After Last Fall’s Wheat Seedings Drop, Only Beans & Cotton Growing Acres

Market Analysis

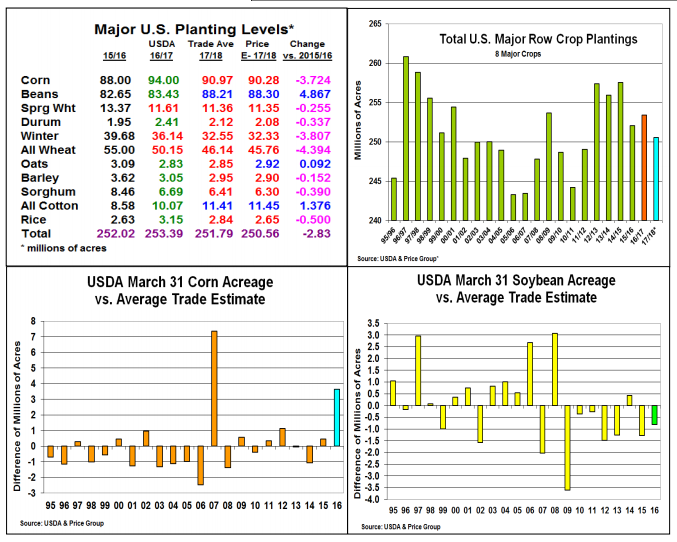

Each spring, the USDA surveys U.S. producers to get an initial sense of their prospective planting ideas for the upcoming year. The results of this sampling will be released on March 31 along with a quarterly stocks report for the major row crops. Because of last fall’s record outputs, sizable supplies are expected reducing the market’s stock report attention. The trade’s focus has been on the upcoming US 2017 planting prospects since the USDA raised its Brazilian crop forecasts at mid-month.

After extremely low grain price last fall prompted US winter wheat seedings to be cut by 3.75 million acres to 32.38 million (1909 levels), stronger protein and fiber prices over the winter are expected to attract more plantings from the feed grains. After last year’s 6 million jump in corn acres (mostly west of the Mississippi River), rotational and soil quality/moisture considerations are likely to retreat corn planting by 3.72 million to 90.28 million acres. Disease and relatively lower prices for sorghum and barley have advanced our corn seeding ideas from the Ag Forum’s 90 million level. Interestingly, the trade’s average estimate has also risen by nearly 1 million acres to 90.97 million after underestimating corn planting by 3.6 million last year and talk of early land workup this month. Historically, March plantings have been mixed and within 1 million acres of the trade in 8 out of last 10 years.

Strong world cotton prices will jump SW plantings and scattered seedings across the Delta and SE this year while firmer MGE prices may limit the slippage in spring wheat seedings in the N. Plains. However, last year’s S. American crop problems shifting export to the US and early Argentina planting issues this year will still likely jump 2017 US soybean plantings to a record 88.3 million acres, up 4.87 million from 2016. Historically, USDA’s seedings have been lower 7 out last 8 years than the trade, but they were higher 10 years vs. previous 14.

What’s Ahead

After last year's record U.S. crop production, the market's outlook is for another bumper crop given the current neutral to modestly developing El Nino pattern by late summer. With reduce extremes, this may limit price volatility for the 2017/18 crop. However, Mother Nature can be a fickled mentor after 3 sizable US crops. Feed buyers should have your quarterly needs covered. Produces should hold sales for now.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more