A Red Letter Day For Oil And For OPEC

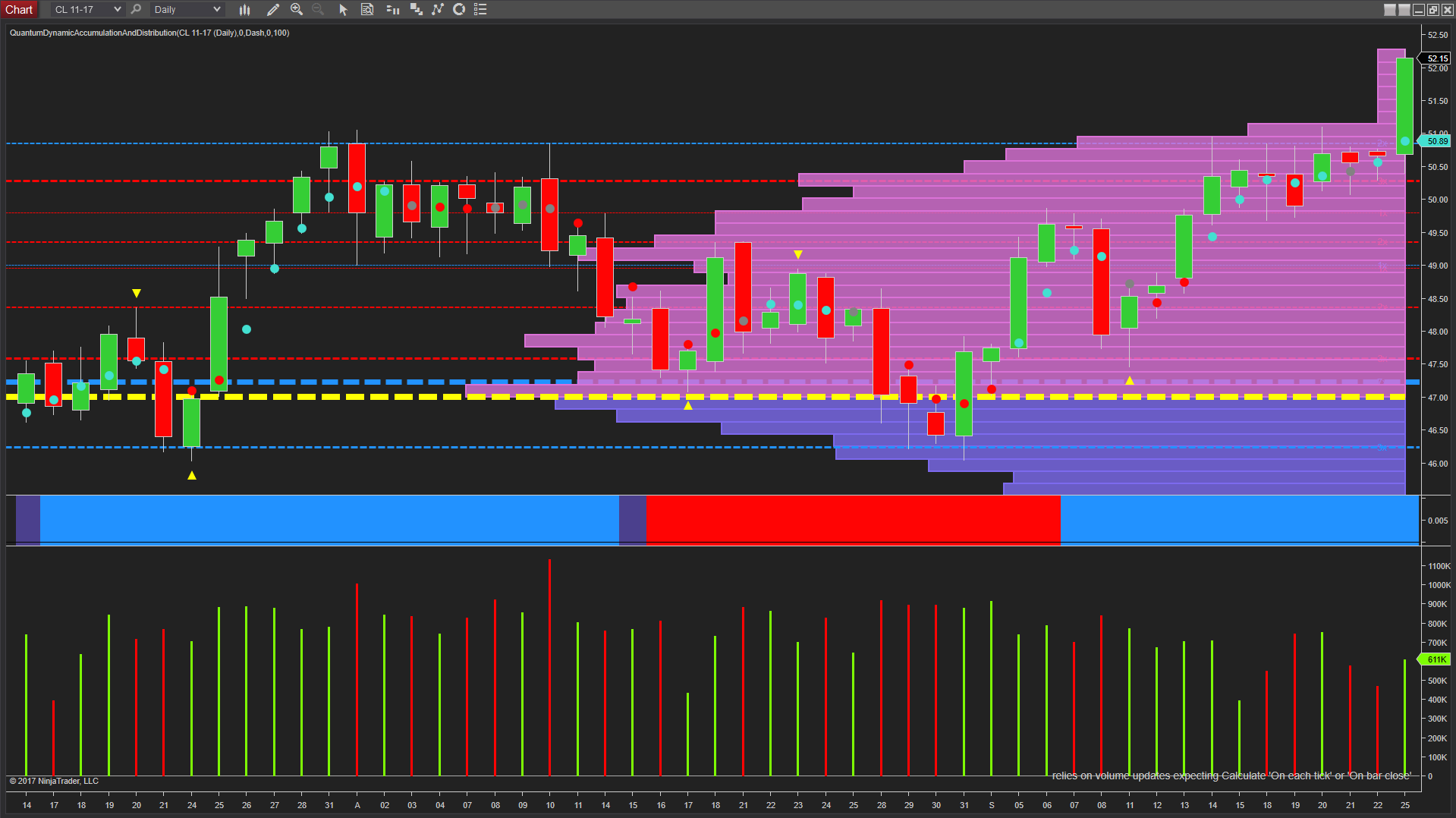

(Click on image to enlarge)

OPEC will no doubt be finally drawing a collective sigh of relief as the management of the glut of oil supply finally seems to be coming under control, as prices hit their highest level since July 2015, with the consensus view that the oil market is finally rebalancing itself with a potential return to a more regulated and controlled market for its members. So far this year, OPEC and its members, along with non OPEC members such as Russia, have cut production by around 1.8 million barrels per day since early 2017 which has finally helped to lift oil prices by around 15% in the last quarter. The Kuwaiti Oil Minister Essam al-Marzouq who chaired the recent meeting in Vienna confirmed OPEC’s view that the current targets were helping to cut output to the target five year average. However, whilst Russia has upheld its own agreed targets, it has yet to confirm whether these will continue beyond the end of March 2018, thereby raising concerns for oil prices in 2018. Meanwhile Nigeria and the UAE continue to operate at or below the currently agreed supply targets, and with Turkey threatening to cut off a key supply line from Norther Iraq, this too has helped to drive oil prices higher. Indeed should the Turkish threat be actioned this could cut over 500,000 barrels of oil a day from the supply chain, helping to boost prices further.

From a technical perspective today has been a pivitol one for WTI futures, with the price breaking through the key resistance level at $50.90 per barrel. This is a region which has been tested several times in the last few weeks, and repeating the price action of mid August which saw this level hold, with oil prices duly reversing. This time however the market appears to have breached this level with confidence, and supported with solid volume as the candle looks set to close the session as a wide-spread up with no wicks and confirming the bullish sentiment now in place. And with little in the way of meaningful resistance ahead, we could see a test of the $55.55 per barrel high of mid April. It is also interesting to note that the correlation between oil and the US dollar appears to have broken down for the time being, with oil rising along with the US dollar which has discovered some minor bullish momentum. This general disconnect has been evident for some time, and confirming that the price of oil is governed more by management of the supply, than a market of true price discovery. Whilst this is always the case with OPEC involved, this factor is particularly strong at present, and no doubt once the over-supply situation is brought back into balance, then this relationship will reconnect once again.

And whilst it is certainly a red letter day for oil prices, the same could also be said for the alternative energy suppliers who will be cheered by falling production costs and rising profits, unlike OPEC members and non members whose production costs are likely to remain high for the foreseeable future.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more