A REIT That Could Return 50% Investing Alongside Fortress

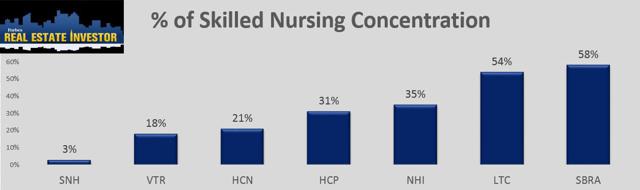

Last week, I wrote an article on HCP, Inc. (NYSE:HCP), in which I examined the risks associated with the company's largest tenant, HCR ManorCare. While HCP's troubles are due in large part to the company's significant concentration with one tenant, the entire skilled nursing sector has become more volatile due to civil actions resulting from questionable billing practices for Medicare and Medicaid reimbursements.

ManorCare said it planned to "vigorously defend the DOJ's civil action" and that its Medicare billings are submitted to and approved for payment by the Centers for Medicare & Medicaid Services, which deemed the services in question to be medically necessary and in compliance with billing guidelines.

Yet, according to BMO Research, "there has been recent precedence with similar allegations of false claims against skilled nursing operators, The Ensign Group and Extendicare. Both of these complaints resulted in cash settlements with the DOJ ($48mm for Ensign and $38mm with Extendicare, in November 2013 and October 2014)."

I have documented articles on other skilled nursing REITs recently, including Sabra Health Care (NASDAQ:SBRA), LTC Properties (NYSE:LTC), National Health Investors (NYSE:NHI), Ventas, Inc. (NYSE:VTR), and Healthcare REIT(NYSE:HCN).

HCP will likely trade with an overhang so long as ManorCare's reimbursements are being heavily scrutinized; the company generates most (around 71%) of its revenue from Medicare and Medicaid sources. It's likely that the HCP's closest peers will also be impacted as the government billing procedures are dissected.

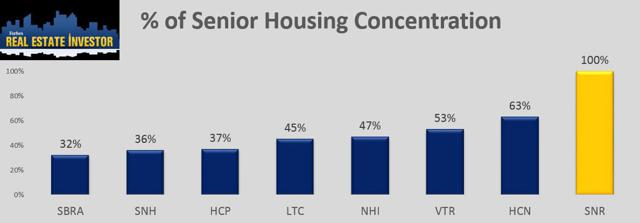

I have often wondered how one could invest in senior housing without the risk of government-backed revenue. It seems that most healthcare REITs have exposure that relies solely on public sources... except for now...

The Pure-Play Senior Housing REIT

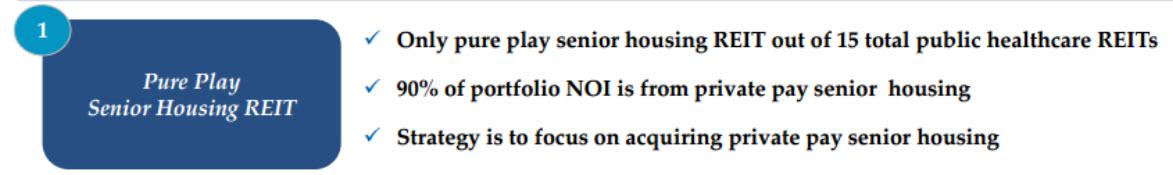

Last November (2014), New Senior Investment Group (NYSE:SNR) spun from Newcastle Investment Corp. by issuing 17.5 million shares generating proceeds of around $241 million.

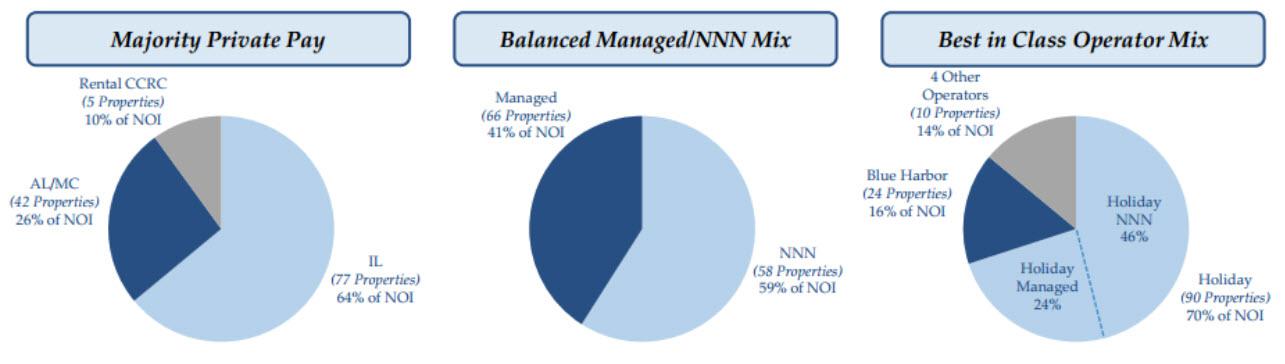

SNR is the only "pure-play" publicly traded senior housing REIT that owns a portfolio of 124 properties (15,600 beds) in 32 states. Over 90% of SNR's properties are PRIVATE PAY independent and assisted living properties.

The New Senior Portfolio

SNR is one of the largest owners of senior housing. The company's total capitalization is around $2.76 billion, and the market cap is around $1.1 billion.

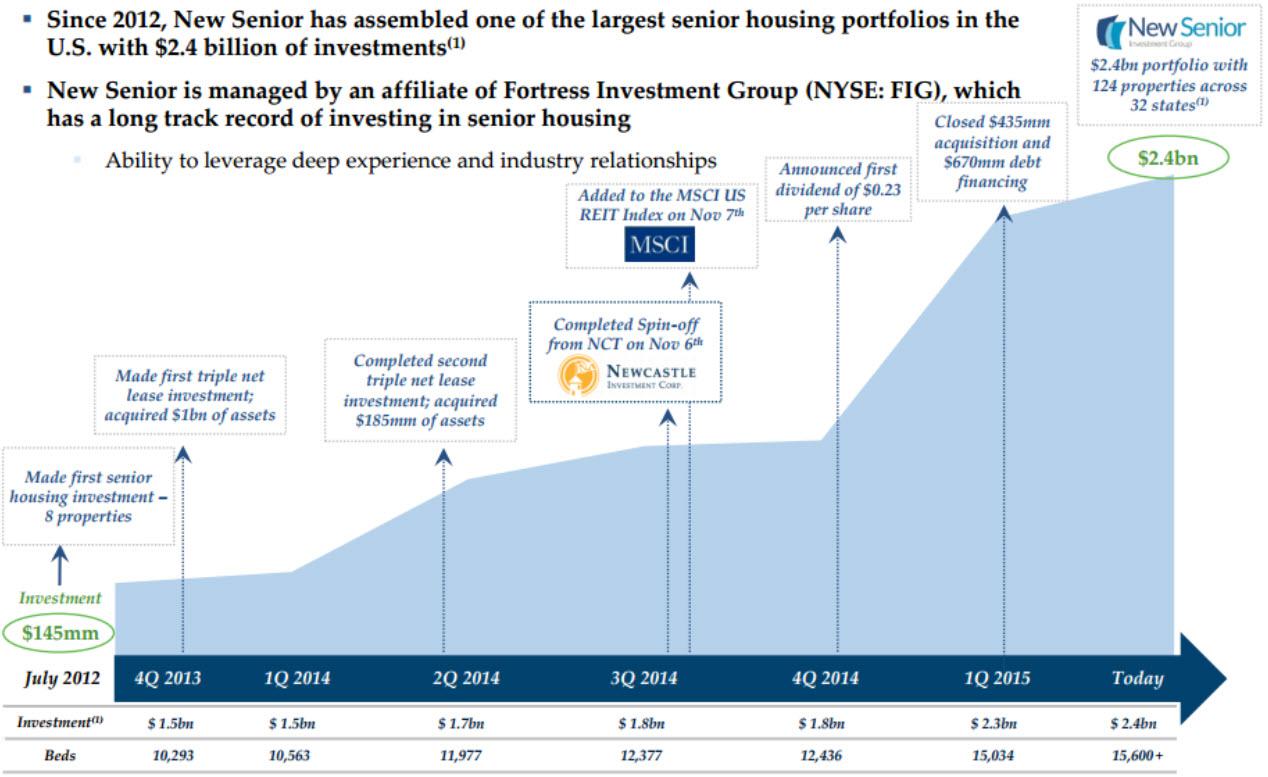

Since 2012, the company has assembled one of the largest senior housing portfolios in the U.S., driven in large part by the affiliation with Fortress Investment Group (NYSE:FIG), which has a long track record in senior housing. FIG still owns around 8 percent in SNR (more on that later). As you can see below, SNR has evolved (in less than two years) into a formidable aggregator of senior housing properties.

Click on picture to enlarge

It has assembled a balanced model of both managed (41 percent of assets) and triple net leased (59 percent) properties that generate very predictable sources of income. As noted, a majority of the properties are private pay, and the new REIT has around 70 percent of revenue being generated from Holiday (formed in 1971 by William Colson, and sold to Fortress in 2007).

Click on picture to enlarge

Around 16 percent of SNR's revenue is generated from Blue Harbor (24 properties), another Fortress-owned operation (See my disclosure at the bottom of the article).

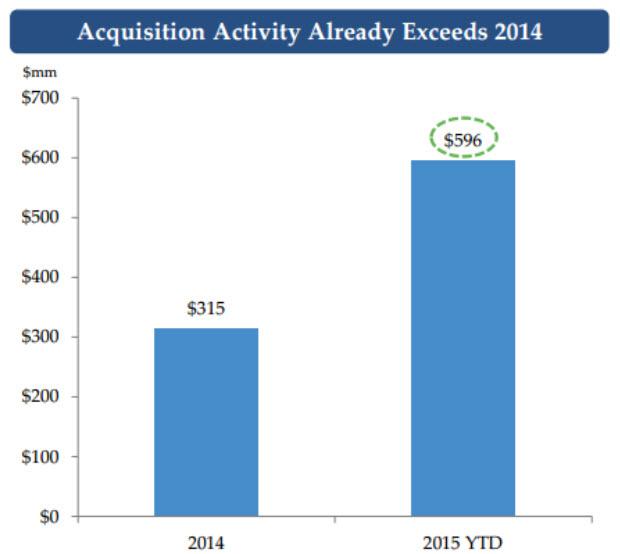

Year-to-date, the company has closed on $596 million of senior housing acquisitions, significantly exceeding 2014 volume of $315 million. SNR estimates the robust pipeline could propel the company into a leading consolidator in this highly fragmented sector.

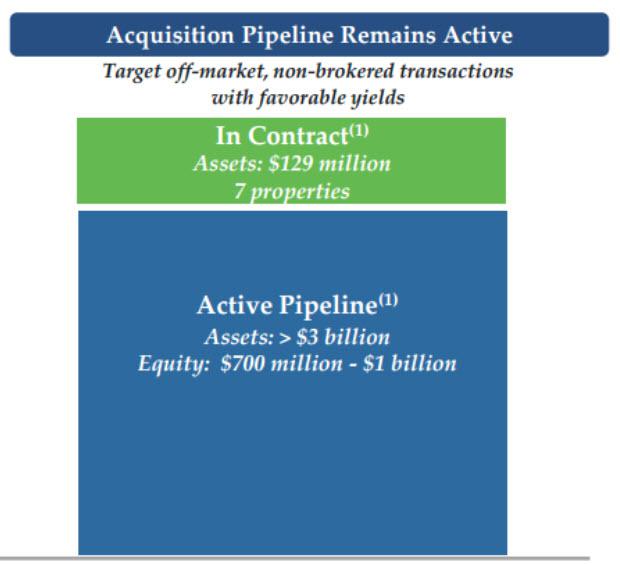

SNR has $129 million under contract (7 properties) and a pipeline estimated at over $3 billion.

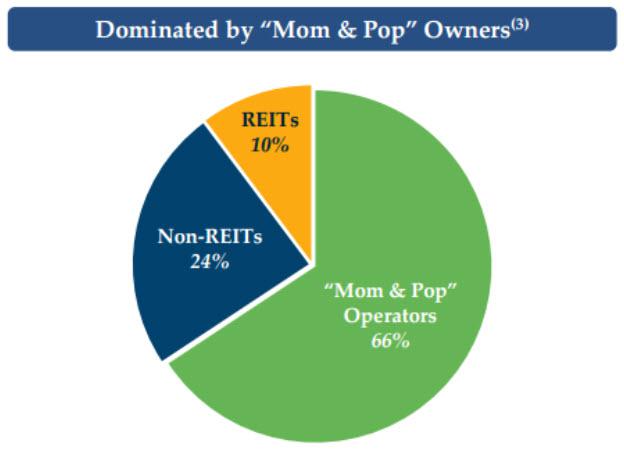

The vast majority of senior living is owned by "mom & pop" owners, and just 10% of the properties are REIT-owned.

Here's a snapshot of the current portfolio and operator stats:

Click on picture to enlarge

Strong Growth Prospects

Senior housing has proven to be resilient through various economic cycles, and it's the only real estate sector to experience positive NOI (net operating income) growth during the recession due to the need-based operating characteristics. SNR forecasts positive NOI growth of 2% for 2015-2018.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more