morning, there would have been no cover behind which they could sell massive amounts of paper gold, creating an enormous "Gravestone Doji" for the Wednesday session, hitting a new recovery high early and giving it all back before it ended.

The problem we have now is that all of the algo-bot-driven funds are in "Sell the Rally" mode for gold (not silver), all because the interventions created a synthetic technical backdrop showing as "bearish" for gold. And therein lies the rub: There is nothing bearish or deflationary about DJT building an enormous wall between Mexico and the U.S.A. and replacing bridges, highways, and airports, and therefore nothing is bearish or demand-destructive for gold and silver.

However, markets are slave to the algorithms and all of that pattern-recognition software, and the patterns are unmistakeable now, in the new post-Obama, ex-Clinton world of high finance. Gold and bonds stink; growth stocks and risky assets (including silver but excluding gold) rule!

While it is all a bunch of steaming manure being shoveled at us by the Wall Street spin machine, there was a massive amount of institutional cash around going into the election, and the events of late Tuesday evening certainly shaved the annual return numbers downward for anyone that tried to game the election. Accordingly, we are most certainly in "chase" mode now, with under-invested managers scrambling to get on board at all-time highs in the Dow.

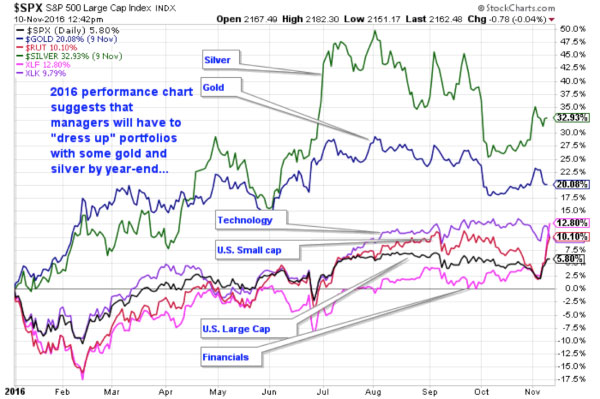

In addition, the performance they are chasing is no longer the gold and silver miners, which were massively outperforming the S&P at the end of Q3, but rather the financials as represented by the XLF ETF. To fully grasp the impact of interventions, look at where we were in mid-September in the chart shown below.

Note that in the "Year-to-Date" chart, silver is still the standout. However, when you shorten it to the "Six-Month" chart, things really change in a big way. Financials go from the bottom of the pack to superstar status as shown below.

So the "chase" back in mid-September, which was shaping up to be gold and silver, has been recalibrated to highlight financials, small caps and technology, followed by silver, large caps and gold.

How do we trade the move in the markets looking out to year-end? As is the case with all politicians, the name of the game is "Print and Spend," so while The Donald’s election has been greeted with gold down and stocks up, the "infrastructure trade" is fine and dandy for those willing to pile on. But ask yourself where the money is going to come from and how it will impact deficits and the purchasing power of the USD.

Second, with the USD Index screaming toward par (100), U.S. corporations are going to find that exports are increasingly challenged given the currency disadvantage. All of this spells "reversal," and after this spin is guzzled by the performance-chasers, I see a Wile E. Coyote moment, when he suddenly realizes he is off the edge of the cliff, staring down through a cloud.

I am adding another 25% to the SLV January $15 calls at $2.85, having initiated the first 25% at $2.50. I see silver as a perfect monetary instrument that captures the attributes of the industrial metal, aligning it with the screaming bull markets we are observing in copper and zinc. As I showed you earlier this week, copper and silver enjoy a correlation, so given the proximity of copper to that downtrend line stretching back to early 2011, and depending on the thickness of the line, it appears to be residing at around $2.50—and that close today would be a break above the downtrend line. I will feel more comfortable if I see copper stay above $2.50 for a few more days.

But despite a relative strength index (RSI) at 87 now, the moving average convergence/divergence (MACD) is still way below the range from which it has historically corrected. Since silver moves in tandem with copper, I will go with the shiny metal and see if we get the move to $22, whichI think is possible within the constraints of this brand new "reflation trade."

So there you have it—my synopsis of the world as I see it going into the final seven weeks of 2016. And with that I leave you all one thought: just as Wall Street asked us to believe that the Fed could rescue the global economy, it is now asking you to believe that the new POTUS—a man stilling using tax losses from decades ago to avoid paying tax—will be able to navigate the global minefield of terrorism (domestic and abroad), expansionism (China), sovereign insolvency (Europe), and derivative risk (Deutsche Bank) while restoring a manufacturing base after thirty years of globalization. Building a wall that the Mexican drug lords will burrow under all the way to Moose Jaw with the petty cash they keep in their shoeboxes seems like it will be a tall order, just like all of the other promises Trump made to appeal to Silent (White and Christian) Majority adult males driving around in pickup trucks with Confederate flags in the rear window.

Just as Brexit was a clandestine anti-immigration and totally ethnocentric outcome brought about by the white English majority, so was the Trump victory a scream from the heartland in the name of a return to Leave it to Beaver and Andy of Mayberry. The feeling I am getting is reminiscent of Kent State and Berkeley in the ’60s antiwar protest movements, which did not end particularly well. DJT had better be very careful because a great many Millennials won't like having their free entitlements yanked out of their hands, along with the free cell phones and food stamps.

And then there is "Crooked Hillary" and the Clinton Foundation. . .and if you think that story has been put to bed, you had better think twice. . .

Disclosure:

more

thanks for sharing

Just like Greenspan, Trump will soon learn about the conundrum. Or if the conundrum is breached, the financial system will melt down and the US taxpayer will pay for it. Credit will freeze like the Arctic in winter. It may even be worse than the Great Recession. He needs to slow down.