Again?

It is more than interesting that Herbert Hoover has become the modern ideal of the liquidationist. In these very trying times, one is either that or a Keynesian, Hoover’s supposed opposite, an interventionist who believes there is no good in any recession or deflation at any time. To “prove” the superior foundations of the latter, the ideological associates of that position will always invoke the Great Depression. In what is the economic equivalent of Godwin’s Law, in some ways just a corollary since it was the Great Depression that made the Nazi extreme possible, to advocate free market liquidation is to be pressed into the corner of wanting another Great Depression.

It is, of course, a true non sequitur, for most who are committed to free markets can be so without ever having the slightest desire for calamity. It has been in the decades since the 1930’s a common tactic to associate free markets with such dangerous messiness and the role of government the virtuous economic janitor forced to clean up from the chaos. The panic in 2008 gives us a great test to some of those theories, especially as intervention was the rule almost from the start (August 2007 rather than February 2007, but still close enough to the initial rupture).

The fact that the Fed interceded at every turn but also on every count humiliatingly failed demonstrates one fact of false interventionist lore – that without the skill and courage, as Mr. Bernanke himself has called it, the Great “Recession” would have become a second Great Depression. In other words, without QE in this specific case there would have been no stopping the destructive capacity of the panic; it would have gone on and on and on until there was nothing left to the global economy.

That was always an irrational assumption, as even the messiest of free markets undergoing the messiest of liquidations reach on their own an end. No economy will ever liquidate down to zero. The idea that a crash will just keep on going until the enlightened central banker stops it is more politics than economics. In the case of 2008, it was truly absurd because nothing any central banker did led to any positive effects whatsoever. If the Panic of 2008 stopped, it was because it was always going to stop.

The case of the Great Depression was a singular, unique one; though there are enormous similarities of general outline between the 1910’s to 1930’s and the 1990’s to the so far 2010’s, in truth there are a great many differences especially monetarily. In the former period the public payment system was greatly endangered by its close and often direct connection to asset markets; in the latest period, the public’s money was never in such peril, as it was only interbank money where panic was realized. The worst of this age was never what happened up front in late 2008, it has been instead the lack of growth following it.

Even though the 2007-09 liquidation stopped largely on its own, intervention has continued almost constantly anyway. Largely based on the credit central bankers had initially given themselves, they kept at it year after year after year even though after several years it was more than enough time to realize “something” wasn’t working. As of last year, even central bankers have quietly surrendered, leaving them to finally admit that something was their “stimulus” – though they have yet to truly consider why.

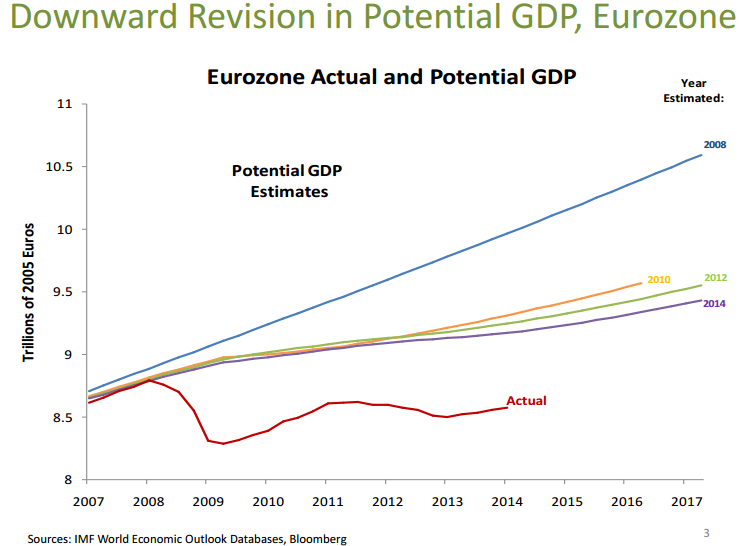

The problem is primarily global economic potential, on that point even the interventionists have finally agreed. The Great “Recession” in other words was never actually a recession, it was instead a giant and permanent rupture in global economic function. Orthodox economists have no idea why even if they now recognize it for that condition. This is the so-called “supply side” where “stimulus” is exclusively intended for aggregate demand; if the supply side is so impaired then it is no wonder demand side stimulus failed to stimulate.

But how could the supply side become so shrunken? There is no mechanism in their literature that could explain it, which is why economists and policymakers have turned to the ludicrous almost exclusively. They will never willingly re-evaluate the assumptions that underpinned their interventionist stance. Including:

“All the stakeholders emphasized today that we have to avoid delays,” EU Economic Affairs Commissioner Pierre Moscovici told a news conference after the meeting. “That would be very harmful. That would impair the confidence of investors and consumers. That would be detrimental to economic recovery.”

I have to confess that when I read this paragraph I actually laughed. It was an inappropriate one, and so more about again the ridiculousness of it the ideas expressed literally rather than the plight which was being described related to it. The article which contains that passage is one published initially yesterday relating apparently a new crisis in Greece, the fifth or sixth depending upon your definitions; which is to say the same crisis of Greece that has been ongoing for now seven years without interruption no matter the intervention.

The EU’s bureaucrat worries that not meeting Greece’s bailout terms would be for Greece “detrimental to economic recovery.” The loss of seven years under the terms of the bailout might be more fairly described as the very thing that is and has been “detrimental.” It has accomplished nothing other than keeping the Greek Republic in the prison of imbalance for which liquidation, painful as that may be, used to be the answer. It is only in the binary, polarized world of Great Depression or nothing that banks become the central if not only consideration.

That is what keeps all this in limbo, as it is the position of the ECB, as all central banks, that the banking system must never take losses even when they are completely appropriate; to do so can only lead to calamity like 1929 (they claim). Public confidence in banks must be maintained so as to avoid ruining the economy in a crash – I guess to the point where the central bank is willing to let the economy to be ruined over the course of nearly a decade to prove that one point? The only thing the Greek people haven’t experienced is recovery, and trying to limit the damage to just the Greek economy hasn’t prevented a Continental depression, either.

(Click on image to enlarge)

Keeping Greece without discipline is a supply side factor, and one that is not exclusive to Greece and sovereign debt. The Italians have faced the same banking irregularities as have the Greeks, if not to the same extreme. Mario Draghi promised to buy Italian as well as Greek bonds to maintain the euro, and the euro has so far been maintained. But its greatest threat in 2017 isn’t Target 2 but rather the lack of recovery being now expressed in terms of enormous and spreading political dissatisfaction and social instability. He accomplished nothing more than wasting precious time.

(Click on image to enlarge)

Because so much time has been squandered, we can reasonably assert that it would have been better in 2011 for central banks to sit that one out, to let a second crash develop even if it was equal in size and duration to the first one. Had it led to actual recovery the second time instead of the first (meaning a clear monetary reform sweep rather than half-assed trying to rebuild, like Greece, the pre-crisis world) we would all years ago have been so much better off by now.

The only objection economists and policymakers can raise against such a scenario is that a second panic in 2011 would surely have led to another Great Depression. We can just ignore that, however, because they say that every time about everything. It is not an argument to be taken seriously, as all intervention has accomplished is to provide a great deal of evidence against blanket intervention. The day we stop worrying about Greece is the day we can finally take global growth serious. That may mean more mess to come, but even a terrible transition is far preferable to continuing without any growth prospects at all.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more